Canadian Dollar Weakening Against Major Currencies

Table of Contents

Key Factors Driving the Canadian Dollar's Weakness

Several interconnected factors contribute to the current Canadian dollar weakening. Understanding these factors is key to anticipating future currency movements.

Commodity Prices and their Impact

The Canadian economy is heavily reliant on commodity exports, particularly oil and natural gas. The Canadian dollar is often referred to as a "commodity currency," meaning its value is closely tied to the price of these commodities. Lower commodity prices directly impact the CAD.

- Recent Fluctuations: The recent decline in global oil prices, driven by factors such as reduced demand and increased supply, has significantly weakened the CAD.

- Global Supply and Demand: Changes in global demand, influenced by economic growth in major economies like China, and supply disruptions due to geopolitical events or production issues, directly affect commodity prices and subsequently the CAD. A decrease in global demand or an increase in supply typically leads to lower commodity prices and a weaker CAD.

Interest Rate Differentials

Interest rate differentials between Canada and other major economies play a crucial role in currency exchange rates. When interest rates in Canada are lower than in other countries, investors may seek higher returns elsewhere, leading to a decrease in demand for the CAD and consequently, a weaker Canadian dollar.

- Canada vs. US: Comparing Canadian interest rates with those in the United States, a key trading partner, highlights this effect. Lower interest rates in Canada compared to the US can make the USD more attractive to investors, pushing the CAD down.

- Influence on Exchange Rates: Interest rate differentials impact currency exchange rates because investors seek higher returns on their investments. A higher interest rate in a country generally attracts more foreign investment, increasing the demand for its currency and strengthening it.

Geopolitical Factors and Uncertainty

Global geopolitical events and uncertainty significantly impact investor sentiment and currency exchange rates. Periods of heightened geopolitical risk often lead to a flight to safety, where investors move their money into perceived safer currencies like the USD, causing the CAD to weaken.

- Examples: Global conflicts, trade wars, and political instability can all contribute to Canadian dollar weakening. For example, escalating trade tensions between major economies can create uncertainty in the market and negatively affect commodity prices, impacting the CAD.

- Investor Confidence: Geopolitical uncertainty reduces investor confidence, leading to capital outflows and a weakening of the Canadian dollar.

Economic Growth and Performance

Canada's economic growth rate and overall economic performance are critical determinants of the CAD's value. Slower economic growth compared to other major economies can lead to a weaker currency.

- GDP Growth: A decline in Canada's Gross Domestic Product (GDP) growth, coupled with weakening key economic indicators like employment rates and consumer confidence, indicates a less attractive investment climate and can lead to a weaker CAD.

- Comparison with other Economies: Comparing Canada's economic performance with other G7 nations provides a context for understanding the relative strength or weakness of the Canadian dollar. A relatively weaker Canadian economy compared to its peers typically results in a weaker CAD.

Impact of a Weakening Canadian Dollar

A weaker Canadian dollar has far-reaching consequences for various sectors of the Canadian economy and individuals.

Implications for Canadian Exporters

A weaker CAD makes Canadian exports more competitive on the global market, as their goods and services become cheaper for foreign buyers. This can boost sales and profits for Canadian exporters.

- Benefiting Industries: Industries heavily reliant on exports, such as natural resources, agriculture, and manufacturing, are likely to benefit from a weaker CAD.

Implications for Canadian Importers

Conversely, a weaker CAD increases the cost of imported goods, potentially leading to higher prices for consumers and businesses. This can contribute to inflation.

- Increased Costs: Imported goods ranging from consumer electronics to raw materials will become more expensive, impacting both businesses and consumers.

Impact on Tourists and Travelers

A weaker CAD makes it more expensive for Canadians to travel abroad, while simultaneously making Canada a more affordable destination for international tourists.

- Travel Expenses: Canadians will find their travel budgets stretched thinner when exchanging CAD for other currencies. Conversely, foreign tourists will enjoy more purchasing power in Canada.

Predicting Future Trends of the Canadian Dollar

Predicting the future direction of the Canadian dollar is challenging, as it depends on the interplay of various factors discussed above. However, monitoring key economic indicators and global events can provide valuable insights.

- Future Outlook: The outlook for the CAD depends on several factors, including the future trajectory of commodity prices, interest rate differentials between Canada and other countries, and global economic growth. Analysts' predictions and forecasts should be considered, but it is important to understand that they are not guarantees.

- Monitoring Key Indicators: Closely monitoring economic indicators such as inflation, employment rates, and GDP growth, as well as global geopolitical events, is crucial for understanding and potentially anticipating future CAD trends.

Conclusion: Navigating the Fluctuations of the Canadian Dollar

The Canadian dollar weakening is a complex issue stemming from a confluence of factors including commodity price fluctuations, interest rate differentials, geopolitical uncertainties, and Canada's overall economic performance. This trend significantly impacts Canadian exporters, importers, travelers, and the overall economy. Staying informed about economic news and global events affecting the CAD is paramount. Stay updated on the latest developments regarding Canadian dollar weakening and its potential impact on your finances by following reputable financial news sources and consulting with a financial advisor.

Featured Posts

-

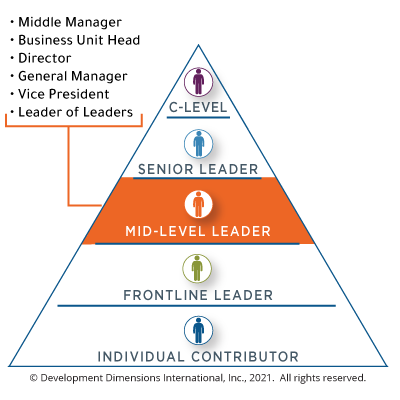

Middle Managers Their Value To Companies And Their Staff

Apr 24, 2025

Middle Managers Their Value To Companies And Their Staff

Apr 24, 2025 -

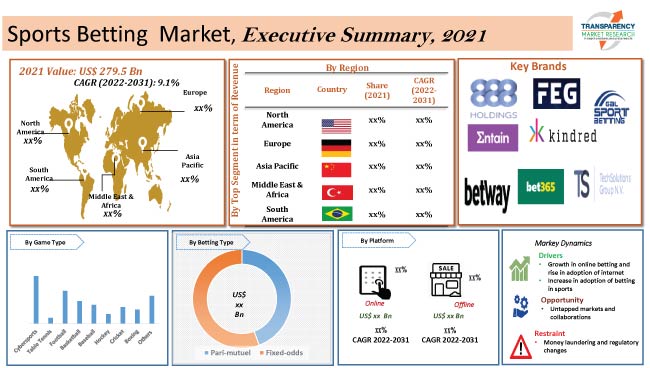

Gambling On Calamity Analyzing The La Wildfires Betting Market

Apr 24, 2025

Gambling On Calamity Analyzing The La Wildfires Betting Market

Apr 24, 2025 -

The Lg C3 77 Inch Oled Real World Performance And Value

Apr 24, 2025

The Lg C3 77 Inch Oled Real World Performance And Value

Apr 24, 2025 -

Bitcoin Btc Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025

Bitcoin Btc Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025 -

Court Challenges Slow Trump Administrations Immigration Crackdown

Apr 24, 2025

Court Challenges Slow Trump Administrations Immigration Crackdown

Apr 24, 2025