Chinese Buyout Firm Mulls Sale Of Chip Tester UTAC

Table of Contents

UTAC's Market Position and Significance

UTAC holds a substantial position in the semiconductor testing equipment market, specializing in advanced testing solutions for high-performance chips. Its market share, while not publicly disclosed, is estimated to be significant within specific niche segments. UTAC boasts cutting-edge technologies, allowing it to test a wide variety of chips, ensuring performance and reliability.

- Specific types of chips UTAC tests: UTAC's expertise spans various chip types, including high-speed processors, memory chips, and specialized integrated circuits for applications like automotive and 5G technology. Their advanced testing capabilities cater to the growing demand for more complex and powerful chips.

- Unique selling propositions (USPs) of UTAC's technology: Sources suggest UTAC’s technology offers superior speed, accuracy, and efficiency compared to competitors, making it a preferred choice for leading chip manufacturers.

- Major clients or industry segments served: UTAC's client base likely includes many of the world's leading semiconductor manufacturers and companies involved in cutting-edge technological applications.

Reasons Behind the Potential Sale

The reasons behind the potential sale of UTAC by the Chinese buyout firm remain largely speculative, but several factors may be at play. Market conditions, financial performance, and strategic considerations all contribute to the complexity of this decision.

- Potential financial distress: The semiconductor industry experiences cyclical fluctuations, and a downturn could have impacted UTAC's profitability, prompting a sale.

- Strategic shift by the buyout firm: The parent company might be divesting to focus on other investments or strategic priorities, shifting their portfolio towards different technological sectors.

- Market consolidation trends: Consolidation is a common trend in many industries, and the sale of UTAC could be a response to increased competition and a desire for a more dominant market position for the acquiring firm.

- Attractive acquisition offers: A compelling offer from a potential buyer could make the sale strategically and financially advantageous for the buyout firm.

Potential Buyers and Acquisition Implications

Several entities could be interested in acquiring UTAC. Potential buyers range from direct competitors seeking to expand their market share to private equity firms looking for lucrative investments.

- List of potential acquirers with rationale: Competitors in the semiconductor testing market, large multinational corporations involved in chip manufacturing, and private equity firms with a strong technology investment track record could all be potential bidders.

- Impact on pricing and competition in the market: The acquisition could lead to increased prices for chip testing services or potentially foster greater competition depending on the buyer and their subsequent business strategies.

- Potential job security concerns for UTAC staff: The change in ownership could bring uncertainties for UTAC employees regarding job security and future opportunities.

- Potential changes in service and support for existing customers: Existing customers may experience changes in service levels, pricing, or support systems following the acquisition.

Regulatory and Geopolitical Considerations

The sale of UTAC, given its position in the semiconductor industry and the involvement of a Chinese buyout firm, is subject to significant regulatory and geopolitical scrutiny.

- Specific regulations that could impact the sale: International trade regulations, national security reviews in various countries, and antitrust laws could all potentially impact the sale's timeline and outcome.

- Potential national security reviews: Given the strategic importance of semiconductor technology, government bodies in several countries are likely to conduct thorough national security reviews of the acquisition.

- Impact of US-China trade relations: The current geopolitical landscape and the existing tensions between the US and China will inevitably play a role in determining the success of the transaction.

Conclusion: The Future of UTAC After the Potential Sale

The potential sale of UTAC marks a significant event in the semiconductor industry. The outcome will depend on various factors, including the buyer, regulatory approvals, and broader market conditions. The implications extend far beyond the immediate parties involved, affecting competition, pricing, and national security. The "Chinese Buyout Firm Mulls Sale of Chip Tester UTAC" situation requires careful monitoring. Stay informed about future developments by following reputable news sources for updates on this potentially transformative transaction. [Link to relevant news source/company website (if available)].

Featured Posts

-

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

Apr 24, 2025

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

Apr 24, 2025 -

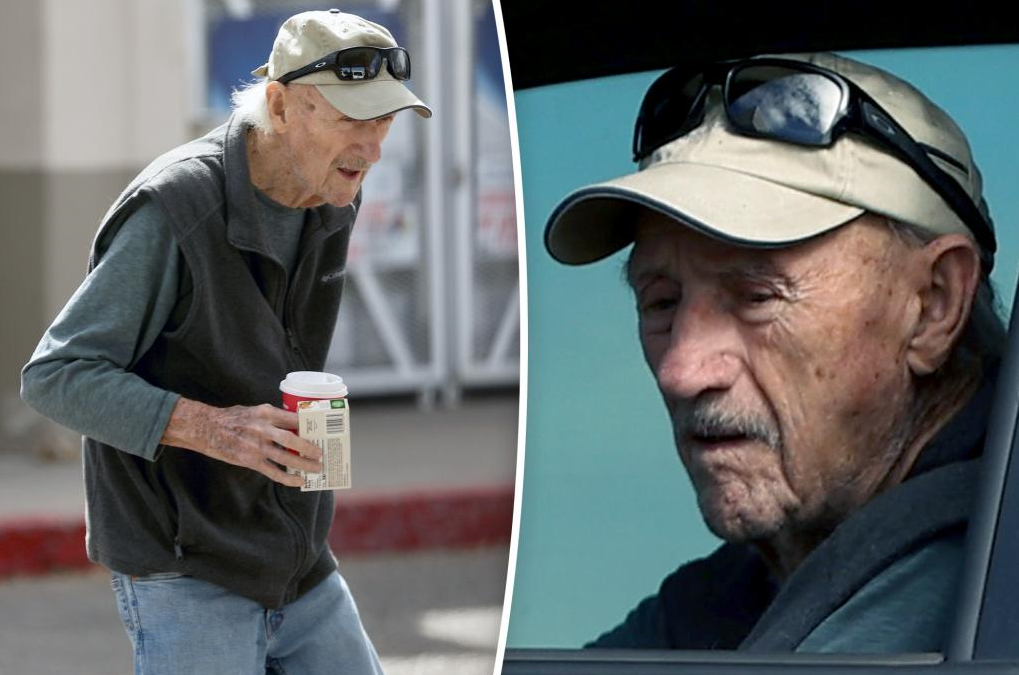

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

417 5 Million Deal Alcon Acquires Village Roadshow

Apr 24, 2025

417 5 Million Deal Alcon Acquires Village Roadshow

Apr 24, 2025 -

Is This The End For Liam The Bold And The Beautiful Spoilers

Apr 24, 2025

Is This The End For Liam The Bold And The Beautiful Spoilers

Apr 24, 2025 -

Judge Abrego Garcias Stern Warning Stonewalling Ends Now

Apr 24, 2025

Judge Abrego Garcias Stern Warning Stonewalling Ends Now

Apr 24, 2025