China's Economic Stimulus And Its Impact On Today's Stock Market: Dow Futures Reaction

Table of Contents

Understanding China's Stimulus Package

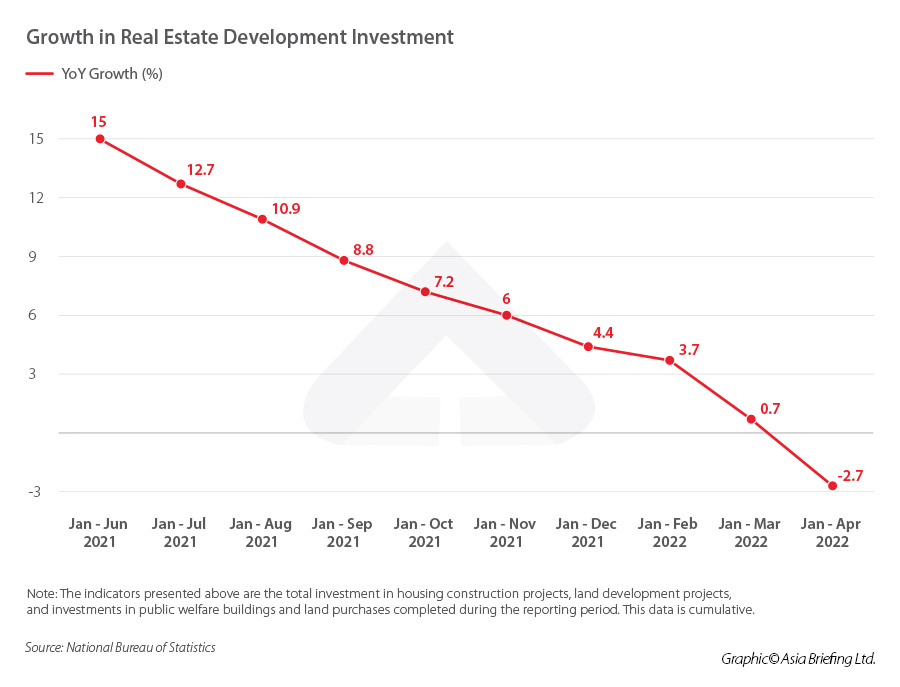

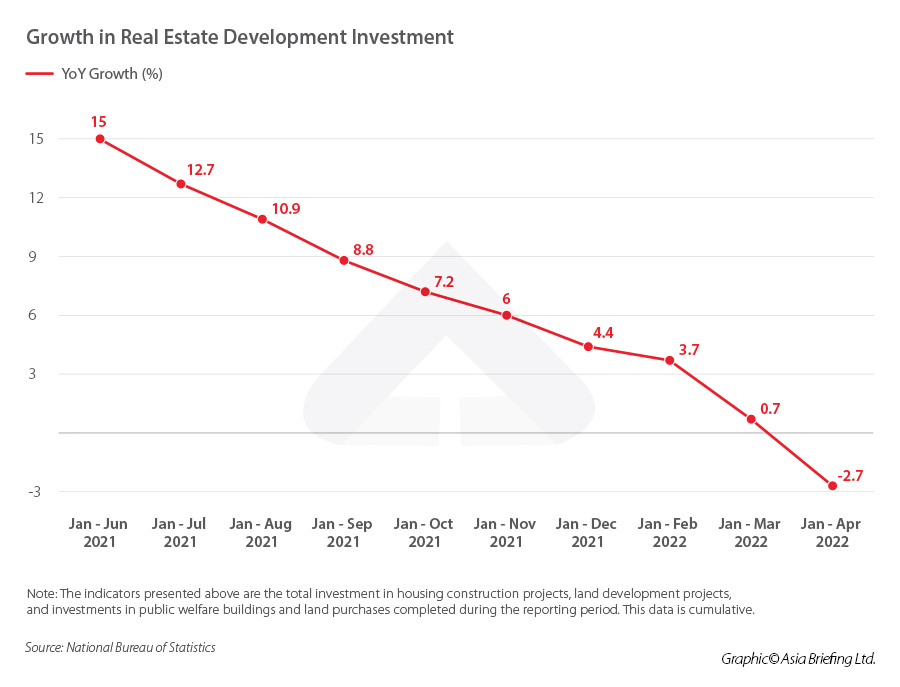

China's stimulus package represents a multifaceted approach designed to revitalize its economy. The rationale behind this substantial intervention stems from several crucial factors: a slowdown in economic growth, concerns surrounding the property sector, and persistent global uncertainties. The package includes a range of measures aimed at boosting investment, supporting businesses, and stimulating consumer spending.

- Increased Infrastructure Investment: Significant funds are allocated to upgrade infrastructure, focusing particularly on renewable energy projects and modernizing transportation networks. This aims to create jobs and boost long-term economic productivity.

- Tax Relief for SMEs: Targeted tax cuts and incentives are offered to small and medium-sized enterprises (SMEs), a vital engine of China's economic growth. This support aims to alleviate financial burdens and encourage expansion.

- Easing of Monetary Policy: The central bank is implementing measures to lower interest rates and increase the availability of credit. This injection of liquidity aims to stimulate lending and investment.

- Support for the Property Sector: While details remain nuanced, the package includes measures aimed at stabilizing the real estate market, addressing concerns about potential defaults and market instability. This is crucial considering the significant role of real estate in the Chinese economy.

Immediate Impact on Dow Futures

The announcement of China's stimulus package triggered an immediate, albeit complex, reaction in Dow Futures. While initial reactions varied, a predominantly positive sentiment emerged, with Dow Futures showing a noticeable increase. This suggests investor optimism regarding the potential positive spillover effects on global markets.

However, this immediate response wasn't uniform. The initial surge was followed by some volatility, reflecting the uncertainty inherent in predicting the actual effectiveness of the stimulus. Several factors contributed to this initial market reaction:

- Investor Optimism: Many investors viewed the stimulus as a positive sign, anticipating increased demand for commodities and a potential boost to global trade.

- Speculation: Market speculation played a role, with some investors anticipating increased profits from increased economic activity in China.

- Uncertainty: Despite optimism, considerable uncertainty remains about the actual effectiveness and long-term consequences of the stimulus package. This uncertainty contributed to some market volatility.

(Insert relevant chart or graph illustrating Dow Futures movement following the announcement here)

Long-Term Implications for the Global Stock Market

The long-term implications of China's economic stimulus are far-reaching and complex. While the potential for positive outcomes is significant, it's crucial to acknowledge potential downsides. The stimulus could lead to several significant shifts in the global economic landscape:

- Increased Demand for Commodities: Increased infrastructure spending and industrial activity will likely boost global demand for raw materials and commodities, potentially affecting prices.

- Potential Inflationary Pressures: A significant injection of liquidity into the Chinese economy could contribute to inflationary pressures globally, particularly if supply chains struggle to keep up with increased demand.

- Shift in Global Economic Power Dynamics: The success of China's stimulus could further solidify its position as a major global economic player, potentially reshaping global trade relationships and economic power dynamics.

- Impact on US-China Trade: Increased economic activity in China could lead to increased demand for US goods and services, potentially benefiting the US economy and positively impacting the Dow. Conversely, increased competition in certain sectors could also impact some US companies.

Analyzing Investor Sentiment and Market Volatility

Investor sentiment following the stimulus announcement has been mixed, ranging from cautious optimism to significant uncertainty. Market volatility increased initially, reflecting the complexity of the situation and the difficulty in predicting the long-term consequences.

Several factors are contributing to this volatility:

- Geopolitical Concerns: Ongoing geopolitical tensions and global uncertainties continue to influence investor sentiment and contribute to market volatility.

- Inflationary Fears: Concerns about rising inflation and its potential impact on global markets are impacting investment strategies.

- Interest Rate Hikes: The actions of central banks globally, including potential interest rate hikes, continue to influence investor decisions.

Different investment strategies are emerging in response to the stimulus. Some investors are focusing on companies that are likely to benefit from increased infrastructure spending, while others are seeking investments less susceptible to inflation.

Conclusion: Navigating the Market After China's Economic Stimulus

China's economic stimulus has undeniably had a significant impact on Dow Futures and the global stock market. The immediate reaction was largely positive, but the long-term effects are still unfolding. Understanding the complex interplay between increased demand, potential inflationary pressures, and geopolitical factors is crucial for navigating this evolving landscape. The potential for both positive and negative consequences necessitates a cautious yet informed approach to investing. Stay updated on further developments regarding China's economic stimulus and its impact on Dow Futures and the broader stock market. Understanding these dynamics is crucial for informed investment decisions. Careful analysis of China's economic policies and their global implications is essential for successful investment strategies in today's dynamic market.

Featured Posts

-

Price Gouging Allegations Surface In La Following Devastating Fires A Selling Sunset Perspective

Apr 26, 2025

Price Gouging Allegations Surface In La Following Devastating Fires A Selling Sunset Perspective

Apr 26, 2025 -

American Battleground Taking On The Worlds Richest In A High Stakes Legal Battle

Apr 26, 2025

American Battleground Taking On The Worlds Richest In A High Stakes Legal Battle

Apr 26, 2025 -

Identifying And Understanding The Countrys Thriving Business Locations

Apr 26, 2025

Identifying And Understanding The Countrys Thriving Business Locations

Apr 26, 2025 -

The Improbable Journey Of Ahmed Hassanein An Nfl Draft Hopeful

Apr 26, 2025

The Improbable Journey Of Ahmed Hassanein An Nfl Draft Hopeful

Apr 26, 2025 -

Explore Orlando 7 Must Try Restaurants Beyond Disney World In 2025

Apr 26, 2025

Explore Orlando 7 Must Try Restaurants Beyond Disney World In 2025

Apr 26, 2025