Do Film Tax Credits Work? A Minnesota Case Study

Table of Contents

The Structure of Minnesota's Film Tax Credit Program

Minnesota's film tax credit program aims to attract film and television productions to the state, boosting economic activity and job creation. Understanding its structure is key to evaluating its effectiveness.

Types of Credits Offered

Minnesota offers several types of film tax credits:

- Production Tax Credit: A credit against Minnesota corporate franchise or individual income tax, typically offering a percentage (check the most current rate on the official website) of qualified production expenses incurred within the state. This is the largest and most frequently utilized credit.

- Post-Production Tax Credit: Similar to the production credit, this incentivizes post-production work, such as editing and sound mixing, to be conducted in Minnesota. The percentage and eligibility criteria are similar to the production credit but may differ slightly.

- Digital Animation Tax Credit: This credit targets the growing digital animation sector, offering incentives for animation projects filmed in Minnesota. Specific percentages and requirements should be verified with the latest official information.

Eligibility Criteria: To qualify for any of these credits, productions must meet specific requirements, including:

- A minimum amount of in-state spending.

- Employment of Minnesota residents in key roles.

- Meeting specific project size and budget thresholds.

- Submission of a detailed application and supporting documentation.

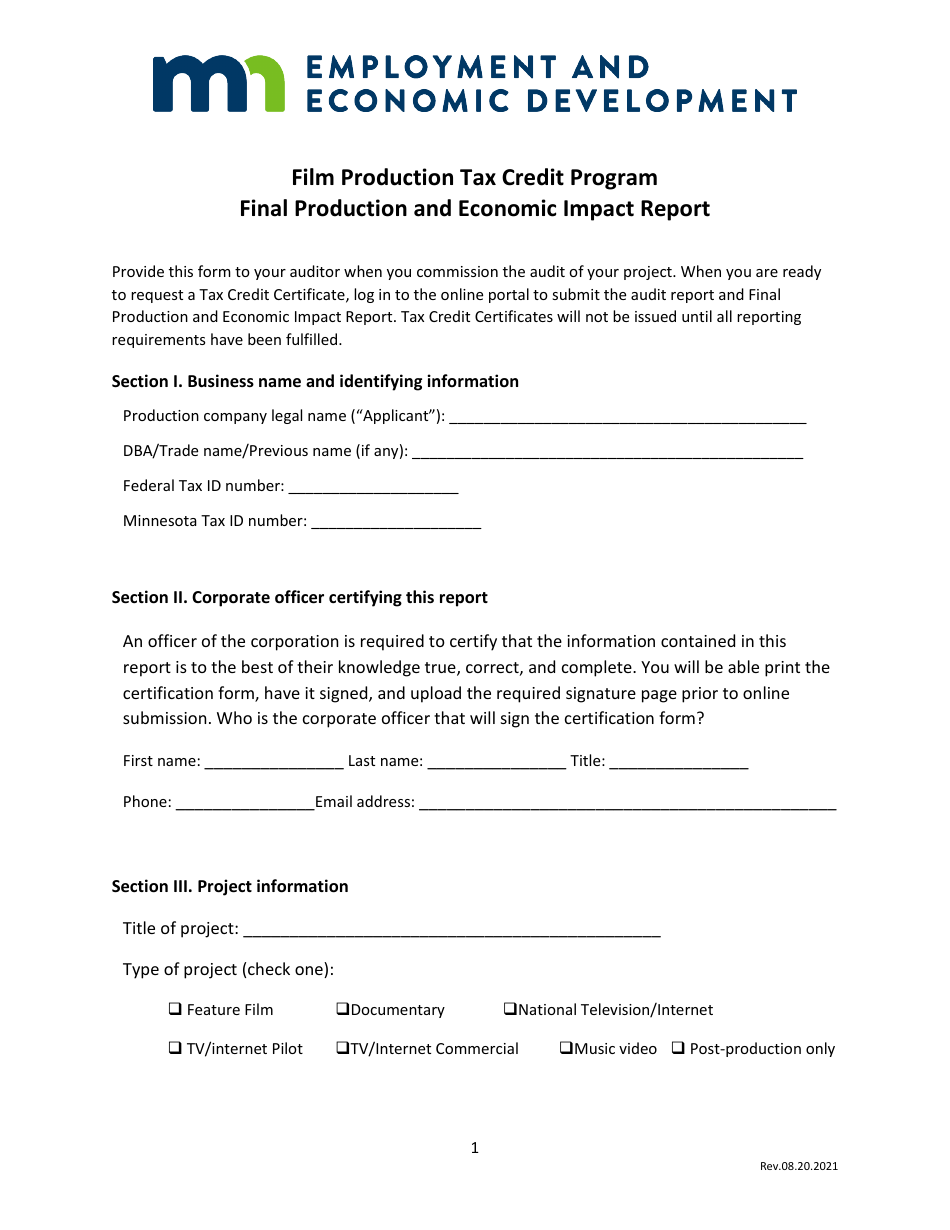

Application Process and Administration

The application process for Minnesota film tax credits involves several steps:

- Pre-filming application: Filmmakers must submit a detailed application outlining their project, budget, and planned in-state spending before commencing production.

- Documentation requirements: Extensive documentation is required, including detailed budget breakdowns, employment records, and proof of in-state expenditures.

- Post-production reporting: After completion, filmmakers submit a final report detailing actual expenses and employment figures.

- Credit issuance: Upon verification of compliance, the Minnesota Department of Revenue issues the tax credits.

Challenges in the application process may include navigating complex regulations, meeting stringent documentation requirements, and potential delays in processing applications.

Economic Impact Assessment of the Minnesota Film Tax Credit

Assessing the economic impact of Minnesota's film tax credit requires examining its effects on job creation, revenue generation, and infrastructure development.

Job Creation and Employment

The film tax credit program aims to create both direct and indirect jobs:

- Direct jobs: These are jobs directly created by film productions (e.g., actors, directors, crew members).

- Indirect jobs: These jobs are in supporting industries, such as catering, transportation, and equipment rentals.

Data on job creation and related economic impact often needs more in-depth analysis and regular updates from official sources. Specific numbers and analyses vary from year to year and are best obtained from the most recent government reports. Independent economic studies may provide additional perspectives on job creation attributed to the film tax credit.

Revenue Generation and State Spending

Evaluating the program’s impact on state revenue involves analyzing both direct and indirect effects:

- Direct revenue: This includes taxes generated by the film industry itself (e.g., sales tax, income tax from employees).

- Indirect revenue: This includes increased tax revenue from related economic activities stimulated by film production spending (e.g., hotels, restaurants).

Analyzing the return on investment (ROI) requires comparing the state's spending on the tax credit program to the additional tax revenue generated and economic activity stimulated. Economic modeling studies might try to quantify the multiplier effect of the tax credit, but this can be complex and require significant assumptions.

Infrastructure Development and Tourism

The film industry can boost infrastructure and tourism in Minnesota:

- Infrastructure: Increased demand for studio space, equipment, and skilled labor can lead to investments in related infrastructure.

- Tourism: Film productions can attract tourists interested in visiting filming locations, boosting local businesses.

While quantifying these impacts precisely is difficult, anecdotal evidence often points towards positive effects on the local economy in communities where filming occurs.

Challenges and Limitations of the Minnesota Film Tax Credit

Despite potential benefits, Minnesota's film tax credit program faces challenges.

Cost-Effectiveness and Accountability

Concerns regarding the program's cost-effectiveness and accountability include:

- Potential for abuse: There's always a risk of the program being exploited by productions seeking to minimize their tax burden without genuinely benefiting the state's economy.

- Lack of rigorous evaluation: The program may lack comprehensive and independent evaluations that accurately assess its economic return and long-term impact.

- Insufficient oversight: Inadequate oversight can lead to inefficiencies and a lack of transparency in program administration.

Regular audits and independent economic analyses are crucial to address these concerns and ensure the program’s accountability.

Competition with Other States

Minnesota's film tax credit program faces competition from other states offering similar incentives:

- Incentive comparisons: Analyzing the competitiveness of Minnesota's incentives requires comparing them to those offered by neighboring states and other major film production hubs.

- Impact on attracting productions: The competitiveness of the program influences the state’s ability to attract film productions and secure high-value projects.

Staying competitive necessitates regular evaluation and potential adjustments to the program’s structure and incentives.

Displacement Effects

It's essential to determine if the film tax credits lead to displacement effects:

- Investment displacement: The credits might divert investment from other sectors of the Minnesota economy, potentially hindering growth in other industries.

- Unintended consequences: These can include potential negative impacts on other sectors or imbalances within the state's overall economic development strategy.

Understanding potential displacement effects is vital for assessing the program's overall impact on the Minnesota economy.

Conclusion

This case study of Minnesota's film tax credits offers a nuanced perspective on their effectiveness. While the program has demonstrably stimulated job creation and some economic activity, questions remain about its long-term cost-effectiveness and overall impact. Further rigorous analysis, independent evaluations, and transparent reporting are needed to fully understand the long-term consequences and ensure accountability. To deepen your understanding of the potential and pitfalls of Minnesota film tax credits, continue your research by exploring [link to relevant Minnesota government website or study]. A comprehensive evaluation of film tax credit programs in Minnesota is crucial for determining their future viability and maximizing their potential benefits for the state's economy.

Featured Posts

-

Attorney General Issues Directive To Minnesota On Transgender Sports

Apr 29, 2025

Attorney General Issues Directive To Minnesota On Transgender Sports

Apr 29, 2025 -

Federal Action Against Minnesota Over Transgender Athlete Restrictions

Apr 29, 2025

Federal Action Against Minnesota Over Transgender Athlete Restrictions

Apr 29, 2025 -

Incentivizing Film Production In Minnesota A Tax Credit Analysis

Apr 29, 2025

Incentivizing Film Production In Minnesota A Tax Credit Analysis

Apr 29, 2025 -

Anthony Edwards Injury Impact On Timberwolves Game Against Lakers

Apr 29, 2025

Anthony Edwards Injury Impact On Timberwolves Game Against Lakers

Apr 29, 2025 -

Announcing The Winning Names For Minnesotas Snow Plows

Apr 29, 2025

Announcing The Winning Names For Minnesotas Snow Plows

Apr 29, 2025