Canadian Dollar Dips Despite US Dollar Gains

Table of Contents

Weakening Canadian Economic Indicators

Several weakening Canadian economic indicators contribute to the loonie's recent dip. The interplay between Canadian GDP growth, inflation, and interest rate adjustments significantly impacts the CAD's value in the forex market.

-

Canadian GDP Growth and Investor Confidence: Recent Canadian GDP growth figures have fallen short of expectations. This slower-than-anticipated growth dampens investor confidence, leading to a reduced demand for the Canadian dollar. Uncertainty about future economic prospects further exacerbates this issue.

-

Inflation and Bank of Canada Policy: Persistent inflation pressures in Canada force the Bank of Canada to adjust its monetary policy. Interest rate hikes, while aiming to curb inflation, can also negatively impact economic growth and reduce the attractiveness of the CAD to investors seeking higher returns.

-

Interest Rate Adjustments and CAD Value: The relationship between interest rates and currency values is inversely proportional. Higher interest rates generally attract foreign investment, increasing demand for the currency. However, excessively high rates can stifle economic growth, ultimately weakening the currency. The Bank of Canada's delicate balancing act in managing inflation and economic growth directly impacts the CAD's value.

- Lower-than-expected GDP growth dampens investor confidence.

- Persistent inflation pressures may lead to further interest rate hikes.

- Uncertainty around future economic growth weakens the CAD.

Strengthening US Dollar

The strength of the US dollar is another significant factor impacting the CAD/USD exchange rate. Several elements contribute to the USD's current dominance in the forex market.

-

US Economic Strength and Investor Sentiment: The perceived strength of the US economy continues to attract global investment. Positive economic data, such as strong job growth and consumer spending, bolster investor confidence, driving up demand for the USD.

-

Federal Reserve's Monetary Policy: The Federal Reserve's monetary policy plays a critical role in influencing the USD's value. Interest rate adjustments by the Federal Reserve directly impact the attractiveness of the USD to international investors. Higher interest rates in the US tend to attract capital flows, increasing the demand for the USD.

-

Safe Haven Currency Status: The USD maintains its status as a safe-haven currency during times of global economic or political uncertainty. Investors often flock to the USD, perceiving it as a less risky investment during periods of instability. This increased demand further strengthens the USD, putting downward pressure on the CAD.

- Rising US interest rates attract foreign investment, increasing demand for the USD.

- Strong US economic data bolsters investor confidence in the USD.

- Geopolitical instability often drives investors towards the USD as a safe haven.

Impact of Commodity Prices on the Canadian Dollar

Canada's economy is significantly reliant on commodity exports, particularly oil. Fluctuations in global commodity prices, therefore, have a direct impact on the CAD's value.

-

Oil Prices and Canadian Exports: Lower oil prices directly affect Canada's export earnings, negatively impacting the CAD. As a major exporter of energy products, Canada's currency is highly sensitive to changes in global oil prices.

-

Global Demand for Commodities: Reduced global demand for commodities, including oil and other Canadian exports, weakens the CAD. Decreased demand translates to lower export revenues, impacting the country's overall economic health and currency value.

-

Volatility in Commodity Markets: Volatility in the global commodity markets creates significant uncertainty, further affecting the stability of the CAD. Unpredictable price swings make it challenging for investors to accurately assess the risk associated with investing in the Canadian dollar.

- Lower oil prices negatively affect the CAD due to Canada's reliance on energy exports.

- Reduced global demand for commodities weakens the CAD.

- Volatility in commodity markets creates uncertainty impacting the CAD's stability.

Conclusion

The recent dip in the Canadian dollar, despite the US dollar's strength, is a multifaceted issue. Weakening Canadian economic indicators, a robust US dollar, and fluctuating commodity prices all contribute to the current state of the CAD/USD exchange rate. Understanding these intertwined factors is crucial for navigating the complexities of the forex market.

Call to Action: Staying informed about the latest economic developments impacting both the Canadian and US economies is essential for businesses, investors, and anyone involved in international transactions. Monitor the Canadian dollar's performance and its relationship with the US dollar closely to make informed financial decisions and manage currency risk effectively. Understanding the nuances of the Canadian dollar's behavior within the global forex market is key to successful financial planning.

Featured Posts

-

Effective Middle Management A Foundation For Organizational Success And Employee Development

Apr 24, 2025

Effective Middle Management A Foundation For Organizational Success And Employee Development

Apr 24, 2025 -

Bitcoin Btc Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025

Bitcoin Btc Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025 -

Why Middle Management Matters Benefits For Both Companies And Employees

Apr 24, 2025

Why Middle Management Matters Benefits For Both Companies And Employees

Apr 24, 2025 -

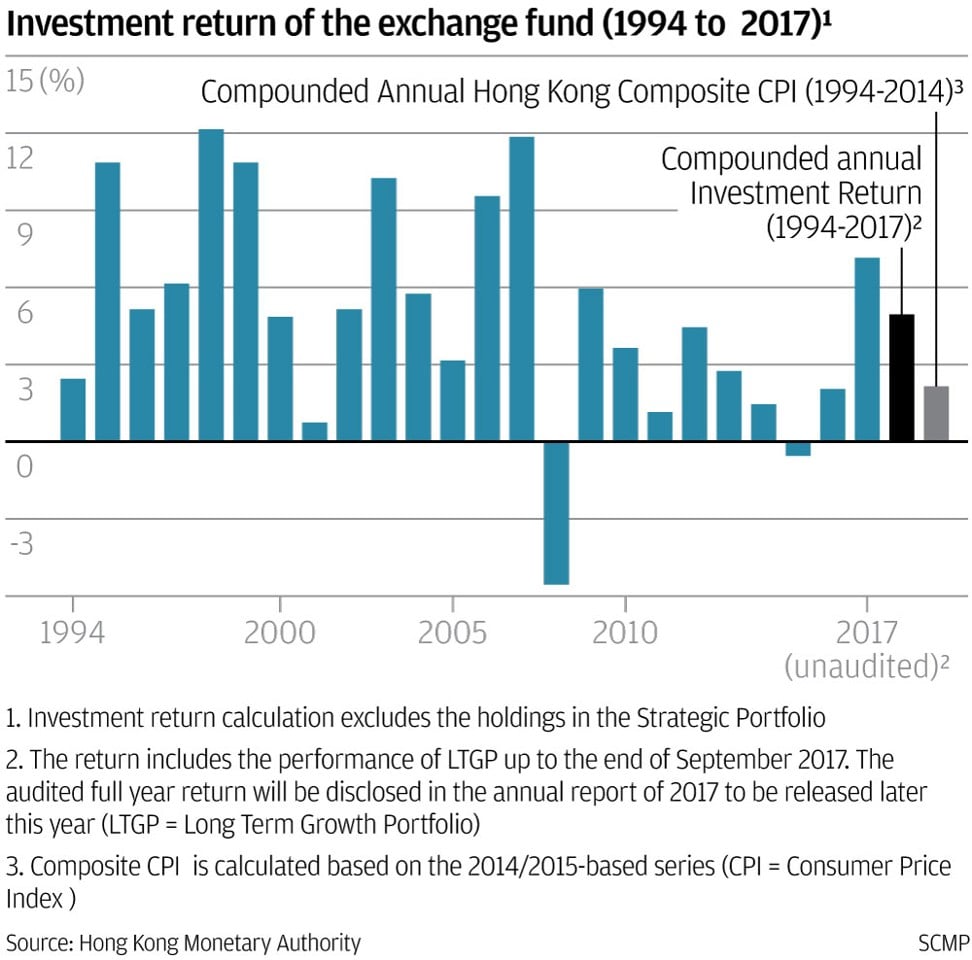

Hong Kong Stock Market Rally Chinese Stocks On The Rise

Apr 24, 2025

Hong Kong Stock Market Rally Chinese Stocks On The Rise

Apr 24, 2025 -

Google Fis 35 Unlimited Plan A Detailed Review

Apr 24, 2025

Google Fis 35 Unlimited Plan A Detailed Review

Apr 24, 2025