BofA's Take: Are High Stock Market Valuations Cause For Investor Concern?

Table of Contents

Understanding Current Stock Market Valuations

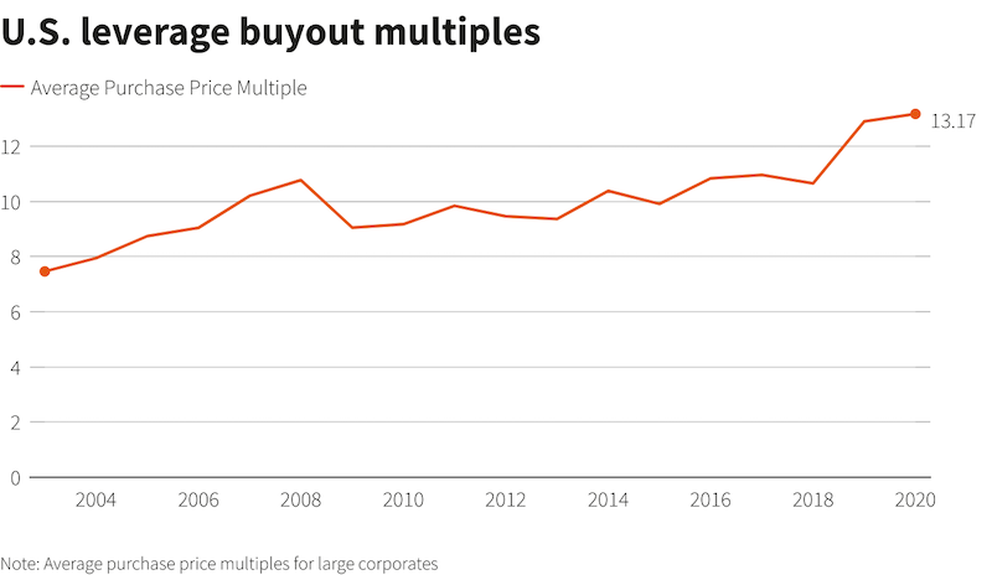

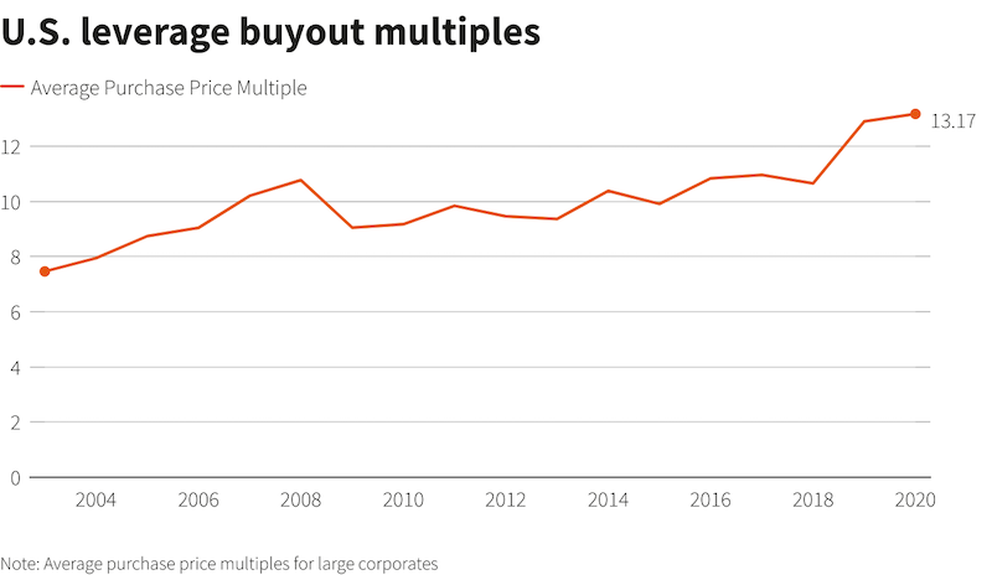

Assessing whether current stock market valuations are justified requires understanding various valuation metrics. Key metrics include the Price-to-Earnings (P/E) ratio, which compares a company's stock price to its earnings per share, and the Price-to-Sales (P/S) ratio, which compares a company's stock price to its revenue. These, along with market capitalization and other indicators, paint a picture of overall market valuation.

Comparing current market valuations to historical averages is critical. Are we significantly above or below the average P/E ratio seen over the past several decades? This provides context and helps determine if current levels are unusually high.

- Current P/E Ratios vs. Long-Term Averages: A comparison reveals whether current valuations are significantly above or below historical norms. For example, a consistently high P/E ratio across major indices might suggest overvaluation.

- Sector-Specific Valuations: Valuations vary widely across sectors. The technology sector, for instance, often commands higher P/E ratios than more established sectors like utilities. Understanding these sector-specific differences is vital for targeted investment strategies.

- Impact of Low Interest Rates: Low interest rates can artificially inflate stock prices, as investors seek higher returns in the equity market. This can contribute to seemingly high valuations even if underlying company fundamentals aren't exceptionally strong.

BofA's Viewpoint on High Valuations

BofA's recent reports and analyses offer valuable insights into prevailing market conditions. Their analysts regularly comment on stock market valuations and their implications for investors. By examining their perspective, we can gain a clearer understanding of the potential risks and opportunities.

- Key Arguments: BofA's analysts may highlight factors such as strong corporate earnings growth, continued low interest rates, or sustained investor confidence as supporting high valuations. Conversely, they may also point to potential risks such as rising inflation or geopolitical instability.

- BofA's Predicted Market Trajectory: BofA's market outlook, based on their valuation analysis, will provide a prediction for future market movements. This might range from continued growth, a period of consolidation, or even a potential market correction.

- Overvalued and Undervalued Sectors: BofA's research often identifies specific sectors they consider overvalued or undervalued based on their assessment of high stock market valuations. This information can be crucial for investors seeking to optimize their portfolios. For example, BofA might suggest that certain tech stocks are overvalued, while other sectors offer better value.

Factors Contributing to High Valuations

Several macroeconomic factors contribute to current high stock market valuations. Understanding these drivers is essential to assessing the sustainability of current market levels.

- Low Interest Rates: The prolonged period of low interest rates has encouraged investors to seek higher returns in the equity markets, thus boosting demand and pushing up prices.

- Corporate Earnings Growth: Strong corporate earnings growth, especially in certain sectors, can justify higher stock prices. However, it's crucial to analyze whether this growth is sustainable.

- Investor Sentiment: Positive investor sentiment and confidence in future economic growth can drive up stock valuations, even in the face of high P/E ratios. Conversely, uncertainty or fear can trigger a market downturn.

- Government Stimulus Packages: Government intervention through stimulus packages can inject significant capital into the economy, potentially boosting corporate earnings and investor sentiment, thus influencing market valuations.

Potential Risks and Opportunities Associated with High Valuations

While high stock market valuations can present opportunities, it's crucial to acknowledge the associated risks. A balanced perspective is vital for informed investment decisions.

- Risk of a Market Correction: High valuations increase the risk of a market correction, where prices experience a significant decline. Understanding this risk is crucial for risk management.

- Opportunities in Undervalued Sectors: Even in a market with high valuations, some sectors or individual companies might be undervalued. Identifying these opportunities requires diligent research and analysis.

- Risk Mitigation Strategies: Diversification across different asset classes, sectors, and geographies is a key strategy for mitigating risk in a high-valuation environment. Defensive investing, focusing on less volatile stocks, is another approach.

Conclusion: Should You Be Concerned About High Stock Market Valuations?

BofA's perspective on high stock market valuations, while nuanced, highlights both potential risks and opportunities. The factors contributing to these high valuations—low interest rates, strong (or potentially unsustainable) corporate earnings growth, and investor sentiment—all play a crucial role in shaping the market's trajectory.

Investors should carefully consider their risk tolerance and reassess their investment strategies based on this analysis. Maintaining a diversified portfolio and regularly reviewing asset allocation are key strategies. While a market correction is always a possibility, opportunities exist within specific sectors or companies.

Stay informed about the latest insights from BofA and other market analysts on high stock market valuations to make well-informed investment choices. Understanding the complexities of market valuation is crucial for long-term investment success.

Featured Posts

-

John Travolta Reassures Fans Following Controversial Family Home Photo

Apr 24, 2025

John Travolta Reassures Fans Following Controversial Family Home Photo

Apr 24, 2025 -

A Comprehensive Guide To The Countrys Newest Business Hotspots

Apr 24, 2025

A Comprehensive Guide To The Countrys Newest Business Hotspots

Apr 24, 2025 -

Is This The End For Liam The Bold And The Beautiful Spoilers

Apr 24, 2025

Is This The End For Liam The Bold And The Beautiful Spoilers

Apr 24, 2025 -

V Mware Price Hike At And T Highlights Broadcoms Proposed 1 050 Increase

Apr 24, 2025

V Mware Price Hike At And T Highlights Broadcoms Proposed 1 050 Increase

Apr 24, 2025 -

Alterya Acquired By Chainalysis Boosting Blockchain Security With Ai

Apr 24, 2025

Alterya Acquired By Chainalysis Boosting Blockchain Security With Ai

Apr 24, 2025