CMA CGM Strengthens Its Position With $440 Million Turkish Acquisition

Table of Contents

Expanding CMA CGM's Global Reach: A Foothold in the Turkish Market

Turkey's strategic location makes it a critical logistics hub, bridging the gap between Europe and Asia. Its extensive port infrastructure and geographical position offer unparalleled access to key markets across the Eurasian continent. For CMA CGM, establishing a stronger presence in Turkey offers numerous advantages:

- Access to New Trade Routes: The acquisition provides CMA CGM with enhanced access to the Black Sea region, opening up new trade routes and opportunities for expansion within Central Asia and the Middle East.

- Increased Market Share: By securing a foothold in the Turkish market, CMA CGM can tap into the growing Eurasian trade corridor, significantly boosting its market share and overall global competitiveness.

- Enhanced Global Network: The move strengthens CMA CGM's global network, creating more efficient and streamlined shipping routes, benefiting both the company and its clients.

Key Benefits:

- Increased access to the Black Sea region.

- Improved connectivity to Central Asia and the Middle East.

- Strengthened position in the growing Eurasian trade corridor.

- Enhanced efficiency in global shipping operations.

Financial Implications of the $440 Million Investment

The $440 million investment represents a significant financial commitment from CMA CGM. While the specifics of the acquisition target and asset breakdown remain undisclosed, the potential return on investment (ROI) is expected to be substantial. The acquisition is likely to lead to:

- Increased Revenue: Access to new markets and trade routes will undoubtedly drive significant revenue growth for CMA CGM.

- Synergies and Cost Savings: Integrating the acquired assets into CMA CGM's existing operations could generate substantial synergies and cost savings.

- Market Expansion: Expansion into the Turkish market promises a huge increase in the company's overall market reach.

Financial Projections (Speculative):

- Acquisition cost breakdown (unavailable publicly).

- Projected revenue increase (subject to market conditions and successful integration).

- Synergies and cost savings (difficult to estimate without specific details).

Competitive Landscape and Market Share Implications

This acquisition significantly alters the competitive landscape within the Turkish shipping industry and surrounding regions. CMA CGM now faces established players, requiring strategic maneuvers to maximize market share gains. The acquisition could:

- Increase CMA CGM's Market Share: The move will likely lead to a significant increase in CMA CGM's market share in Turkey and neighboring regions.

- Elicit Competitive Responses: Competitors are likely to respond to this strategic move, intensifying competition and potentially prompting counter-strategies.

- Improve Market Positioning: The acquisition consolidates CMA CGM's position as a major player in the global shipping market and enhances its brand reputation.

Competitive Analysis:

- Comparison with other major shipping companies operating in Turkey (requires further research for specific competitors).

- Potential market share gains for CMA CGM (dependent on successful integration and market response).

- Analysis of competitive reactions (requires monitoring industry news and announcements).

Long-Term Strategic Goals and Future Growth

This Turkish acquisition is a clear demonstration of CMA CGM's long-term strategic vision for global expansion and growth. The investment aligns with the company's broader goals of:

- Global Market Domination: The acquisition represents another step towards CMA CGM's ambition to become a dominant force in the global shipping industry.

- Strategic Infrastructure Investment: The company is likely to invest further in Turkey's logistics infrastructure to maximize the return on its investment.

- Sustainable Growth: The move aims to deliver sustained and profitable growth for the company, improving its financial standing within the industry.

Future Projections (Speculative):

- CMA CGM's overall expansion strategy will likely incorporate similar strategic acquisitions in other key markets.

- Future investment plans in Turkey could include infrastructure upgrades or partnerships with local businesses.

- Long-term projections for growth and profitability depend on successful market integration and overall economic conditions.

Conclusion: CMA CGM's Turkish Acquisition: A Strategic Masterstroke?

CMA CGM's $440 million investment in Turkey is a significant strategic move with far-reaching implications. The acquisition strengthens its global reach, improves its competitive position, and offers substantial financial benefits. While the full impact will unfold over time, the initial signs suggest this could be a successful strategic masterstroke. The acquisition’s potential to enhance CMA CGM's market share and profitability in a key geographic location makes this investment a promising venture. To learn more about CMA CGM's strategic acquisitions and its ongoing global expansion, visit their official website and stay updated on their future investments.

Featured Posts

-

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025 -

Top Seed Pegula Claims Charleston Victory Against Collins

Apr 27, 2025

Top Seed Pegula Claims Charleston Victory Against Collins

Apr 27, 2025 -

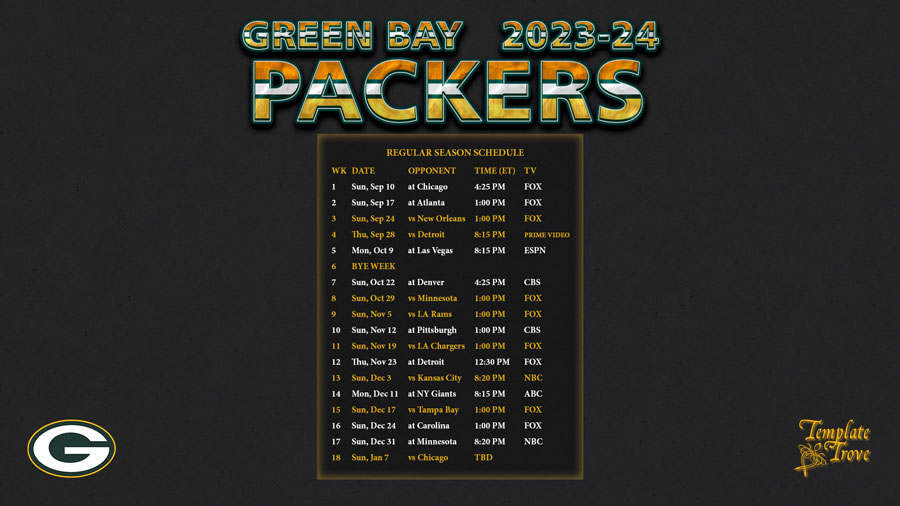

Green Bay Packers Two Chances For A 2025 International Game

Apr 27, 2025

Green Bay Packers Two Chances For A 2025 International Game

Apr 27, 2025 -

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

Apr 27, 2025

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

Apr 27, 2025 -

Bencic De Vuelta A La Cima Victoria Nueve Meses Despues De Ser Madre

Apr 27, 2025

Bencic De Vuelta A La Cima Victoria Nueve Meses Despues De Ser Madre

Apr 27, 2025