GPU Market Volatility: Explaining The Current Price Fluctuations

Table of Contents

The Impact of Cryptocurrency Mining on GPU Prices

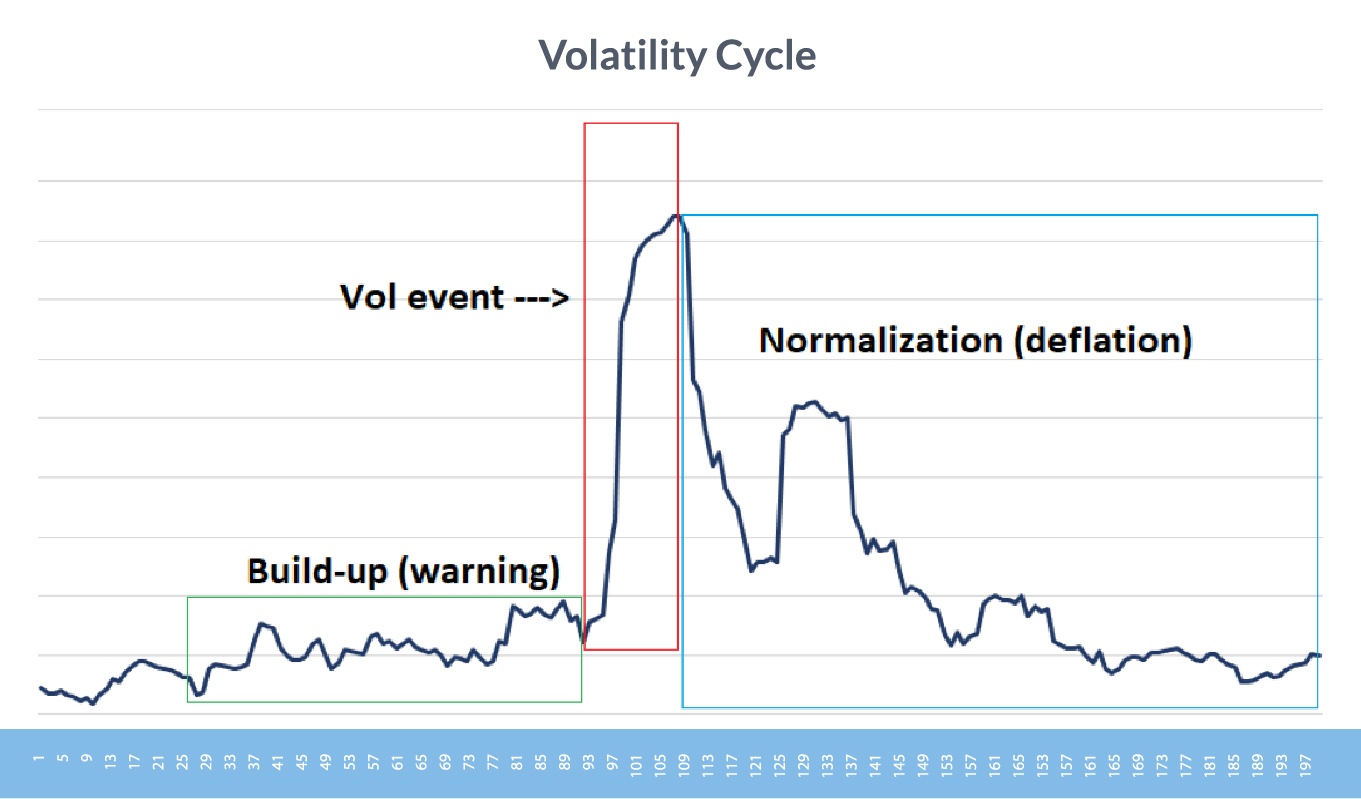

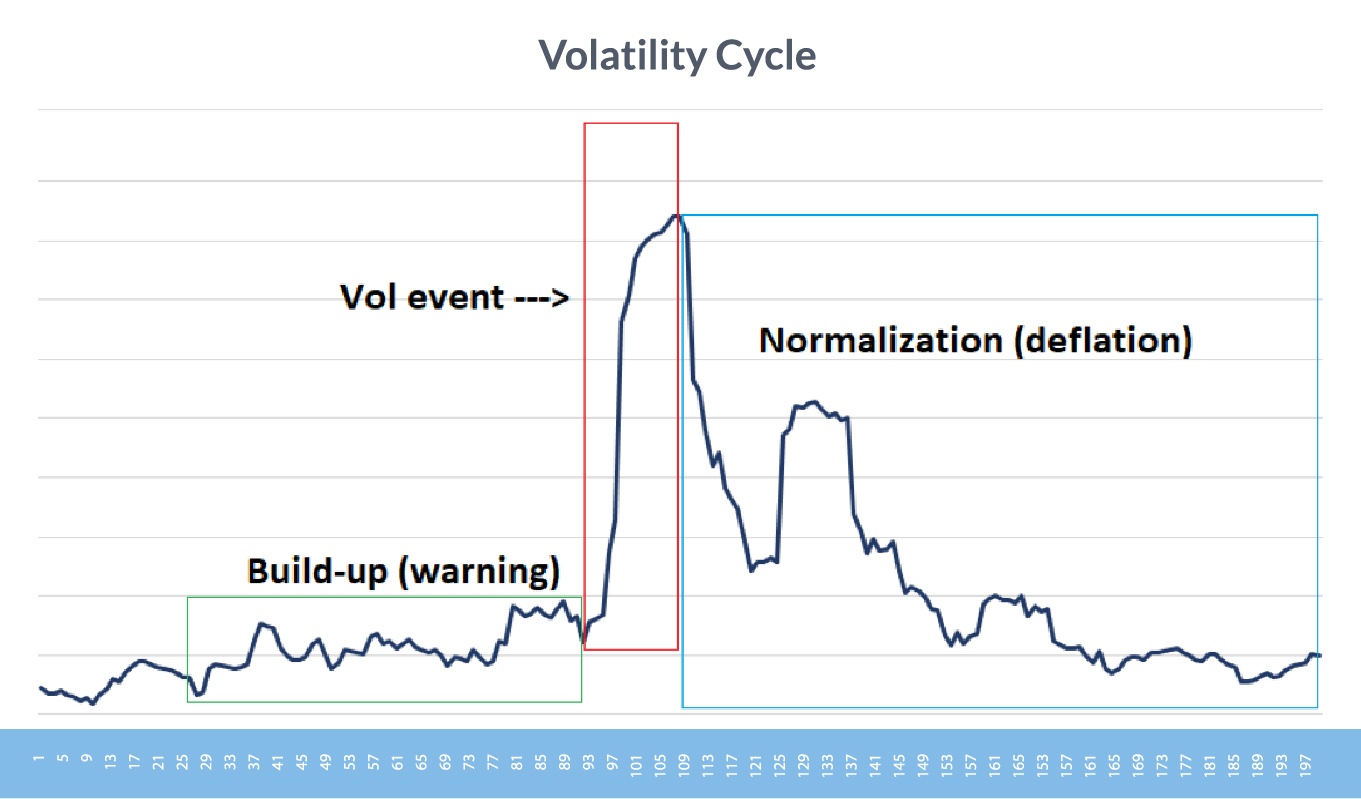

The historical correlation between cryptocurrency mining and GPU demand is undeniable. High-performance GPUs, with their powerful parallel processing capabilities, are ideal for mining cryptocurrencies like Ethereum. This created a significant surge in demand, driving prices to unprecedented levels.

- The surge in cryptocurrency mining in previous years significantly increased demand for high-performance GPUs. The profitability of mining directly fueled this demand, creating a competitive market where GPUs were often sold out quickly.

- Mining profitability directly impacted GPU prices – high profitability led to increased demand and higher prices. As the value of cryptocurrencies like Bitcoin and Ethereum rose, so did the incentive to mine, resulting in a bidding war for available GPUs.

- The decline in cryptocurrency prices reduced mining profitability, leading to decreased demand and price drops, but the market is still recovering from this event. While the initial impact of the crypto crash significantly reduced GPU demand, the effects linger, particularly in terms of supply chain recovery and lingering shortages.

- Long-term effects of mining on GPU availability and pricing remain. While the immediate impact of the crypto mining boom has subsided, the ripple effects continue to be felt. The market is still working to balance supply and demand, leaving long-term effects on GPU pricing.

For example, during the peak of Ethereum mining, the price of high-end GPUs like the Nvidia RTX 3080 could easily double or even triple their MSRP. Conversely, when Ethereum transitioned to a proof-of-stake consensus mechanism, rendering GPU mining less profitable, prices began to fall, though not always to pre-boom levels.

Global Chip Shortages and Supply Chain Disruptions

Global chip shortages have significantly impacted GPU production and availability, exacerbating the volatility in the GPU market. These shortages weren't solely caused by cryptocurrency mining; they are the result of a complex confluence of factors.

- The pandemic and related logistical issues significantly hampered the production and distribution of semiconductors, including GPUs. Factory closures, worker shortages, and transportation bottlenecks all played a role.

- Increased demand for electronics during the pandemic exacerbated the shortage. The shift to remote work and online learning fueled demand for laptops, gaming PCs, and other electronics, further straining already limited semiconductor supplies.

- Factory closures and disruptions in the supply chain further contributed to the problem. Natural disasters, political instability, and geopolitical tensions further complicated the already fragile supply chain.

- The ongoing impact of these shortages on GPU pricing and availability is substantial. While the situation has improved somewhat, the semiconductor industry is still working to catch up with demand, leading to ongoing price fluctuations.

Major GPU manufacturers like Nvidia and AMD have openly acknowledged the impact of these shortages, citing production delays and difficulties in sourcing components. The ripple effect continues to influence the GPU market.

The Role of New GPU Generations and Technological Advancements

The release of new GPU generations significantly influences the prices of older models. This dynamic ensures a constant state of flux.

- The launch of new, high-performance GPUs often leads to price drops for previous generations. As newer models become available, older cards become less desirable, resulting in price reductions.

- This creates a dynamic market where older models become more affordable. Consumers seeking a balance between performance and affordability can find good value in slightly older GPU generations.

- The price-performance ratio of different GPU generations varies significantly. Understanding the generational differences and their corresponding price points is crucial for making informed purchasing decisions.

- Technological advancements (e.g., ray tracing, DLSS) impact GPU pricing. New features and improved performance often come at a premium, influencing the pricing strategies of manufacturers.

For instance, the release of the Nvidia RTX 40-series cards significantly impacted the prices of the RTX 30-series, making the latter more accessible to budget-conscious consumers. However, the performance differences must be considered in relation to the price reduction.

Scalpers and Market Manipulation

Scalpers and the use of bots contribute significantly to GPU market volatility. Their actions create artificial scarcity and inflate prices.

- Scalpers use automated bots to purchase large quantities of GPUs at retail prices and resell them at inflated prices. This often leaves genuine consumers struggling to find cards at reasonable prices.

- This artificial scarcity contributes to GPU market volatility. The actions of scalpers create instability, making it challenging to predict GPU prices accurately.

- The ethical implications of scalping are substantial. Scalping exploits market demand and can harm consumers, making it a controversial practice.

- Potential solutions to combat scalping include regulatory measures and anti-bot technologies. Governments and retailers are exploring strategies to prevent large-scale scalping operations.

The use of bots to circumvent purchasing limits and secure large quantities of GPUs contributes to the price inflation. This artificial scarcity, driven by scalpers, is a major factor impacting GPU market volatility.

Conclusion

This article has explored the key factors driving GPU market volatility, including the impact of cryptocurrency mining, global chip shortages, new GPU generations, and scalping activities. The complex interplay of these factors makes predicting future price fluctuations challenging. Understanding these elements is crucial for navigating the volatile GPU market. Stay informed about the latest developments in GPU technology and market trends to make informed purchasing decisions. Continuously monitor GPU market volatility to secure the best deals and manage your purchasing strategy effectively. The fluctuating nature of the GPU market demands constant awareness and a proactive approach to securing your desired hardware.

Featured Posts

-

Global Leaders Gather To Mourn Pope Francis

Apr 28, 2025

Global Leaders Gather To Mourn Pope Francis

Apr 28, 2025 -

The 2000 Yankees Key Moments Joe Torres Decisions And Andy Pettittes Performance

Apr 28, 2025

The 2000 Yankees Key Moments Joe Torres Decisions And Andy Pettittes Performance

Apr 28, 2025 -

Abwzby Kazakhstan Rhlat Jwyt Mbashrt Me Tyran Alerbyt

Apr 28, 2025

Abwzby Kazakhstan Rhlat Jwyt Mbashrt Me Tyran Alerbyt

Apr 28, 2025 -

Mntda Abwzby Llabtkar Fy Mjal Tb Alhyat Alshyt Almdydt Tqnyat Wttwrat Jdydt

Apr 28, 2025

Mntda Abwzby Llabtkar Fy Mjal Tb Alhyat Alshyt Almdydt Tqnyat Wttwrat Jdydt

Apr 28, 2025 -

Red Sox Breakout Star Unexpected Player Fuels Championship Contention

Apr 28, 2025

Red Sox Breakout Star Unexpected Player Fuels Championship Contention

Apr 28, 2025