Bundestag Elections And The German Economy: Implications For The Dax

Table of Contents

Key Policy Differences & Their Economic Impact

The major German political parties – CDU/CSU, SPD, Greens, FDP, and AfD – hold differing views on key economic policies, leading to potentially significant variations in the future economic landscape and DAX performance.

Fiscal Policy

Government spending and taxation policies vary considerably across party lines.

- CDU/CSU (Christian Democrats): Typically advocates for fiscal responsibility, targeted tax cuts, and moderate social spending.

- SPD (Social Democrats): Generally favors increased social spending, potentially funded through higher taxes on corporations and higher earners.

- Greens: Prioritizes investments in green technologies and renewable energy, potentially funded through carbon taxes and other environmental levies.

- FDP (Free Democrats): Emphasizes tax cuts and deregulation to stimulate economic growth.

- AfD (Alternative for Germany): Proposes significant cuts in government spending and immigration-related costs.

Impact on the DAX: Tax cuts proposed by the CDU/CSU and FDP could boost investor confidence and lead to a rise in the DAX. Conversely, increased corporate taxes favored by the SPD could negatively impact corporate profitability and DAX performance. Significant infrastructure investments, potentially favored by a coalition including the Greens, could benefit certain DAX-listed construction and engineering companies.

Regulatory Environment

The regulatory environment significantly impacts business operations and investment.

- Environmental Regulations: The Greens advocate for stricter environmental regulations, which could impact energy and automotive companies. The CDU/CSU and FDP are generally less stringent in their approach.

- Labor Laws: The SPD generally supports stronger worker protections, while the FDP favors deregulation to reduce labor costs.

- Corporate Taxation: The SPD and Greens generally support higher corporate taxes, while the CDU/CSU and FDP advocate for lower taxes.

Impact on the DAX: Stringent environmental regulations could negatively affect the profitability of automotive and energy companies listed on the DAX. Conversely, deregulation could positively impact businesses in these sectors, though potentially at the expense of worker protections. Changes in corporate taxation directly affect the profitability of DAX-listed companies.

European Union Policy

Different parties have differing stances on EU integration, affecting German trade and economic relations.

- EU Budget and Fiscal Rules: The FDP might advocate for more fiscal flexibility within the EU, whereas the Greens and SPD may prioritize social and environmental considerations within the EU budget.

- Trade Agreements: Parties have varying approaches towards negotiating and implementing trade agreements, impacting German exports and imports.

- Migration Policy: The impact of migration policies on the German labor market and economy has implications for the DAX, affecting labor costs and consumer spending.

Impact on the DAX: Stronger EU integration could boost German exports and foreign investment, positively impacting the DAX. Conversely, friction within the EU could negatively impact German trade and economic growth, leading to lower DAX performance.

Investor Sentiment and Market Volatility

Election periods typically see increased market volatility.

Pre-Election Uncertainty

The period leading up to the Bundestag elections is usually characterized by uncertainty, influencing investor behavior.

- Opinion Polls: Fluctuations in opinion polls can cause significant shifts in investor sentiment, leading to market volatility.

- Election Predictions: Predictions from political analysts and experts significantly influence market expectations and investor confidence.

- Historical Data: Analyzing the DAX's performance during previous Bundestag elections provides insights into potential future trends.

Impact on the DAX: Pre-election uncertainty often translates to increased market volatility, with the DAX potentially exhibiting significant price swings depending on the shifting political landscape.

Post-Election Market Reaction

The market typically reacts to election results based on the perceived economic implications of the winning coalition's policies.

- Coalition Agreement: The clarity and specifics of the coalition agreement strongly influence market reaction. A clear and detailed agreement reduces uncertainty, leading to more predictable market responses.

- Market Expectations: The extent to which the election outcome meets or deviates from market expectations influences the speed and magnitude of the DAX's response.

- Historical Examples: Examining past election cycles and their immediate impact on the DAX helps assess potential future reactions.

Impact on the DAX: A decisive victory for a party with clearly defined and market-friendly policies generally leads to a positive market reaction. Conversely, a fragmented coalition or policies perceived as negative for business could cause a downturn in the DAX.

Sector-Specific Impacts on the DAX

The Bundestag elections' impact varies across different DAX sectors.

Automotive Industry

Policy changes regarding emissions standards, electric vehicle subsidies, and fuel efficiency regulations will heavily influence the automotive sector's performance.

Energy Sector

The energy transition and investments in renewable energy will significantly affect energy companies listed on the DAX. Policies supporting or hindering the shift to renewable energy will determine the sector's trajectory.

Financial Services

Changes in financial regulations, banking supervision, and tax policies significantly impact the financial services sector's profitability and consequently the DAX.

Conclusion

The Bundestag elections have significant implications for the German economy and the DAX. The policies adopted by the new government will profoundly influence investor confidence, economic growth, and the performance of individual DAX-listed companies across various sectors. Understanding the key policy differences between the competing parties and their potential impact on the regulatory environment, fiscal policy, and EU relations is crucial for investors seeking to navigate the market effectively. Therefore, closely monitoring the election results and the subsequent policy announcements is essential for making informed decisions regarding investments related to the German economy and the DAX. Stay informed about the Bundestag Elections and their impact on the German Economy and the DAX.

Featured Posts

-

Enforcement Action Pfc Moves Eo W On Gensol Due To Fraudulent Documentation

Apr 27, 2025

Enforcement Action Pfc Moves Eo W On Gensol Due To Fraudulent Documentation

Apr 27, 2025 -

Paolini Y Pegula Fuera Del Wta 1000 De Dubai Analisis Del Torneo

Apr 27, 2025

Paolini Y Pegula Fuera Del Wta 1000 De Dubai Analisis Del Torneo

Apr 27, 2025 -

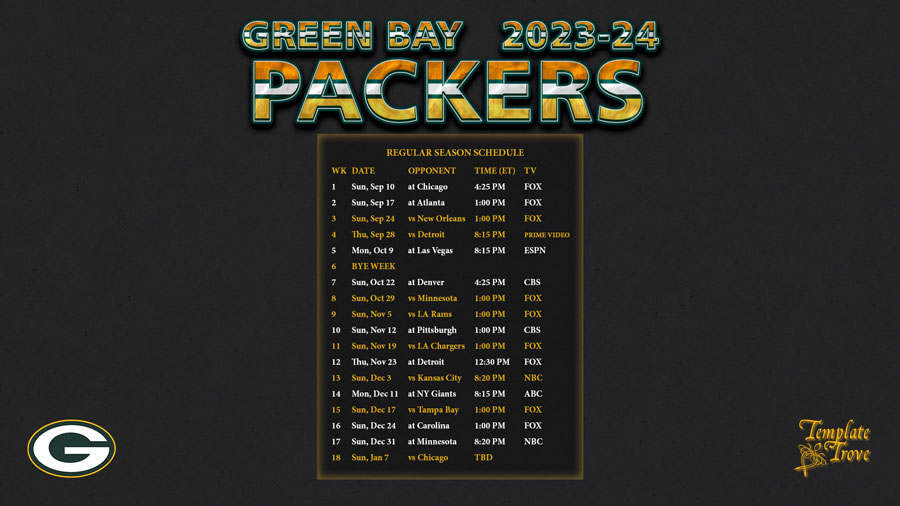

Green Bay Packers Two Chances For A 2025 International Game

Apr 27, 2025

Green Bay Packers Two Chances For A 2025 International Game

Apr 27, 2025 -

E Bay And Section 230 Court Ruling On Listings Of Banned Chemicals

Apr 27, 2025

E Bay And Section 230 Court Ruling On Listings Of Banned Chemicals

Apr 27, 2025 -

Una Favorita Se Despide De Indian Wells Analisis Del Resultado

Apr 27, 2025

Una Favorita Se Despide De Indian Wells Analisis Del Resultado

Apr 27, 2025