Dollar Rises Against Major Peers Amid Trump's Softened Tone On Fed Chair Powell

Table of Contents

Trump's Changed Stance and its Impact on the Dollar

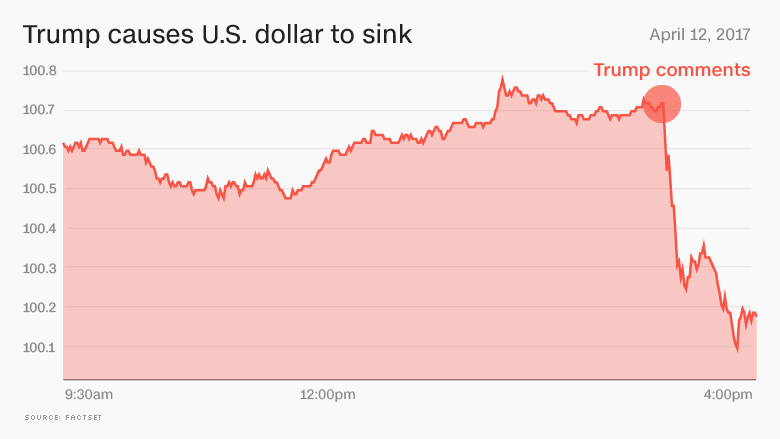

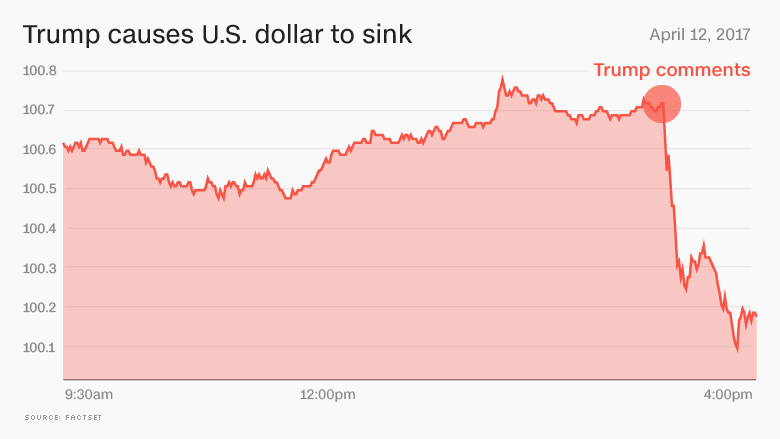

For months, a palpable tension existed between President Trump and Fed Chair Powell, largely stemming from differing opinions on monetary policy. Trump repeatedly criticized Powell for raising interest rates, arguing that such actions hampered economic growth. These criticisms injected significant uncertainty into the markets, often leading to volatility in the dollar's value. The President's public pronouncements were frequently seen as undermining the Fed's independence and creating an unpredictable environment for investors.

However, a noticeable shift in Trump's tone has recently emerged. Instead of harsh criticisms, more conciliatory statements have characterized his recent public comments regarding Powell and the Fed's actions. This change, however subtle, has significantly calmed market anxieties.

- Examples of Trump's previous criticisms: Public tweets accusing Powell of being an enemy of the people, statements criticizing interest rate hikes during economic expansion.

- Specific instances of Trump's recent more conciliatory statements: Statements praising the Fed's recent actions, less frequent public criticism of Powell's decisions.

- Market reactions: Previous criticisms frequently led to a weakening of the dollar. The recent softened tone has been correlated with a marked increase in the dollar's value against major currencies.

Market Reactions and Dollar Strength

The dollar's recent gains have been substantial, particularly against the Euro, Yen, and Pound. This strengthening reflects a renewed investor confidence in the US economy, partially fueled by the decreased political uncertainty surrounding the Fed.

- Percentage changes in exchange rates: USD/EUR saw a [Insert percentage change], USD/JPY a [Insert percentage change], and USD/GBP a [Insert percentage change] rise. (Replace bracketed information with actual data).

- Analysis of investor confidence indicators: Indices like the VIX (volatility index) have shown a decline, indicating reduced market fear. Other indicators of investor sentiment should be mentioned here with supporting data.

- Other macroeconomic factors: Global economic uncertainty, particularly concerning trade wars and Brexit, has also played a role, potentially driving investors towards the perceived safety of the US dollar.

Analysis of Federal Reserve Policy and its Influence

The Federal Reserve's current stance on monetary policy remains a key driver of the dollar's value. While the recent shift in Trump's rhetoric has reduced uncertainty, the Fed's decisions on interest rates and quantitative easing continue to exert significant influence.

- Summary of the Fed's recent policy decisions: Briefly outline the Fed's recent meetings and their decisions on interest rates, providing context for their impact on the dollar.

- Relationship between interest rates and currency value: Explain how higher interest rates generally attract foreign investment, increasing demand for the dollar and strengthening its value.

- Predictions of future Fed actions: Offer a reasoned analysis of potential future Fed actions and their likely impact on the dollar's strength. Consider mentioning potential scenarios (e.g., rate cuts or further rate hikes).

Long-Term Outlook for the Dollar

While the current dollar strength is noteworthy, a cautious outlook is warranted. Several factors could potentially reverse the trend.

- Potential economic risks: A slowdown in the US economy, escalating trade tensions, or unexpected geopolitical events could weaken the dollar.

- Geopolitical factors: International conflicts or shifts in global power dynamics could influence investor sentiment and the dollar's value.

- Long-term predictions: While the short-term outlook appears positive, sustained dollar strength is not guaranteed. Factors mentioned above, as well as unpredictable market shifts, can significantly influence the long-term trajectory of the USD exchange rates.

Conclusion

The recent surge in the US dollar's value is primarily attributed to President Trump's softened tone towards Fed Chair Powell. This reduction in political uncertainty has boosted investor confidence, leading to increased demand for the dollar. However, other factors, including interest rate differentials and global economic uncertainty, continue to play significant roles. Maintaining awareness of these dynamic influences is critical for navigating the currency markets successfully. Stay informed about the latest developments affecting dollar strength and global currency exchange rates by regularly checking our website for updates on the latest US Dollar news and analysis. Understanding Fed Chair Powell's actions and their implications on the US Dollar is crucial for savvy investors.

Featured Posts

-

Office365 Security Breach Millions Lost Executive Accounts Targeted

Apr 24, 2025

Office365 Security Breach Millions Lost Executive Accounts Targeted

Apr 24, 2025 -

Apr 24, 2025

Apr 24, 2025 -

Draymond Green Moses Moody And Buddy Hield Join The Nba All Star Festivities

Apr 24, 2025

Draymond Green Moses Moody And Buddy Hield Join The Nba All Star Festivities

Apr 24, 2025 -

Selling Sunset Star Exposes La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Exposes La Landlord Price Gouging After Fires

Apr 24, 2025 -

Fbi Investigating Multi Million Dollar Office365 Executive Data Breach

Apr 24, 2025

Fbi Investigating Multi Million Dollar Office365 Executive Data Breach

Apr 24, 2025