Live Stock Market Updates: Tracking Dow Futures And Dollar

Table of Contents

Understanding Dow Futures

What are Dow Futures?

Dow Futures contracts are agreements to buy or sell the Dow Jones Industrial Average (DJIA) at a predetermined price on a specific future date. They are not the actual DJIA itself, but rather derivatives that track its expected performance. This allows investors to speculate on the future direction of the index without directly owning the underlying stocks.

- Contract Specifications: Dow Futures contracts have standardized specifications regarding contract size, delivery dates, and trading hours.

- Leverage: Trading Dow Futures involves leverage, meaning you can control a larger position with a smaller initial investment. This amplifies both potential profits and losses.

- Trading Hours: Dow Futures are traded electronically on exchanges, offering extended trading hours compared to the regular stock market.

- Contract Sizes: Contracts are typically sized to represent a multiple of the DJIA itself, making them accessible to a wide range of traders.

Interpreting Dow Futures Data

Changes in Dow Futures prices reflect the collective sentiment of market participants about the anticipated direction of the DJIA. A rising Dow Futures price generally suggests optimism and an expected increase in the DJIA, while a falling price indicates pessimism and a potential decline. Analyzing charts is critical for understanding these price movements.

- Technical Indicators: Traders use various technical indicators, such as moving averages (e.g., 50-day, 200-day), support and resistance levels, and candlestick patterns, to identify potential trends and trading opportunities.

- Volume Analysis: Examining trading volume alongside price movements offers further insights into the strength and sustainability of a trend. High volume confirms a price movement, while low volume may suggest a weak trend.

Utilizing Dow Futures for Trading Strategies

Dow Futures offer versatile tools for various trading strategies.

- Long Positions: Taking a long position involves buying a futures contract with the expectation that the price will rise.

- Short Positions: A short position involves selling a contract, betting the price will fall.

- Day Trading: This involves opening and closing positions within the same trading day.

- Swing Trading: This involves holding positions for several days or weeks to capitalize on larger price swings.

- Hedging: Companies or investors can use Dow Futures to hedge against potential losses in their stock portfolios.

The Impact of the Dollar Index

What is the Dollar Index (DXY)?

The US Dollar Index (DXY) measures the value of the US dollar against a basket of other major currencies. It's a crucial indicator for global finance, influencing exchange rates, trade, and investment decisions worldwide.

- Components: The DXY includes the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc, each weighted according to their relative importance in international trade.

Dollar Index and Stock Market Correlation

The Dollar Index and the stock market, including the Dow Jones, share a complex relationship. A strong dollar (higher DXY) can negatively impact US multinational companies' earnings because their overseas sales translate into fewer dollars. Conversely, a weak dollar (lower DXY) might boost exports and corporate profits.

- Strong Dollar Effects: A strong dollar makes imports cheaper but exports more expensive, potentially reducing the profitability of US companies with significant international operations and lowering stock prices.

- Currency Fluctuations and Investor Confidence: Significant fluctuations in the Dollar Index can create uncertainty in the market and impact investor confidence, leading to increased volatility in stock prices.

Using the Dollar Index in Trading Decisions

Traders can utilize the Dollar Index to enhance their trading strategies, especially concerning Dow Futures.

- Predicting Dow Futures Movement: A weakening dollar might indicate increased demand for riskier assets, including stocks, potentially leading to higher Dow Futures prices. Conversely, a strengthening dollar might suggest risk aversion, possibly leading to lower Dow Futures prices.

- Correlation Analysis: Employing correlation analysis techniques can help identify the strength and direction of the relationship between the DXY and Dow Futures, further refining trading decisions.

Resources for Live Stock Market Updates

Reliable Data Providers

Accessing accurate and timely data is paramount for effective trading.

- Financial News Websites: Reputable financial news websites provide real-time updates and analysis.

- Brokerage Platforms: Many brokerage platforms offer live market data feeds and charting tools for their clients.

- Dedicated Financial Data Providers: Companies specializing in financial data provide comprehensive information and advanced analytical tools. (Note: Specific links to providers would be added here if permitted.)

Utilizing Market Analysis Tools

Several tools and software enhance the analysis of Dow Futures and the Dollar Index.

- Charting Software: Technical analysis software aids in visualizing price movements, identifying trends, and applying technical indicators.

- Trading Platforms: Many trading platforms incorporate comprehensive charting tools, real-time data feeds, and order execution capabilities in a single integrated environment. (Note: Specific software mentions would be added here if permitted.)

Conclusion

Tracking live stock market updates, specifically focusing on Dow Futures and the Dollar Index, is essential for informed investment decisions. Understanding their interplay and utilizing available resources allows investors to develop more effective trading strategies, navigate market volatility, and improve their overall investment outcomes. Actively monitor Dow Futures and the Dollar Index, leverage available analytical tools, and continue researching to stay updated with the latest live stock market updates on Dow Futures and the Dollar Index. This continuous learning will enhance your ability to capitalize on market opportunities and mitigate potential risks.

Featured Posts

-

1 Billion Funding Cut Planned For Harvard Exclusive Report On Trump Administrations Actions

Apr 22, 2025

1 Billion Funding Cut Planned For Harvard Exclusive Report On Trump Administrations Actions

Apr 22, 2025 -

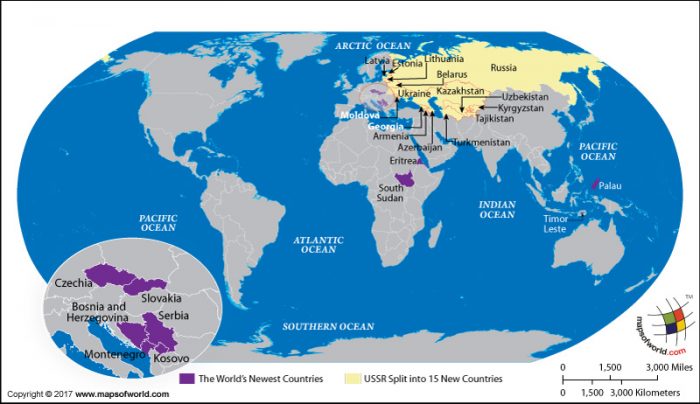

Growth Areas A Map Of The Countrys Newest Business Hotspots

Apr 22, 2025

Growth Areas A Map Of The Countrys Newest Business Hotspots

Apr 22, 2025 -

The Crucial Role Of Middle Managers In Business And Employee Development

Apr 22, 2025

The Crucial Role Of Middle Managers In Business And Employee Development

Apr 22, 2025 -

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025 -

Exploring New Business Opportunities A Map Of The Countrys Hotspots

Apr 22, 2025

Exploring New Business Opportunities A Map Of The Countrys Hotspots

Apr 22, 2025