China's Targeted Tariff Exemptions For US Products

Table of Contents

The History and Context of Tariff Exemptions

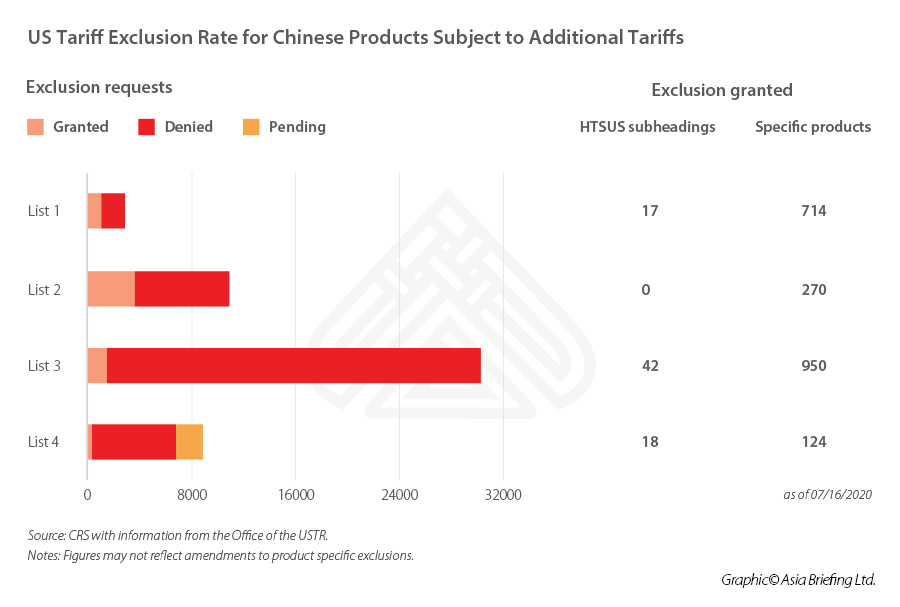

The US-China trade dispute, escalating significantly since 2018, involved the imposition of tariffs on hundreds of billions of dollars worth of goods traded between the two countries. These tariffs, acting as import tariffs on Chinese goods entering the US and export tariffs on US goods sent to China, were levied in response to concerns about unfair trade practices, intellectual property theft, and trade imbalances. China, in response to US tariffs, implemented its own retaliatory measures.

However, amidst this trade war, China strategically introduced targeted tariff exemptions for certain US products. These exemptions weren't uniformly applied; rather, they served as a tool in bilateral trade negotiations, a mechanism for de-escalation, or even to target specific sectors or products deemed crucial to China's economy.

- Initial imposition of tariffs on US goods: The initial rounds of tariffs targeted various sectors, including agriculture, technology, and manufacturing.

- Subsequent rounds of escalation and de-escalation: The imposition of tariffs was often followed by periods of negotiation, leading to temporary pauses or modifications in tariff rates, sometimes including exemptions.

- China's strategic use of exemptions as a negotiation tactic: The granting of exemptions was often linked to broader trade discussions and concessions sought by China.

- The role of bilateral trade negotiations in influencing exemptions: The "Phase One" trade deal, for example, led to some tariff reductions and the modification of existing exemption policies, showcasing the direct link between negotiations and the availability of exemptions.

Identifying Eligible Products for Exemptions

Securing tariff exemptions in China requires a thorough understanding of the application process and eligibility criteria. While the exact criteria and processes can be complex and subject to change, they generally involve submitting extensive documentation to Chinese customs authorities.

The types of products historically receiving exemptions have varied, often reflecting China's strategic priorities. Industries like agriculture (certain soybeans, for instance) and some technology components have seen exemptions granted at different times. This is largely due to the influence of political factors and the specific needs of the Chinese market.

- Specific industry sectors benefiting from exemptions (e.g., agriculture, technology): The selection criteria are often opaque, making it challenging for businesses to predict which products are most likely to be granted exemptions.

- Requirements for documentation and application submission: Businesses must provide detailed information about their products, including origin, value, and intended use in the Chinese market.

- The role of Chinese customs authorities in the exemption process: Chinese customs authorities have the final say on whether an application is approved. Their decisions can be influenced by various factors, including bilateral trade relations and domestic economic considerations.

- Transparency and accessibility of information related to exemptions: While information is available, it is not always readily accessible or transparent to foreign businesses, potentially creating challenges for application processes.

Economic and Political Implications of Tariff Exemptions

The granting of tariff exemptions carries significant economic and political weight. For US businesses, exemptions can increase competitiveness in the Chinese market, boosting exports and potentially creating or securing jobs. Conversely, the lack of exemptions can harm US businesses and lead to lost opportunities.

For China, the exemptions can impact domestic industries and consumers. They can create competition for Chinese producers and influence consumer prices. Moreover, these decisions have significant geopolitical ramifications, influencing the broader US-China relationship.

- Increased competitiveness for exempted US products in the Chinese market: Exemptions allow US products to be more price-competitive, potentially capturing a larger share of the Chinese market.

- Potential shifts in supply chains and manufacturing locations: Tariff exemptions may incentivize companies to maintain or establish supply chains connected to China, influencing global manufacturing and trade flows.

- Effects on consumer prices in China: Exemptions can lead to lower prices for certain imported goods for Chinese consumers, impacting the overall inflation rate.

- Impact on overall bilateral trade volume: The overall effect of exemptions on bilateral trade volume is complex and depends on the scale and scope of the exemptions granted, as well as their effectiveness.

Future Outlook and Predictions for Tariff Exemptions

Predicting the future of US-China trade relations, and consequently, tariff exemptions, is inherently challenging. However, several factors will likely play a role. Future trade negotiations between the two nations will undoubtedly influence existing exemptions. Geopolitical events and shifts in global economic power could also trigger changes in China's policy. The long-term sustainability of current exemption programs remains questionable, depending largely on the overall trajectory of US-China relations.

- Potential impacts of future trade negotiations on existing exemptions: Future negotiations could lead to the extension, modification, or elimination of current exemptions.

- The influence of geopolitical events on exemption policies: Increased geopolitical tensions between the US and China could potentially lead to a tightening of exemptions or even their complete removal.

- Long-term sustainability of current exemption programs: The long-term sustainability will depend on various factors, including the overall health of the global economy, ongoing trade negotiations, and the broader geopolitical climate.

Conclusion

China's targeted tariff exemptions for US products represent a dynamic and evolving aspect of the complex US-China trade relationship. Understanding the historical context, application processes, and economic implications of these exemptions is critical for businesses involved in international trade. The future of these exemptions remains uncertain, hinging on future trade negotiations and broader geopolitical dynamics.

Call to Action: Stay informed on the latest developments regarding China's targeted tariff exemptions for US products to optimize your business strategies and navigate this fluctuating trade landscape successfully. Regularly review official announcements from Chinese customs authorities and consult with trade experts to ensure compliance and capitalize on opportunities arising from these exemptions. Understanding these nuances in customs duties is critical for success in this market.

Featured Posts

-

Addressing The O Neill Void Red Sox Roster Options For 2025

Apr 28, 2025

Addressing The O Neill Void Red Sox Roster Options For 2025

Apr 28, 2025 -

Red Sox Breakout Season Could This Underrated Player Be The Key

Apr 28, 2025

Red Sox Breakout Season Could This Underrated Player Be The Key

Apr 28, 2025 -

Mets Rotation Battle How A Key Change Gave One Pitcher The Advantage

Apr 28, 2025

Mets Rotation Battle How A Key Change Gave One Pitcher The Advantage

Apr 28, 2025 -

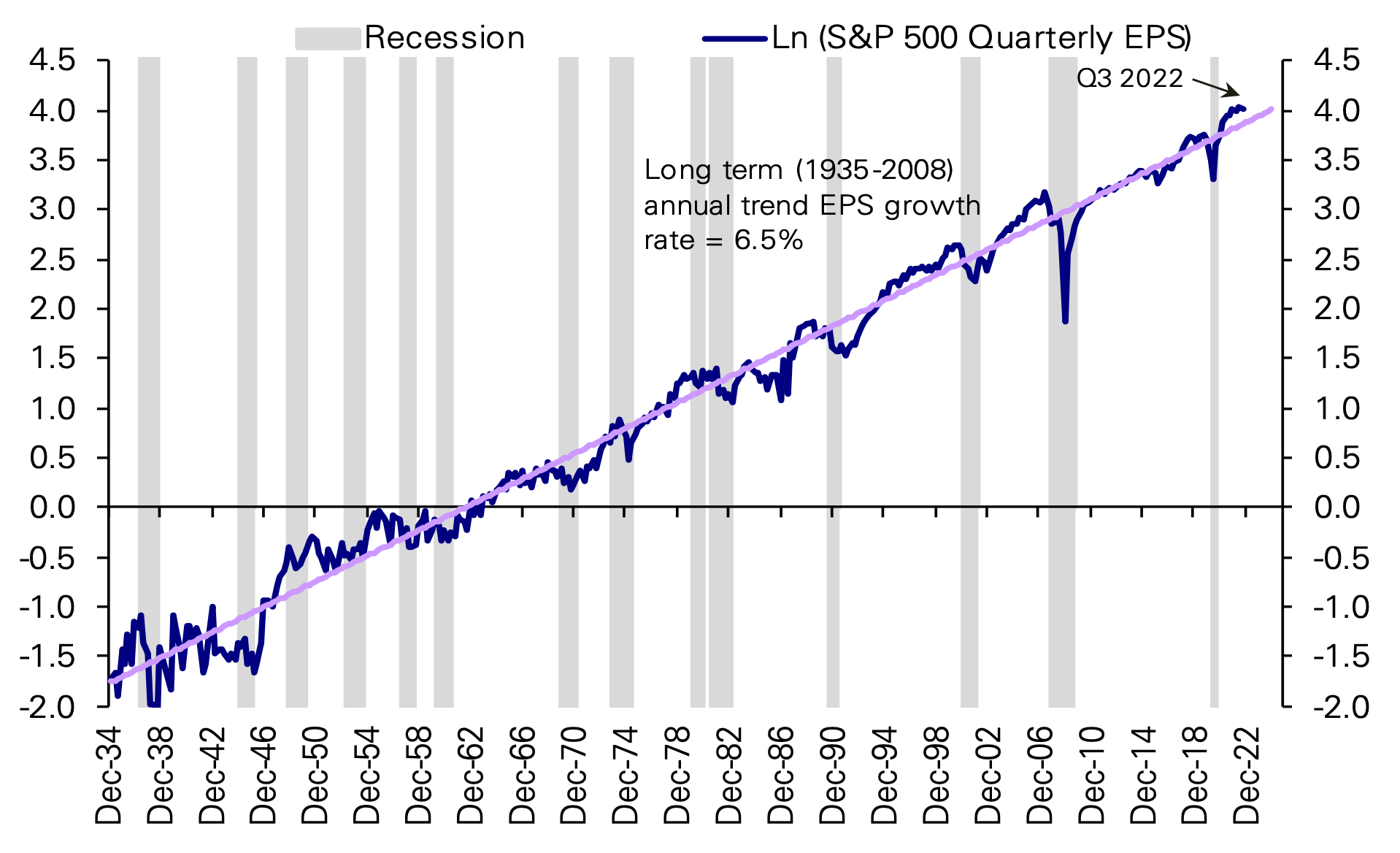

U S Stock Market Climbs On Tech Giant Strength Teslas Leading Role

Apr 28, 2025

U S Stock Market Climbs On Tech Giant Strength Teslas Leading Role

Apr 28, 2025 -

Analysis Mets Starters Development And Future Potential

Apr 28, 2025

Analysis Mets Starters Development And Future Potential

Apr 28, 2025