Hong Kong's Chinese Stock Market: A Positive Outlook

Table of Contents

Economic Growth and Government Support

China's ongoing economic growth, despite facing global headwinds, is a primary driver of the positive outlook for Hong Kong's Chinese stock market. The robust performance of the Chinese economy directly impacts Hong Kong, a key financial hub deeply integrated with mainland China. Government initiatives play a crucial role, fostering a favorable environment for investment. These initiatives include strategic infrastructure projects and targeted fiscal stimulus packages.

- Strong GDP growth projections: China's continued economic expansion fuels investor confidence, translating into increased investment in the Hong Kong stock market. Analysts predict robust GDP growth projections for the coming years, bolstering the overall positive market outlook.

- Continued investment in key infrastructure projects: The Belt and Road Initiative, among other significant infrastructure projects, continues to drive economic activity and create opportunities for businesses, leading to a positive ripple effect in the Hong Kong stock market.

- Supportive government policies: The Chinese government's focus on fostering innovation and technology, coupled with policies aimed at attracting foreign direct investment, further strengthens the Hong Kong economy and its associated stock market.

- Increased foreign direct investment (FDI): China's ongoing efforts to attract FDI contribute significantly to its economic growth and create a positive feedback loop for Hong Kong’s Chinese stock market, enhancing investor confidence.

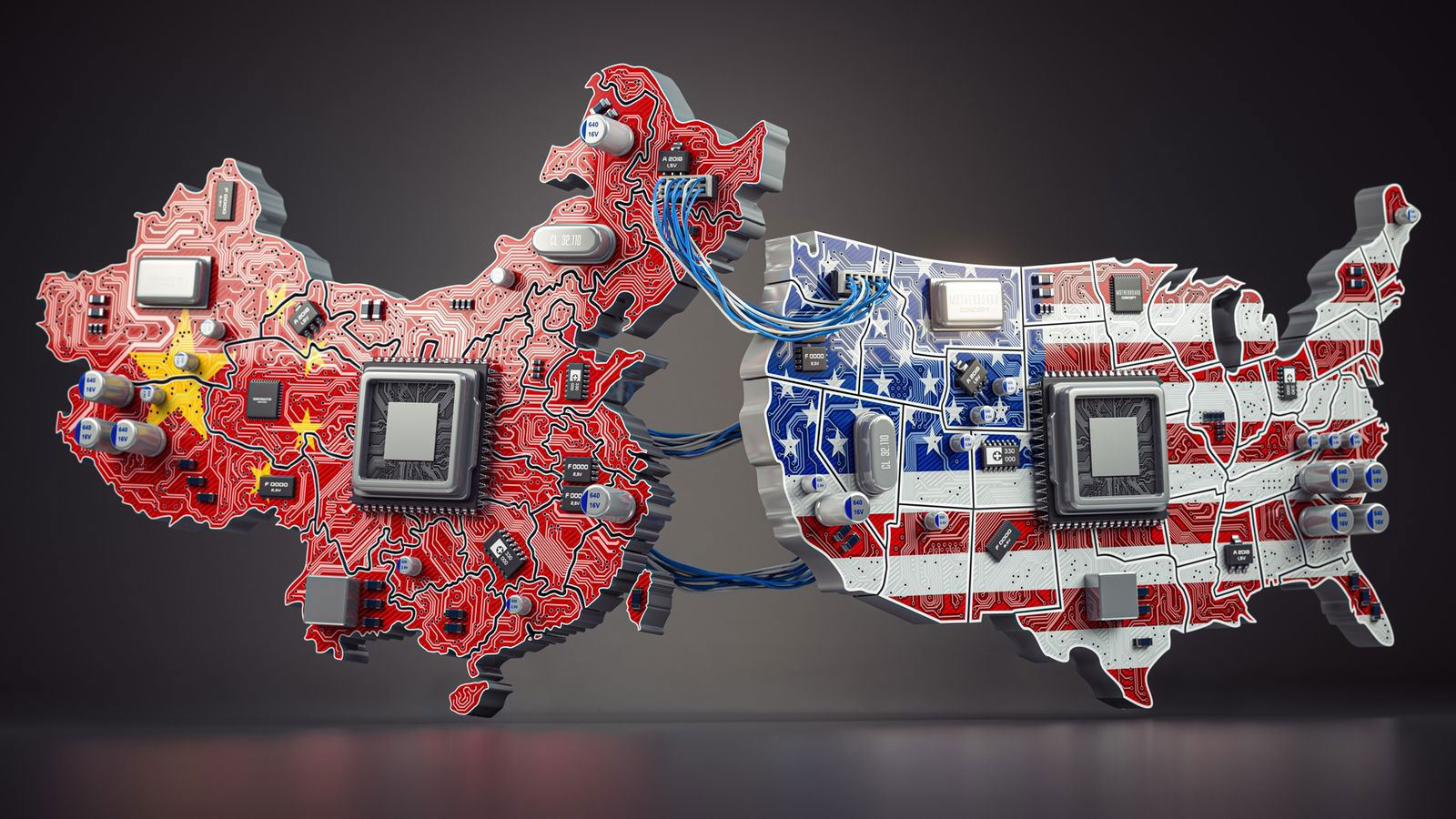

Technological Advancements and Innovation

Hong Kong acts as a crucial gateway to China's burgeoning tech sector. Investing in Hong Kong provides investors with unparalleled exposure to innovative companies in various high-growth areas. The rapid expansion of the technology sector significantly contributes to the positive market outlook for Hong Kong investments.

- High growth potential of Chinese tech companies: Many leading Chinese tech companies are listed on the Hong Kong Stock Exchange, offering investors access to high-growth potential within the fintech, artificial intelligence (AI), and e-commerce sectors.

- Increasing technology adoption: The widespread adoption of technology across various sectors of the Chinese economy is driving further innovation and creating numerous investment opportunities in the Hong Kong stock market.

- Growing investment in R&D: Increased investment in research and development within China fuels technological advancements, leading to the emergence of new and disruptive technologies, many of which are represented on the Hong Kong Stock Exchange.

- Opportunities in emerging technologies: Investors can access opportunities in exciting, emerging technologies like blockchain and the metaverse, further diversifying their portfolios within the Hong Kong Chinese stock market.

Attractive Valuation and Investment Opportunities

Despite the strong growth potential, some sectors and individual companies within Hong Kong's Chinese stock market still offer attractive valuations relative to their global counterparts. This creates compelling investment opportunities for those who conduct thorough due diligence.

- Identification of undervalued stocks: Careful analysis can uncover undervalued stocks with significant growth potential, offering investors the chance to achieve substantial returns. This requires a robust investment strategy and careful market analysis.

- Diversification opportunities: The Hong Kong stock market provides opportunities for diversification across various sectors and asset classes, allowing investors to mitigate risk and optimize their portfolios.

- Access to investment vehicles: Investors can access a range of investment vehicles, including exchange-traded funds (ETFs) and mutual funds, providing flexible options for participation in the Hong Kong stock market.

- Potential for high returns on investment: The combination of strong growth prospects and attractive valuations points to the potential for significant returns on investments within Hong Kong’s Chinese stock market.

Managing Risk in the Hong Kong Stock Market

While the outlook for Hong Kong's Chinese stock market is positive, it’s crucial to acknowledge inherent market volatility and implement effective risk management strategies. Understanding and mitigating risks is paramount for successful investment.

- Diversify your portfolio: Diversifying across different asset classes and sectors minimizes the impact of potential market downturns.

- Conduct thorough due diligence: Thorough research and analysis of potential investments are crucial for informed decision-making.

- Consult a financial advisor: Seeking advice from a qualified financial advisor can help tailor an investment strategy that aligns with individual risk tolerance and financial goals.

- Monitor market trends: Continuously monitoring market trends and adjusting your investment strategy accordingly is vital for adapting to changing market conditions.

Conclusion

Hong Kong's Chinese stock market presents a compelling investment opportunity, driven by strong economic growth, technological advancements, and attractive valuations. While managing risk is essential, the potential rewards are significant for investors who adopt a well-defined strategy. By carefully considering the factors discussed and implementing thorough due diligence, investors can potentially capitalize on the positive outlook of Hong Kong's Chinese stock market. Start exploring the exciting investment possibilities in the Hong Kong Chinese stock market today!

Featured Posts

-

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025 -

Goldsteins Resurrected Cat Analyzing Ted Lassos Unexpected Return

Apr 24, 2025

Goldsteins Resurrected Cat Analyzing Ted Lassos Unexpected Return

Apr 24, 2025 -

Elon Musk Dogecoin And The Epas Scrutiny Of Tesla And Space X

Apr 24, 2025

Elon Musk Dogecoin And The Epas Scrutiny Of Tesla And Space X

Apr 24, 2025 -

Chinese Buyout Firm Considers Divesting Chip Tester Utac

Apr 24, 2025

Chinese Buyout Firm Considers Divesting Chip Tester Utac

Apr 24, 2025 -

The Crucial Role Of Middle Managers In Employee Development And Company Growth

Apr 24, 2025

The Crucial Role Of Middle Managers In Employee Development And Company Growth

Apr 24, 2025