Land Your Dream Private Credit Job: 5 Essential Tips

Table of Contents

Master the Fundamentals of Private Credit Investing

Demonstrating a deep understanding of private credit markets, structures, and investment strategies is crucial. Employers want to see you can hit the ground running and contribute meaningfully from day one. A solid foundation in private credit investing sets you apart from the competition.

How to Achieve This:

- Formal Education: Consider an MBA with a concentration in finance, a Master's in Financial Engineering, or a dedicated private credit certification. These programs provide structured learning and networking opportunities.

- Self-Education: Supplement formal education with self-study. Leverage online courses from platforms like Coursera or edX, focusing on topics like leveraged buyouts (LBOs), debt structuring, and credit analysis. Stay updated on industry trends by subscribing to publications like PEI Media, Debtwire, and other relevant journals. Read books focusing on private equity and credit strategies.

- Networking: Attend industry events like conferences (SuperReturn, etc.) and workshops to connect with professionals. Engage in conversations, ask insightful questions, and actively build your professional network. This is invaluable for gaining practical insights and uncovering hidden job opportunities within private credit funds.

Develop a Strong Network within the Private Credit Industry

Networking is often the unsung hero in landing a private credit job. Personal connections can significantly boost your chances, leading to introductions and opportunities you might not find otherwise. Cultivating relationships with people in the industry is an investment that pays off significantly.

How to Achieve This:

- LinkedIn Optimization: Create a compelling LinkedIn profile that showcases your skills, experience, and passion for private credit. Use relevant keywords like "private credit analyst," "senior associate private credit," or "private debt investment." Connect with recruiters specializing in finance and private credit, as well as professionals working at target firms.

- Industry Events: Actively participate in industry conferences, workshops, and networking events. These events provide excellent opportunities to meet potential employers, learn about new roles, and expand your network organically. Prepare talking points to initiate conversations and remember to follow up after these events.

- Informational Interviews: Reach out to professionals working in private credit for informational interviews. These conversations provide invaluable insights into different roles, company cultures, and the overall industry landscape. Prepare thoughtful questions beforehand to maximize your learning.

Tailor Your Resume and Cover Letter for Each Private Credit Application

Generic applications rarely impress. Highlighting relevant skills and experiences for each specific role is essential for demonstrating your understanding of the opportunity and the firm's needs. A customized approach shows genuine interest and significantly improves your chances.

How to Achieve This:

- Keyword Optimization: Carefully review each job description and incorporate relevant keywords throughout your resume and cover letter. Use applicant tracking system (ATS) friendly language and tailor it to each specific opportunity.

- Quantifiable Results: Focus on quantifiable achievements and demonstrate your impact in previous roles. Use numbers to showcase your successes (e.g., "Increased efficiency by 15%," "Managed a portfolio of $X million").

- Storytelling: Craft a compelling narrative that showcases your passion for private credit and your career aspirations. Connect your experience to the specific requirements of the role, highlighting transferable skills.

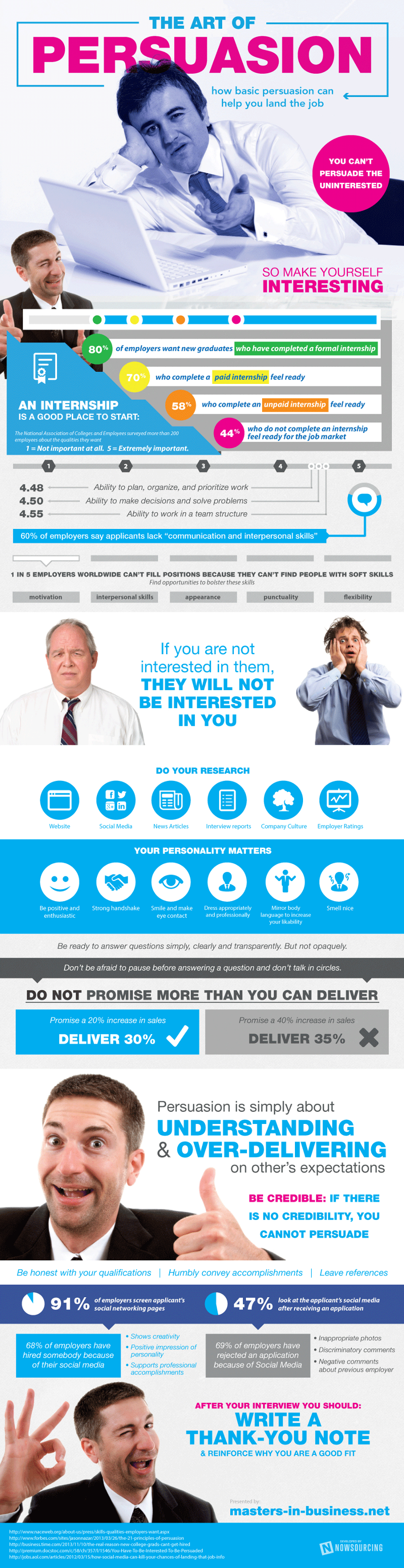

Ace the Private Credit Interview Process

The interview is your chance to showcase your personality, skills, and knowledge. Thorough preparation is crucial for a successful outcome. Demonstrate your understanding of the firm and the role to impress the hiring team.

How to Achieve This:

- Research the Firm: Thoroughly research the firm's investment strategy, portfolio companies, recent transactions, and the team you'll be working with. Demonstrate your knowledge during the interview.

- Practice Behavioral Questions: Prepare for common interview questions like "Tell me about a time you failed," "Why are you interested in private credit?", and "Describe your experience with financial modeling." Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Prepare Insightful Questions: Ask thoughtful questions to demonstrate your interest and understanding of the firm and the role. This shows initiative and genuine interest in the opportunity.

Showcase Your Analytical and Financial Modeling Skills

Private credit roles demand strong analytical skills and proficiency in financial modeling. Demonstrate your expertise through your resume, cover letter, and interview performance. This is a critical skillset that employers highly value.

How to Achieve This:

- Excel Proficiency: Master Excel and its advanced features, including financial modeling techniques like discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and sensitivity analysis. Practice creating comprehensive financial models.

- Data Analysis Skills: Demonstrate expertise in analyzing financial statements, interpreting data, and drawing insightful conclusions. Showcase your ability to identify key trends and risks.

- Case Studies: Develop case studies showcasing your analytical skills and problem-solving abilities within a private credit context. This could involve analyzing a specific company's financial performance or structuring a hypothetical private credit investment.

Conclusion

Securing your dream private credit job requires dedication, strategic planning, and a proactive approach. By mastering the fundamentals of private credit, building a strong network, tailoring your application materials, acing the interview process, and showcasing your analytical skills, you will significantly improve your chances of success. Don't delay – start implementing these five essential tips today and take a giant leap towards landing your ideal private credit job! Remember to constantly refine your skills and network within the dynamic world of private credit investment. Good luck!

Featured Posts

-

A Fathers Remembrance John Travoltas Birthday Post For His Late Son Jett

Apr 24, 2025

A Fathers Remembrance John Travoltas Birthday Post For His Late Son Jett

Apr 24, 2025 -

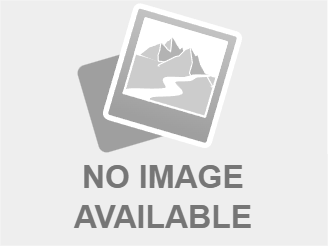

Todays Stock Market Dow S And P 500 April 23rd Analysis

Apr 24, 2025

Todays Stock Market Dow S And P 500 April 23rd Analysis

Apr 24, 2025 -

A More Global Church Examining Pope Francis Complex Legacy

Apr 24, 2025

A More Global Church Examining Pope Francis Complex Legacy

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Crisis And Potential Demise

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Potential Demise

Apr 24, 2025 -

India Market Buzz Nifty Bulls Charge Ahead On Positive Trends

Apr 24, 2025

India Market Buzz Nifty Bulls Charge Ahead On Positive Trends

Apr 24, 2025