Credit Card Companies Feel The Pinch As Consumers Cut Back On Spending

Table of Contents

Declining Credit Card Spending and Revenue

Reduced consumer spending directly translates to lower revenue for credit card companies. This impact is felt across several key revenue streams: transaction fees, merchant fees, and interest income. The decrease in credit card usage is affecting the bottom line significantly.

- Lower Transaction Volumes: Fewer purchases mean less revenue from merchant fees. Credit card companies typically charge merchants a percentage of each transaction processed. When spending declines, so do these fees.

- Decreased Interest Income: Outstanding credit card balances are the lifeblood of interest income for credit card companies. With reduced spending, consumers are carrying smaller balances, leading to a decline in the interest earned on those balances. This is particularly impactful given the rising interest rates designed to combat inflation.

- Exploring Alternative Revenue Streams: To offset these losses, credit card companies are actively seeking alternative revenue streams. This might involve increasing fees for services, expanding into new financial products, or focusing on higher-yielding customer segments.

- Disproportionate Impact on Smaller Companies: Smaller credit card companies are likely to feel the impact of reduced spending more severely than their larger counterparts. They have less financial cushion to absorb revenue shortfalls and may struggle to compete for market share in a tightening economy.

Rising Credit Card Defaults and Delinquencies

As consumers face financial hardship, a worrying trend is emerging: a rise in credit card defaults and delinquencies. This is a major concern for credit card companies, impacting their profitability and financial stability.

- Increased Defaults: Financial instability among consumers leads to a higher likelihood of missed payments and, ultimately, defaults. This means consumers are failing to make their minimum monthly payments, let alone pay down the principal.

- Higher Charge-Off Rates: Increased delinquencies directly translate to higher charge-off rates—the percentage of outstanding debt written off as uncollectible. This significantly reduces profitability.

- Increased Provisions for Loan Losses: Credit card companies are forced to increase their provisions for loan losses, setting aside more capital to cover potential defaults. This reduces their available capital for other investments and operations.

- Tighter Lending Standards: The increased credit risk will likely result in tighter lending standards in the future. Credit card companies may become more selective in approving applications, potentially reducing access to credit for some consumers.

Increased Competition and Pressure on Profit Margins

The credit card industry is highly competitive, and the current economic downturn is intensifying the pressure on profit margins. Companies are battling for market share through various strategies, often leading to reduced profitability for all involved.

- Intense Competition: Existing credit card companies are vying for a shrinking pool of spending, leading to intense competition.

- Attractive Rewards Programs: Companies are offering increasingly attractive rewards programs, such as cashback offers, points systems, and travel rewards, to lure and retain customers. These programs can cut into profitability.

- Potential Interest Rate Wars: To attract customers, there's a potential for interest rate wars, where companies undercut each other's interest rates, ultimately reducing overall profitability for the industry.

- Focus on Customer Retention: Companies are shifting their focus towards customer retention strategies and loyalty programs to maintain their existing customer base.

The Impact on Credit Card Rewards Programs

The economic downturn is also impacting the lucrative credit card rewards programs offered to consumers. Reduced spending and profitability might force companies to make adjustments to these programs.

- Reduced Cashback Percentages: Consumers might see lower cashback percentages or reduced points earning rates on their cards.

- Changes in Earning Structures: Companies might alter the structure of their rewards programs, making it harder to earn points or redeem rewards.

- Fewer Partnership Offers: The number of partnerships and associated perks offered through credit card rewards programs may decline.

Conclusion

The decrease in consumer spending is creating significant challenges for credit card companies. Reduced revenue, rising defaults, and increased competition are putting pressure on profitability and forcing companies to adapt their strategies. Understanding the impact of reduced consumer spending on credit card companies is crucial for both consumers and businesses. Stay informed about the evolving credit card market and make responsible financial decisions to navigate this economic climate effectively. Learn more about managing your credit card debt and improving your financial health amidst the current challenges in the credit card market.

Featured Posts

-

Bitcoin Btc Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025

Bitcoin Btc Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025 -

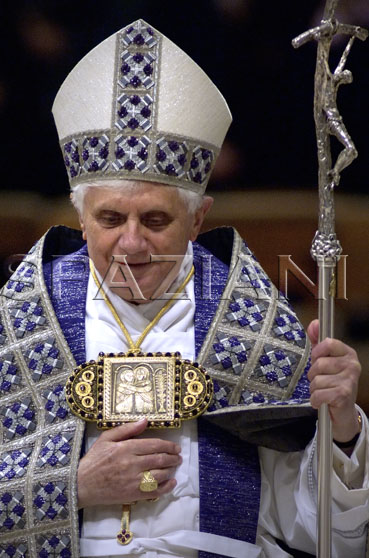

The Papal Rings Demise Tradition And The End Of A Pontificate

Apr 24, 2025

The Papal Rings Demise Tradition And The End Of A Pontificate

Apr 24, 2025 -

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

Apr 24, 2025

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

Apr 24, 2025 -

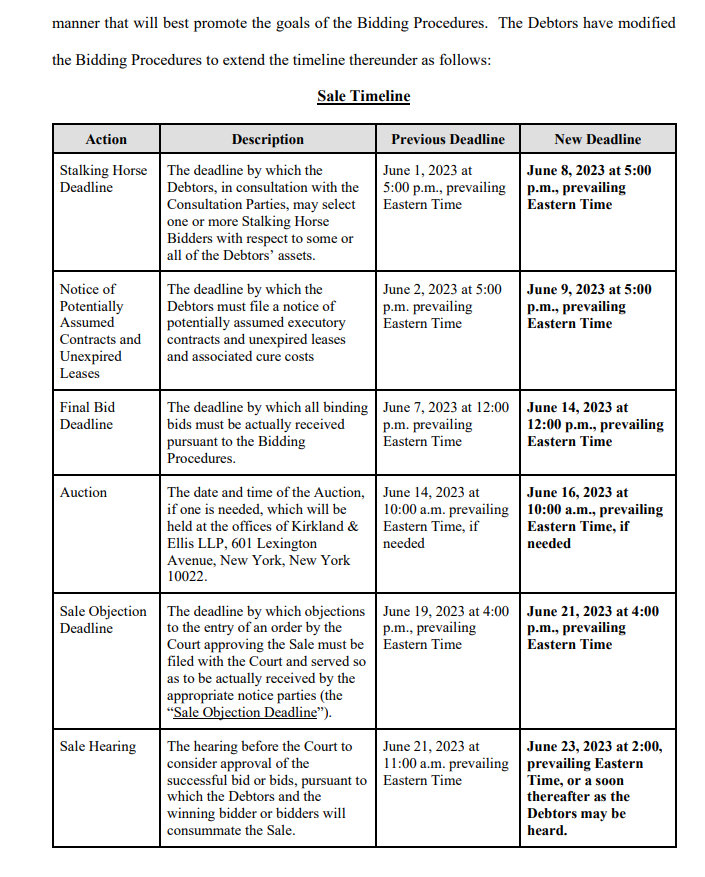

Village Roadshow Acquisition Complete Alcons Stalking Horse Bid Successful

Apr 24, 2025

Village Roadshow Acquisition Complete Alcons Stalking Horse Bid Successful

Apr 24, 2025 -

Child Actor Sophie Nyweide Mammoth Noah Dies At 24

Apr 24, 2025

Child Actor Sophie Nyweide Mammoth Noah Dies At 24

Apr 24, 2025