Conservative Party Promises Tax Cuts And Deficit Reduction In Canada

Table of Contents

Proposed Tax Cuts

The Conservative Party's platform centers around substantial tax relief for individuals and corporations. Let's break down the key proposals:

Individual Income Tax Reductions

The Conservatives propose reducing individual income taxes across various brackets. Specific details often vary slightly depending on the election cycle and platform updates, so it's crucial to consult the most recent official party documents for exact figures. However, generally, the plan usually includes:

- Percentage reduction: A proposed percentage reduction for several income brackets, aiming to increase disposable income for Canadian families.

- Tax bracket adjustments: Potential adjustments to tax brackets to benefit middle- and lower-income earners.

- Elimination of specific taxes: The party might propose the elimination of certain smaller taxes or levies to further reduce the tax burden on individuals.

Who benefits most? Generally, the proposed tax cuts would offer greater benefits to higher-income earners due to the progressive nature of the tax system. However, adjustments to tax brackets could mitigate this, offering more substantial relief to middle- and lower-income families.

Estimated savings: The estimated savings per tax bracket vary depending on the specifics of the proposed cuts. Independent economic analyses are needed to accurately estimate the impact on individual taxpayers.

Impact on disposable income: The projected increase in disposable income is a key element of the Conservative argument. Increased disposable income could stimulate consumer spending and boost economic growth. However, the magnitude of this effect is subject to various economic factors and consumer behavior.

Corporate Tax Rate Cuts

The Conservatives typically propose lowering the corporate tax rate to stimulate business investment and job creation. This usually involves:

- Current corporate tax rate: Currently, Canada’s federal corporate tax rate is [Insert current rate].

- Proposed reduction: The Conservatives usually propose a reduction in this rate, aiming to make Canada a more competitive environment for businesses.

- Impact on business investment and job creation: Lower corporate taxes are intended to encourage businesses to invest more, expand operations, and create jobs. However, the effectiveness of this strategy is debated, with some arguing that other factors play a larger role in investment decisions.

Other Tax Measures

Beyond individual and corporate income tax cuts, other proposed tax changes might include:

- GST/HST changes: Potential adjustments to the Goods and Services Tax or Harmonized Sales Tax are sometimes part of the Conservative platform. These changes could impact consumer spending and prices.

- Capital gains tax: Modifications to the capital gains tax rate could influence investment decisions and wealth distribution.

These additional tax measures often add complexity to the overall fiscal picture and require detailed analysis to understand their full impact.

Planned Deficit Reduction Strategies

The Conservative Party's plan to reduce the budget deficit typically involves a combination of spending cuts, revenue generation initiatives, and economic growth strategies.

Spending Cuts

To achieve fiscal responsibility, the Conservatives often propose:

- Targeted spending cuts: Specific government programs or departments are identified for reductions in funding. These cuts may target areas deemed less efficient or less essential.

- Estimated savings: The party usually provides estimates of the savings these cuts would generate. However, these figures are often subject to debate and scrutiny.

- Potential consequences: Critics often point to potential negative consequences of spending cuts, such as reduced access to public services or job losses in the public sector.

Increased Revenue Generation (Beyond Tax Cuts)

Beyond tax cuts, the Conservative Party may suggest alternative methods to increase government revenue without raising taxes:

- Improved tax collection: Strengthening tax enforcement to reduce tax evasion and improve collection rates.

- Increased government efficiency: Streamlining government operations to reduce administrative costs and improve service delivery.

Economic Growth Initiatives

The Conservatives usually emphasize economic growth as a crucial element of deficit reduction. Their plans often include:

- Job creation initiatives: Policies aimed at fostering job creation in various sectors.

- Investment incentives: Policies designed to attract investment from both domestic and foreign sources.

- Innovation and technology: Support for innovation and technological development to drive economic growth.

Analysis and Potential Impact

Analyzing the Conservative Party's proposed fiscal policies requires careful consideration of several factors:

Economic Forecasts and Projections

Independent economic analyses of the Conservative plan are crucial for assessing its feasibility and potential impact. These analyses usually consider:

- Fiscal outlook: Independent economists provide projections of the impact of the proposed policies on the budget deficit and debt levels.

- Economic forecast: They offer predictions on the overall effect of the plan on economic growth, inflation, and employment.

- Budget projections: The credibility of the party's budget projections is a key factor in evaluating their fiscal plan.

Potential Social and Political Impacts

The proposed policies are likely to have a significant social and political impact:

- Winners and losers: Different segments of the population are likely to be affected differently by the proposed changes. Some may gain (e.g., high-income earners from tax cuts), while others may lose (e.g., those reliant on government services facing cuts).

- Political ramifications: The plan's impact on public opinion and the political landscape are crucial factors to consider.

- Public opinion: Public support for the proposed policies will influence their ultimate success and implementation.

Conclusion

The Conservative Party's promise of tax cuts and deficit reduction represents a significant aspect of their political platform. The proposed strategies – including individual and corporate tax cuts, spending reductions, revenue generation initiatives, and economic growth policies – offer a comprehensive approach to fiscal policy. However, the feasibility and effectiveness of these proposals remain subject to ongoing debate and scrutiny from economists and the public. Careful consideration of independent economic analyses and projections is vital for understanding the potential benefits and drawbacks. To learn more about the complete platform and their plans, visit the official Conservative Party website. Stay informed on the Conservative Party Promises Tax Cuts and Deficit Reduction in Canada and its impact on your future.

Featured Posts

-

60 Minutes Producer Resigns After Trump Lawsuit Loss Of Independence Cited

Apr 24, 2025

60 Minutes Producer Resigns After Trump Lawsuit Loss Of Independence Cited

Apr 24, 2025 -

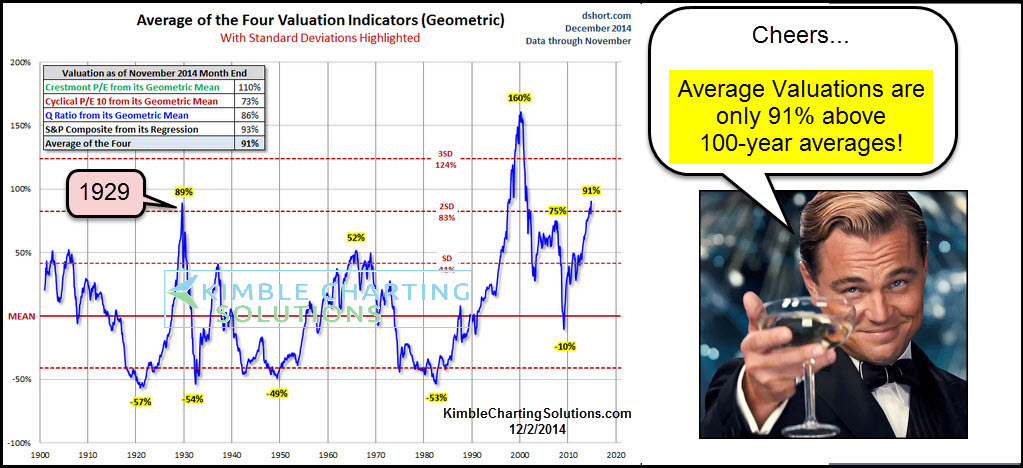

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 24, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 24, 2025 -

Sophie Nyweide Mammoth And Noah Child Actress Dead At 24

Apr 24, 2025

Sophie Nyweide Mammoth And Noah Child Actress Dead At 24

Apr 24, 2025 -

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025 -

The Lg C3 77 Inch Oled Real World Performance And Value

Apr 24, 2025

The Lg C3 77 Inch Oled Real World Performance And Value

Apr 24, 2025