BofA On Stretched Stock Market Valuations: Why Investors Shouldn't Panic

Table of Contents

BofA's Assessment of Stretched Stock Market Valuations

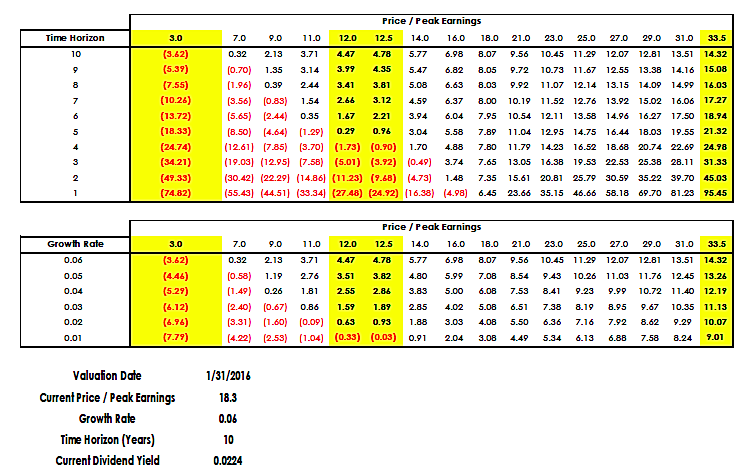

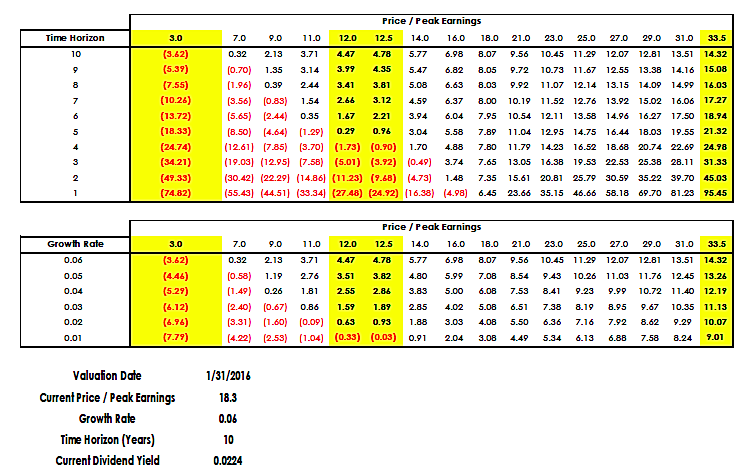

BofA employs several key metrics to evaluate market valuations, including traditional Price-to-Earnings ratios (P/E) and the more sophisticated cyclically adjusted price-to-earnings ratio (CAPE), which smooths out earnings fluctuations over a longer period (typically 10 years). Their analysis considers various factors to gauge whether current prices accurately reflect underlying company performance and future prospects.

BofA's recent findings suggest that certain sectors are significantly overvalued relative to historical norms and projected future earnings. While they acknowledge the potential for continued growth, they express concern about the sustainability of current price levels in some areas.

- Specific valuation metrics cited by BofA: P/E ratios, CAPE ratios, Price-to-Sales ratios, and other relevant metrics are used in their assessment, often compared to historical averages.

- Sectors identified as particularly overvalued: BofA's reports often highlight specific sectors like technology or certain consumer discretionary stocks as showing elevated valuation concerns.

- BofA's forecast for future market performance: While the forecasts vary, their reports typically include a range of scenarios, incorporating both optimistic and pessimistic outlooks for market performance based on various valuation assumptions. These usually highlight both the potential for further gains and the risk of corrections.

Understanding the Nuances of High Valuations

While high valuations are a valid concern, it's crucial to understand the context. Several factors can justify elevated price-to-earnings ratios:

- Strong corporate earnings growth: Companies demonstrating consistent and robust earnings growth can command higher valuations as investors anticipate future profitability.

- Low interest rates: Low interest rates reduce the cost of borrowing for companies and make equities a more attractive investment relative to bonds, thereby supporting higher valuations.

- Technological innovation driving future growth: Breakthrough technologies with significant growth potential can justify higher valuations, as investors bet on future market disruption and potential returns.

It's essential to distinguish between short-term market volatility and long-term market trends. Short-term fluctuations are normal; however, long-term growth often outpaces short-term anxieties.

- Examples of companies with high valuations but strong growth prospects: Many high-growth technology companies fall into this category, demonstrating significant revenue growth despite high valuations. Their future potential often justifies the current prices.

- Historical context of high valuations and subsequent market performance: History shows periods of high valuations followed by both corrections and continued growth. Examining past market cycles provides crucial context for understanding current conditions.

Long-Term Growth Potential Despite High Valuations

Adopting a long-term investment strategy is crucial, even in a market with high valuations. Focusing on the long-term potential of underlying assets minimizes the impact of short-term market fluctuations.

Specific sectors offer promising long-term growth prospects despite potentially high valuations today.

- Sectors with promising long-term growth potential: Technology (AI, cloud computing), renewable energy, healthcare (biotechnology, pharmaceuticals), and certain emerging markets all offer significant long-term opportunities.

- Factors influencing long-term growth: Demographic shifts (aging population, growing middle class), technological advancements, and evolving consumer preferences are all key drivers of long-term growth. Understanding these trends can help identify companies poised for success. Identifying companies with strong management, innovative products or services, and a sustainable competitive advantage is crucial, regardless of current market valuations.

Strategies for Navigating a High-Valuation Market

Investors concerned about high valuations should adopt a cautious yet proactive approach. This involves diversification, risk management, and selective stock picking.

- Specific diversification strategies: Asset allocation across different asset classes (stocks, bonds, real estate), international diversification, and diversification across sectors are essential risk mitigation tools.

- Risk management techniques: Employing stop-loss orders to limit potential losses, hedging strategies to protect against market downturns, and carefully managing position sizes are all important.

- Criteria for selecting undervalued or growth stocks in a high-valuation market: Focus on companies with strong fundamentals, consistent earnings growth, and a sustainable competitive advantage. Thorough due diligence is essential. Look beyond P/E ratios and consider other metrics to identify companies with true value potential.

Conclusion: Navigating BofA's Concerns on Stretched Stock Market Valuations

BofA's concerns about stretched stock market valuations are valid, highlighting the potential for corrections. However, a long-term perspective is critical. Focusing on the potential for continued growth in specific sectors and employing sound investment strategies can help mitigate risk. While high valuations present a legitimate challenge, panic selling is rarely the optimal response.

Conduct thorough research, consult with qualified financial advisors, and develop a well-informed investment strategy tailored to your risk tolerance and financial goals. Remember, managing your portfolio effectively requires a long-term outlook and a balanced approach to navigating potentially stretched stock market valuations. Explore further resources and articles on investment strategies for a high-valuation market to enhance your understanding and refine your approach.

Featured Posts

-

417 5 Million Deal Alcon Acquires Village Roadshow

Apr 24, 2025

417 5 Million Deal Alcon Acquires Village Roadshow

Apr 24, 2025 -

Trump Administrations Response To Harvard Lawsuit Will Talks Begin

Apr 24, 2025

Trump Administrations Response To Harvard Lawsuit Will Talks Begin

Apr 24, 2025 -

Stock Market Update Dows 1000 Point Rally Nasdaq And S And P 500 Gains

Apr 24, 2025

Stock Market Update Dows 1000 Point Rally Nasdaq And S And P 500 Gains

Apr 24, 2025 -

This Startup Airline Is Now Flying Deportation Flights Heres Why

Apr 24, 2025

This Startup Airline Is Now Flying Deportation Flights Heres Why

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Impact On Tech And Politics

Apr 24, 2025

The Zuckerberg Trump Dynamic Impact On Tech And Politics

Apr 24, 2025