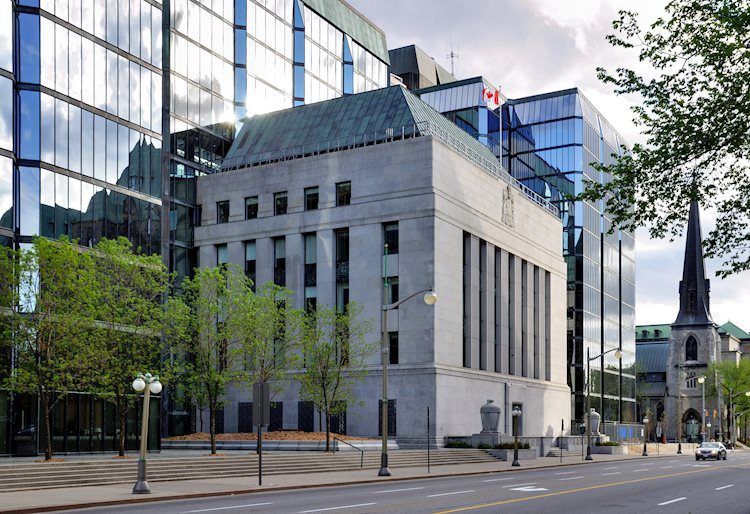

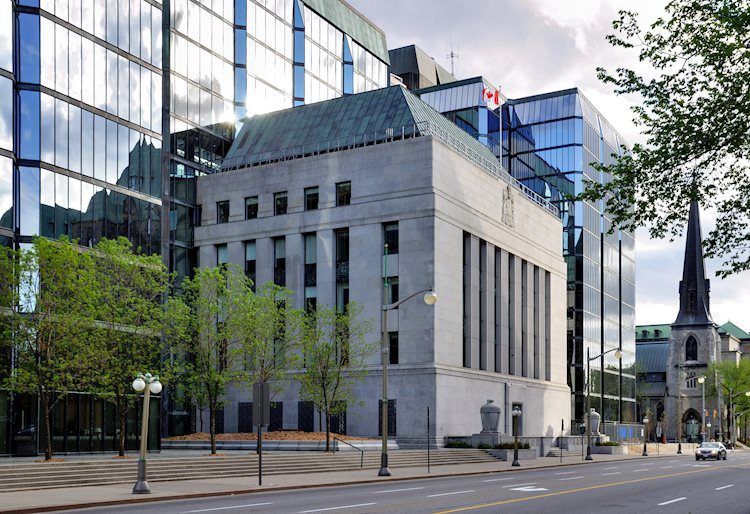

FP Video: Deconstructing The Bank Of Canada's Decision To Hold Rates

Table of Contents

The Economic Landscape Leading to the Decision

The Bank of Canada's decision to hold rates was a complex one, shaped by a confluence of economic factors. Let's examine the key elements that informed their choice.

Inflationary Pressures

Inflation remains a central concern for the Bank of Canada. While recent CPI figures show a decrease from peak levels, inflationary pressures persist. Analyzing whether this cooling is sufficient to justify a rate pause requires a closer look at the data.

- CPI figures: Recent data shows a gradual decline in the Consumer Price Index (CPI), but it still remains above the Bank of Canada's target range.

- Core inflation: Core inflation, which excludes volatile components like food and energy, also needs careful consideration. Its persistence indicates underlying inflationary pressures.

- Contributing factors to inflation: Supply chain disruptions, lingering effects of the pandemic, and elevated energy prices all contribute to persistent inflationary pressures, impacting the Bank of Canada's inflation targets. Understanding these factors is crucial in assessing the effectiveness of past rate hikes.

GDP Growth and Employment

The strength of the Canadian economy is another critical factor. Robust GDP growth and strong employment figures might suggest the economy can withstand further rate hikes. However, signs of weakening could signal a need for caution.

- Recent GDP growth numbers: While recent GDP growth figures have shown some moderation, they are still positive, indicating continued economic expansion. However, the pace of growth is slowing.

- Unemployment rates: The unemployment rate remains relatively low, suggesting a strong labor market. This positive sign counters the risks of slowing economic activity.

- Job creation data: Recent job creation data provides insights into the health of the Canadian labor market and the economy's ability to absorb potential rate hikes.

Global Economic Uncertainty

The global economic climate significantly impacts the Bank of Canada's decision-making. Geopolitical risks and potential recessions in other major economies create uncertainty and influence their policy choices.

- The war in Ukraine: The ongoing conflict continues to disrupt global supply chains and energy markets, contributing to inflationary pressures globally and in Canada.

- Global supply chain disruptions: Lingering supply chain issues continue to impact the availability of goods and contribute to inflation.

- Potential recessions in other major economies: The risk of recessions in major economies like the US and Europe could negatively impact Canadian exports and economic growth, influencing the Bank’s approach to interest rates.

Analyzing the Bank of Canada's Official Statement

Understanding the Bank of Canada's rationale requires a careful examination of their official press release and monetary policy report.

Key Quotes and Interpretations

The Bank of Canada's statement provides crucial insights into their decision-making process. Analyzing key quotes helps understand the rationale behind holding rates.

- Key phrases related to future rate decisions: The statement likely contains clues regarding the Bank's future intentions, suggesting whether further rate hikes are expected.

- Inflation forecasts: The Bank's inflation forecasts will highlight their expectations for future inflation and the effectiveness of current policies in bringing inflation down to their target range.

- Economic assessments: The statement will detail the Bank’s assessment of the current economic situation, including GDP growth, employment, and inflation.

Forward Guidance and Future Expectations

The Bank of Canada's forward guidance is crucial for market participants. What signals did they give about the next rate decision?

- Hints regarding future rate hikes or cuts: The statement may offer hints about the likelihood of future rate hikes or cuts, providing guidance for investors and businesses.

- Conditions for future rate adjustments: The statement might outline the economic conditions that would trigger future rate adjustments, providing clarity for market expectations.

Market Reactions and Expert Opinions

The Bank of Canada's decision had immediate and significant impacts on various markets and prompted diverse expert commentary.

Immediate Market Response

The market's reaction to the rate hold provides a real-time assessment of its impact.

- Canadian dollar exchange rate: The Canadian dollar’s response to the announcement indicates how markets perceive the decision’s impact on the country's economic prospects.

- Bond yields: Changes in bond yields reflect investor expectations regarding future interest rates and economic growth.

- Stock market indices: Movement in major stock market indices like the S&P/TSX Composite Index reflects market sentiment regarding the implications of the decision for corporate earnings and economic growth.

Expert Commentary

Economists and financial experts offered varying perspectives on the Bank of Canada's decision.

- Diverse perspectives: Analyzing diverse opinions allows for a more comprehensive understanding of the decision’s potential consequences and implications. Some experts may have praised the decision for its cautious approach, while others may have criticized it for not being aggressive enough.

Conclusion: FP Video: Deconstructing the Bank of Canada's Decision to Hold Rates

The Bank of Canada's decision to hold interest rates reflects a complex interplay of inflationary pressures, economic growth concerns, global uncertainty, and the Bank's assessment of the current economic landscape. Analyzing the Bank’s official statement and the market reactions provides a clearer picture of the implications for the Canadian economy. The decision highlights the ongoing balancing act between controlling inflation and avoiding a potential recession. The key takeaway is that the Bank of Canada is carefully monitoring economic indicators and will adjust its monetary policy as needed. To gain a deeper understanding of the nuances and intricacies of this important decision, we highly encourage you to watch our accompanying FP Video for a comprehensive analysis. For continued insights on Bank of Canada rate decision analysis and understanding the Bank of Canada's monetary policy, subscribe to our channel for further updates and expert commentary.

Featured Posts

-

White House Cocaine Found Secret Service Concludes Investigation

Apr 22, 2025

White House Cocaine Found Secret Service Concludes Investigation

Apr 22, 2025 -

Open Ai Simplifies Voice Assistant Development 2024 Developer Event Highlights

Apr 22, 2025

Open Ai Simplifies Voice Assistant Development 2024 Developer Event Highlights

Apr 22, 2025 -

Trumps Ukraine Proposal Kyivs Urgent Response Needed

Apr 22, 2025

Trumps Ukraine Proposal Kyivs Urgent Response Needed

Apr 22, 2025 -

Corporate Espionage Office365 Data Breach Leads To Multi Million Dollar Theft

Apr 22, 2025

Corporate Espionage Office365 Data Breach Leads To Multi Million Dollar Theft

Apr 22, 2025 -

Bezos Blue Origin Vs Katy Perrys Career A Comparative Analysis Of Public Perception

Apr 22, 2025

Bezos Blue Origin Vs Katy Perrys Career A Comparative Analysis Of Public Perception

Apr 22, 2025