Crack The Code: 5 Do's & Don'ts For Private Credit Jobs

Table of Contents

Do's for Securing Private Credit Jobs

1. Develop Specialized Skills & Expertise

The private credit industry demands a specialized skillset. To stand out, focus on developing expertise in key areas:

- Financial Modeling: Master LBO modeling, discounted cash flow (DCF) analysis, and other advanced techniques. Proficiency in these areas is crucial for evaluating investment opportunities.

- Credit Underwriting: Develop a deep understanding of credit risk assessment, including analyzing financial statements, performing due diligence, and structuring debt instruments.

- Due Diligence: Hone your skills in conducting thorough investigations, identifying potential risks, and verifying information related to potential investments.

- Legal Documentation Review: Familiarize yourself with loan agreements, security documents, and other legal instruments common in private debt transactions.

- Portfolio Management: Understand the principles of portfolio construction, risk management, and performance monitoring for private credit portfolios.

Beyond theoretical knowledge, demonstrate proficiency in essential software:

- Excel: Advanced Excel skills, including financial modeling and data analysis, are paramount.

- Bloomberg Terminal: Familiarity with the Bloomberg Terminal is highly valuable for accessing market data and performing financial analysis.

- Argus: Proficiency in Argus software is beneficial for real estate-focused private credit roles.

Consider pursuing relevant certifications to further enhance your credentials:

- CFA (Chartered Financial Analyst): A globally recognized designation demonstrating expertise in investment management and analysis.

- CAIA (Chartered Alternative Investment Analyst): Specializes in alternative investments, including private equity and hedge funds, making it highly relevant to private credit.

Finally, a strong understanding of different debt structures is vital:

- Senior Secured Debt: Understand the characteristics and risks associated with senior secured debt, which typically offers the highest priority in repayment.

- Mezzanine Debt: Gain expertise in mezzanine financing, a hybrid form of debt and equity that typically carries higher risk and higher returns.

2. Network Strategically within the Private Credit Industry

Networking is paramount in the private credit industry. Actively cultivate relationships with professionals in private equity, venture capital, and credit funds.

- Attend Industry Conferences: Participate in conferences like those organized by the ACA (Asset-Based Lending Association) and IMN (Institutional Money Network) to meet professionals and learn about market trends.

- Join Relevant Professional Organizations: Membership in professional organizations provides networking opportunities and access to industry insights.

- Leverage LinkedIn Effectively: Optimize your LinkedIn profile and actively engage with professionals in your field.

- Informational Interviews: Reach out to professionals for informational interviews to learn about their careers and gain valuable insights.

Don't limit yourself to large-scale events; smaller, niche events often offer more intimate networking opportunities.

3. Tailor Your Resume and Cover Letter to Each Private Credit Job Application

Generic applications rarely succeed in the competitive private credit market. Each application must be tailored to the specific job description and the firm's investment strategy.

- Highlight Relevant Experience: Focus on experiences directly relevant to the specific job requirements.

- Quantify Achievements: Use numbers and data to demonstrate the impact of your past contributions.

- Use Keywords from Job Descriptions: Incorporate keywords from the job description to ensure your resume and cover letter are optimized for applicant tracking systems (ATS).

Showcase your understanding of the firm's investment strategy and target market. Use a strong, action verb-based approach to highlight your skills and accomplishments.

4. Prepare for Behavioral and Technical Interviews in Private Credit

Private credit interviews assess both technical skills and behavioral traits. Thorough preparation is key.

- Practice Common Interview Questions (STAR Method): Use the STAR method (Situation, Task, Action, Result) to structure your answers and highlight your accomplishments.

- Prepare for Technical Questions: Be ready to answer questions on financial statements, valuation, credit analysis, and relevant financial modeling techniques.

Demonstrate your problem-solving skills, strong communication, and teamwork capabilities. Here are examples of common technical questions:

- "Walk me through a DCF model."

- "How do you assess credit risk?"

- "Explain the difference between senior secured and mezzanine debt."

5. Showcase Your Understanding of Market Trends in Private Credit

Demonstrate your awareness of current market conditions and industry trends.

- Stay Updated on Industry News: Regularly read industry publications, such as PEI Media, and follow key players and market influencers.

- Follow Key Players: Keep abreast of the activities of major private credit firms and understand their investment strategies.

- Understand Current Market Cycles: Analyze interest rate fluctuations, economic forecasts, and their impact on the private credit market.

Leverage resources such as specialized podcasts, websites, and industry reports to stay informed about the latest developments in the private credit market.

Don'ts for Seeking Private Credit Jobs

1. Don't Neglect the Importance of Networking

Networking is crucial for uncovering hidden opportunities and making a strong first impression.

- Avoid Relying Solely on Online Applications: Direct applications are important, but networking significantly expands your reach.

- Don't Underestimate the Power of Referrals: A referral from a trusted contact can significantly increase your chances of getting an interview.

2. Don't Submit Generic Resumes and Cover Letters

Generic applications demonstrate a lack of effort and often get overlooked.

- Avoid Generic Templates: Tailor each application to the specific requirements of the role and the firm's culture.

- Personalize Each Application: Highlight the aspects of your experience that are most relevant to the specific job and company.

3. Don't Underestimate the Importance of Technical Skills in Private Credit

Strong technical skills are highly competitive advantages in this field.

- Don't Overlook the Need for Proficiency: Financial modeling, valuation, and credit analysis skills are essential.

- Highlight Your Technical Abilities: Showcase your expertise in your resume, cover letter, and during interviews.

4. Don't Neglect Your Soft Skills

Soft skills are crucial for success in a team-oriented environment.

- Communication: Clearly and effectively convey your ideas and analysis.

- Teamwork: Collaborate effectively with colleagues to achieve common goals.

- Problem-Solving: Identify and solve complex problems efficiently.

- Adaptability: Adjust to changing circumstances and priorities.

5. Don't Be Afraid to Show Enthusiasm and Passion for Private Credit

Genuine enthusiasm can significantly enhance your candidacy.

- Research Firms Thoroughly: Demonstrate a deep understanding of the firms you're applying to.

- Demonstrate Genuine Interest: Express your passion for the private credit industry and the specific role.

Conclusion

Successfully navigating the competitive landscape of private credit jobs requires a multifaceted approach. By diligently following these dos and don'ts, you'll significantly increase your chances of landing your dream role in the dynamic world of private debt and alternative lending. Remember to consistently hone your skills, network effectively, and tailor your application materials to each opportunity. Don't delay – start cracking the code to your private credit job today!

Featured Posts

-

Teslas Q1 2024 Financial Results Significant Net Income Decrease

Apr 24, 2025

Teslas Q1 2024 Financial Results Significant Net Income Decrease

Apr 24, 2025 -

William Watson On The Liberal Platform A Critical Review

Apr 24, 2025

William Watson On The Liberal Platform A Critical Review

Apr 24, 2025 -

The Importance Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025

The Importance Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025 -

417 5 Million Deal Alcon Acquires Village Roadshow

Apr 24, 2025

417 5 Million Deal Alcon Acquires Village Roadshow

Apr 24, 2025 -

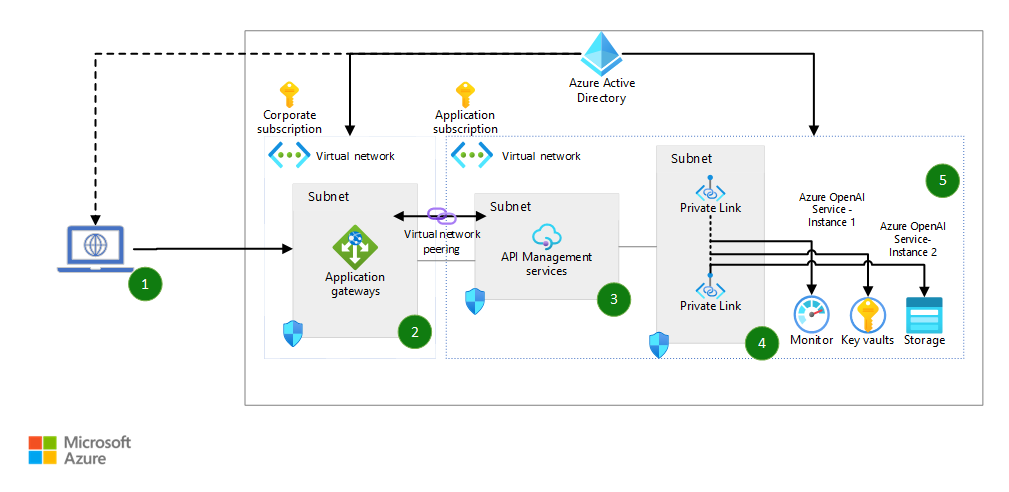

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 24, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 24, 2025