Dax Performance: The Influence Of Political And Economic Factors

Table of Contents

Political Factors Affecting Dax Performance

Government Policies and Regulations

Government policies significantly impact Dax performance through their influence on corporate profitability and investor sentiment. Fiscal policies, encompassing taxation and government spending, directly affect corporate earnings. Tax cuts, for instance, can boost corporate profits and incentivize investment, leading to a positive Dax performance. Conversely, increased taxation can dampen business activity and negatively affect the Dax.

Monetary policies, including interest rate adjustments and quantitative easing programs implemented by the European Central Bank (ECB), significantly influence borrowing costs and market liquidity. Lower interest rates generally stimulate economic growth and encourage investment, potentially driving up the Dax. However, excessively low rates can also fuel inflation and create market instability.

Regulatory changes targeting specific sectors, such as the automotive or energy industries, which have a substantial presence in the Dax, can have significant ripple effects. Stricter environmental regulations, for example, might increase costs for companies in these sectors, impacting their profitability and thus Dax performance.

Political stability is paramount. Periods of political uncertainty, such as elections or coalition changes, can create volatility and negatively impact investor confidence, leading to fluctuations in Dax performance.

- Example: The formation of a new coalition government in Germany can trigger uncertainty in the market, leading to short-term Dax declines until investors assess the new government's policies.

- Example: Changes in automotive emission standards can heavily impact the performance of German automotive giants listed on the Dax.

Geopolitical Events and International Relations

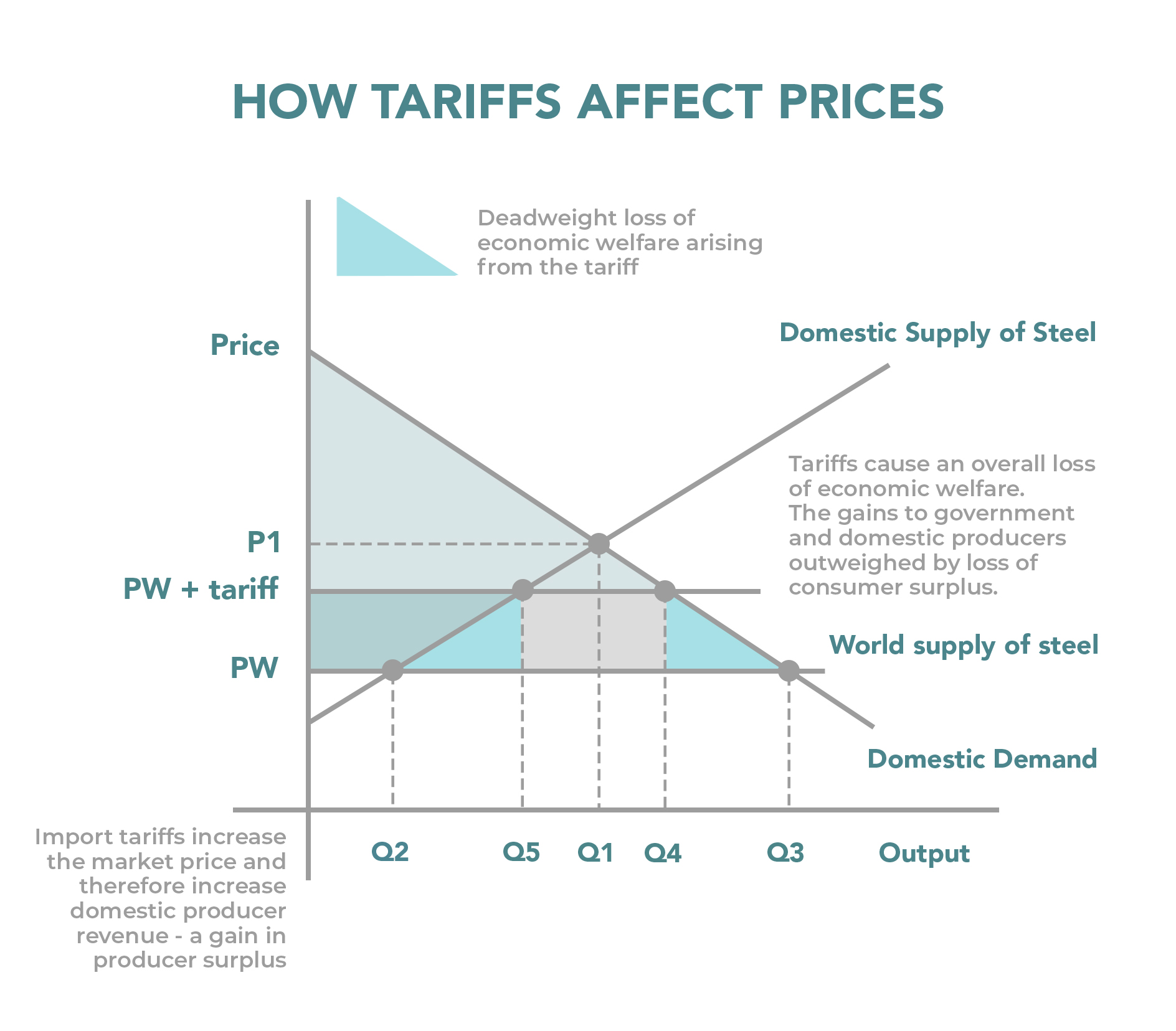

Geopolitical events and international relations exert considerable influence on the Dax. Global trade tensions and conflicts directly impact German exports, a significant driver of the German economy. Trade wars, such as the US-China trade war, can disrupt supply chains and reduce demand for German goods, negatively affecting Dax constituents heavily reliant on international trade.

Decisions within the European Union (EU) have a direct bearing on the German economy and the Dax. EU regulations and policies impacting the single market can influence the business environment for German companies.

Global economic power shifts also impact the German market. The rise of new economic powers can alter global trade patterns and competition, affecting German industries and impacting the Dax.

- Example: Brexit significantly impacted the Dax due to uncertainty about future trade relations between Germany and the UK.

- Example: The war in Ukraine significantly impacted energy prices and supply chains, leading to a negative impact on Dax performance.

Economic Factors Affecting Dax Performance

Domestic Economic Growth and Indicators

The correlation between domestic economic growth and Dax performance is strong. GDP growth, inflation rates, and unemployment rates are key indicators. Strong GDP growth typically translates into higher corporate earnings and increased investor confidence, boosting the Dax. High inflation, conversely, can erode corporate profits and negatively influence the Dax. Low unemployment suggests a healthy economy, which usually benefits the Dax.

Leading economic indicators like the Purchasing Managers' Index (PMI) and consumer confidence surveys provide valuable insights into the future direction of the economy. A rising PMI, indicating increased manufacturing activity, generally suggests positive Dax performance. Similarly, high consumer confidence suggests strong consumer spending, which is beneficial for the Dax.

Domestic consumer spending and investment are major drivers of corporate earnings. Increased consumer spending fuels demand, boosting corporate revenue and impacting the Dax positively.

- Example: A rise in the German PMI suggests increased manufacturing activity and usually leads to a positive Dax trend.

- Example: High consumer confidence signals increased spending, benefiting consumer goods companies listed on the Dax.

Global Economic Conditions and Market Sentiment

Global economic conditions and market sentiment exert a significant impact on Dax performance. Global economic growth is crucial; fears of a global recession can trigger sell-offs and negatively influence the Dax. Market volatility, often reflected in indices like the VIX (Volatility Index), impacts investor behavior. High volatility generally leads to increased caution and potential downward pressure on the Dax.

Commodity prices, particularly oil and metals, significantly influence German industries. Fluctuations in oil prices, for example, can affect transportation costs and energy expenses for German companies, impacting their profitability and influencing the Dax.

Global interest rate changes and currency fluctuations influence investor behavior and Dax valuations. Changes in global interest rates can affect the relative attractiveness of investments in German assets, impacting the Dax. Currency fluctuations affect the competitiveness of German exports and the valuations of German companies with international operations.

- Example: A global recession typically leads to a decline in Dax performance due to reduced global demand for German goods and services.

- Example: A strengthening Euro can make German exports less competitive, potentially leading to negative Dax performance.

Conclusion

This article has explored the intricate interplay of political and economic factors influencing Dax performance. From government policies and geopolitical events to domestic economic indicators and global market sentiment, numerous elements contribute to the index's fluctuations. Understanding these factors is crucial for effective investment strategies in the German stock market.

Call to Action: Stay informed about current political and economic developments to make informed decisions regarding your Dax investments. Regularly monitor key economic indicators and geopolitical events, and deepen your understanding of Dax performance to optimize your Dax investment strategy. Consider consulting with a financial advisor to create a personalized investment plan tailored to your risk tolerance and financial goals.

Featured Posts

-

Belinda Bencic Claims First Wta Win After Motherhood

Apr 27, 2025

Belinda Bencic Claims First Wta Win After Motherhood

Apr 27, 2025 -

Svitolinas Strong Start Dubai First Round Win Over Kalinskaya

Apr 27, 2025

Svitolinas Strong Start Dubai First Round Win Over Kalinskaya

Apr 27, 2025 -

The Perfect Couple Season 2 Whos Joining The Cast Source Material Details

Apr 27, 2025

The Perfect Couple Season 2 Whos Joining The Cast Source Material Details

Apr 27, 2025 -

Professional Analysis Ariana Grandes Bold Hair And Tattoo Choices

Apr 27, 2025

Professional Analysis Ariana Grandes Bold Hair And Tattoo Choices

Apr 27, 2025 -

Professional Commentary Ariana Grandes Striking Hair And Tattoo Changes

Apr 27, 2025

Professional Commentary Ariana Grandes Striking Hair And Tattoo Changes

Apr 27, 2025

Latest Posts

-

Teslas Canadian Inventory Strategy A Response To Tariff Concerns

Apr 27, 2025

Teslas Canadian Inventory Strategy A Response To Tariff Concerns

Apr 27, 2025 -

Understanding Teslas Price Adjustments In The Canadian Market

Apr 27, 2025

Understanding Teslas Price Adjustments In The Canadian Market

Apr 27, 2025 -

Teslas Canadian Price Hike Impact On Consumers And Inventory

Apr 27, 2025

Teslas Canadian Price Hike Impact On Consumers And Inventory

Apr 27, 2025 -

Tesla Raises Canadian Prices Accelerates Pre Tariff Vehicle Sales

Apr 27, 2025

Tesla Raises Canadian Prices Accelerates Pre Tariff Vehicle Sales

Apr 27, 2025 -

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025