Canadian Auto Sector Job Losses: Trump's Tariffs Deliver A Posthaste Blow

Table of Contents

The Immediate Impact of Trump's Tariffs on Canadian Auto Workers

The immediate aftermath of the tariff announcements was swift and brutal for Canadian auto workers. Plant closures and production cuts became commonplace, leading to significant job losses across the country. The ripple effect impacted not only the major manufacturers but also the vast network of smaller suppliers.

Plant Closures and Production Cuts

Several major auto plants in Canada faced significant production cuts or outright closures due to the increased costs associated with tariffs. This resulted in widespread layoffs and economic hardship for countless families.

- Ford Oakville Assembly Plant: Experienced production cuts, leading to hundreds of temporary layoffs. The uncertainty surrounding the future of the plant significantly impacted employee morale and the local economy.

- General Motors Oshawa Assembly Plant: Suffered a complete closure, resulting in the loss of thousands of jobs. This closure had a devastating impact on the Oshawa community and highlighted the vulnerability of the Canadian auto sector.

- Fiat Chrysler Automobiles (FCA) Windsor Assembly Plant: While not facing closure, the plant experienced reduced production runs, leading to temporary job losses and impacting the broader Windsor-Essex region.

- Government Support Measures: While the Canadian government offered some support packages (detailed later), these were often criticized as insufficient to offset the job losses caused by the tariffs.

Supply Chain Disruptions

The Canadian auto sector relies on a complex and intricate network of suppliers. The tariffs disrupted this network, leading to increased costs for parts and materials. Smaller suppliers, often lacking the financial resources to absorb these increased costs, faced significant challenges, resulting in further job losses throughout the supply chain.

- Increased Costs of Steel and Aluminum: These were major components in vehicle manufacturing, and the tariffs significantly increased their prices.

- Impact on Smaller Suppliers: Many smaller parts suppliers, particularly those heavily reliant on US markets, struggled to remain competitive, leading to business closures and job losses.

- Delays in Production: The disruption in the supply chain also led to delays in vehicle production, further exacerbating the economic impact on the industry.

Reduced Consumer Demand

Higher vehicle prices, a direct result of the tariffs, led to a decrease in consumer demand. This decrease in sales negatively affected dealerships, reducing employment opportunities within that sector.

- Decreased Vehicle Sales: Statistics showed a clear downturn in new vehicle sales following the imposition of tariffs.

- Impact on Dealership Employment: Dealerships reduced staff as sales declined, further adding to the job losses within the broader automotive sector.

- Ripple Effect on Related Industries: The reduced consumer demand had a knock-on effect on related industries, such as financing and insurance, resulting in further job losses.

Long-Term Economic Consequences for the Canadian Auto Industry

The impact of Trump's tariffs extended far beyond the immediate job losses. The long-term consequences threaten the future competitiveness and viability of the Canadian auto industry.

Loss of Competitiveness

The tariffs increased production costs for Canadian auto manufacturers, making them less competitive in the global market. This resulted in a loss of market share and reduced export opportunities.

- Increased Production Costs: The added costs associated with tariffs made Canadian-made vehicles more expensive compared to vehicles produced in other countries.

- Reduced Export Opportunities: The increased costs hindered the ability of Canadian manufacturers to export vehicles competitively to other markets.

- Loss of Market Share: Canadian auto manufacturers saw a decrease in their market share to competitors from countries unaffected by the tariffs.

Investment Slowdown

The uncertainty caused by the tariffs led to a slowdown in foreign direct investment (FDI) in the Canadian auto sector. This reduced investment has significant implications for future plant expansions, technological upgrades, and job creation.

- Reduced Investment: Statistics reveal a significant decrease in FDI in the Canadian auto industry during and after the tariff period.

- Impact on Future Plant Expansions: The lack of investment hindered plans for new plants and expansions, reducing potential job creation.

- Technological Upgrades: The slowdown in investment also limited opportunities for technological upgrades and modernization, potentially leaving Canadian manufacturers behind their competitors.

Skilled Labour Migration

The job losses and uncertainty within the industry led to some skilled auto workers seeking employment opportunities in other countries. This potential "brain drain" has long-term implications for the skill base and future innovation within the Canadian auto industry.

- Anecdotal Evidence of Worker Emigration: Reports and anecdotal evidence suggest that skilled workers left Canada seeking employment elsewhere.

- Impact on Future Skill Base: The loss of experienced and skilled workers weakens the future capabilities of the Canadian auto sector.

- Long-Term Implications for Innovation: The departure of skilled workers could hinder technological innovation and development within the industry.

Government Response and Mitigation Strategies

The Canadian government responded to the job losses with various aid packages and initiatives aimed at mitigating the impact of the tariffs and supporting affected workers. However, the effectiveness of these measures has been a subject of debate.

Government Aid and Support Packages

The government implemented various programs, including financial assistance and retraining initiatives, to help workers displaced by the tariff-related job losses.

- Wage Subsidies: Programs offering wage subsidies to companies to help retain employees.

- Retraining Programs: Initiatives designed to provide workers with new skills for alternative employment opportunities.

- Criticism of Government Response: Some argue that government support was insufficient or too slow to address the scale of the job losses.

Trade Negotiations and Diversification Efforts

The Canadian government actively worked to renegotiate trade agreements and diversify its export markets to reduce reliance on the US automotive market.

- Negotiations with Other Countries: Efforts to secure new trade agreements with other countries to open up new export markets.

- Diversification Strategies: Initiatives aimed at diversifying the Canadian auto industry's customer base and reducing its dependence on the US market.

- Impact of Diversification: While diversification efforts were undertaken, their full impact on mitigating the job losses might not be seen for several years.

Conclusion

The imposition of Trump-era tariffs inflicted significant damage on the Canadian auto sector, resulting in substantial Canadian auto sector job losses and long-term economic consequences. Plant closures, supply chain disruptions, and reduced consumer demand contributed to a decline in employment and investment. While the Canadian government implemented support measures and pursued trade diversification, the full impact of these tariffs may not be felt for years to come. Understanding the extent of these Canadian auto sector job losses is crucial to developing effective strategies to support affected workers and ensure the long-term viability of the Canadian auto industry. Further research into the lasting effects of these tariffs is necessary to inform future trade policies and safeguard against similar economic shocks. Staying informed on the ongoing implications of these tariffs on Canadian auto sector job losses is vital for all stakeholders.

Featured Posts

-

Vaccine Study Review Hhs Appoints Controversial Figure David Geier

Apr 27, 2025

Vaccine Study Review Hhs Appoints Controversial Figure David Geier

Apr 27, 2025 -

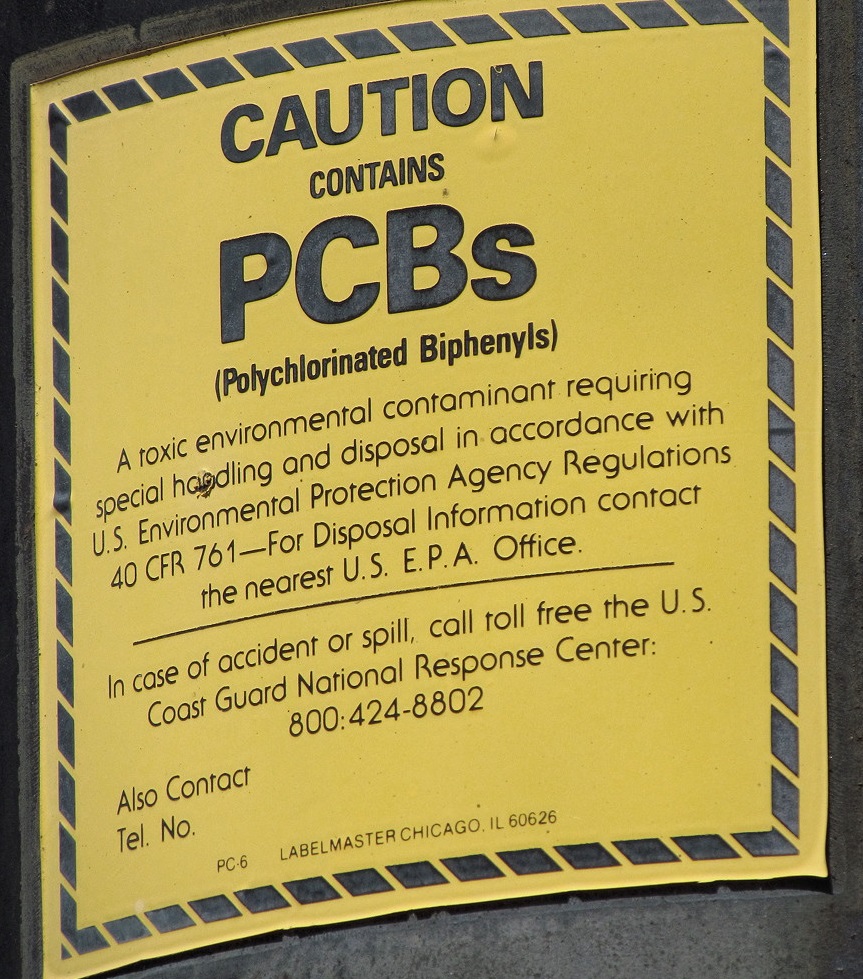

Legal Battle E Bay Section 230 And The Sale Of Banned Chemicals

Apr 27, 2025

Legal Battle E Bay Section 230 And The Sale Of Banned Chemicals

Apr 27, 2025 -

Now Torontos Detour Exploring The Cinematic Legacy Of Nosferatu The Vampyre

Apr 27, 2025

Now Torontos Detour Exploring The Cinematic Legacy Of Nosferatu The Vampyre

Apr 27, 2025 -

Binoche Chosen To Chair Cannes Film Festival Jury

Apr 27, 2025

Binoche Chosen To Chair Cannes Film Festival Jury

Apr 27, 2025 -

Trumps Trade Demands Carneys Warning To Canadian Voters

Apr 27, 2025

Trumps Trade Demands Carneys Warning To Canadian Voters

Apr 27, 2025