BofA Assures Investors: Why High Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Bullish Outlook: Understanding the Rationale Behind Their Confidence

BofA maintains a bullish market forecast despite the current high valuations. Their confidence stems from a confluence of factors suggesting continued growth and stability.

- Strong Corporate Earnings: BofA points to robust corporate earnings reports as a key indicator of sustained economic health. Many companies are exceeding expectations, demonstrating resilience and strong underlying fundamentals. This robust earnings growth helps to justify current valuations.

- Supportive Monetary Policy: The continued low-interest-rate environment, while potentially inflationary in the long run, provides a supportive backdrop for stock prices. Low borrowing costs encourage investment and stimulate economic activity, further supporting corporate profitability.

- Continued Economic Growth: BofA's forecast incorporates projections of continued, albeit potentially slower, economic growth. This sustained expansion, coupled with strong corporate performance, underpins their optimistic view.

- Favorable Sectors: While BofA's outlook is generally positive, they have identified specific sectors they believe are particularly well-positioned for growth, such as technology and healthcare. These sectors often command higher valuations due to their growth potential.

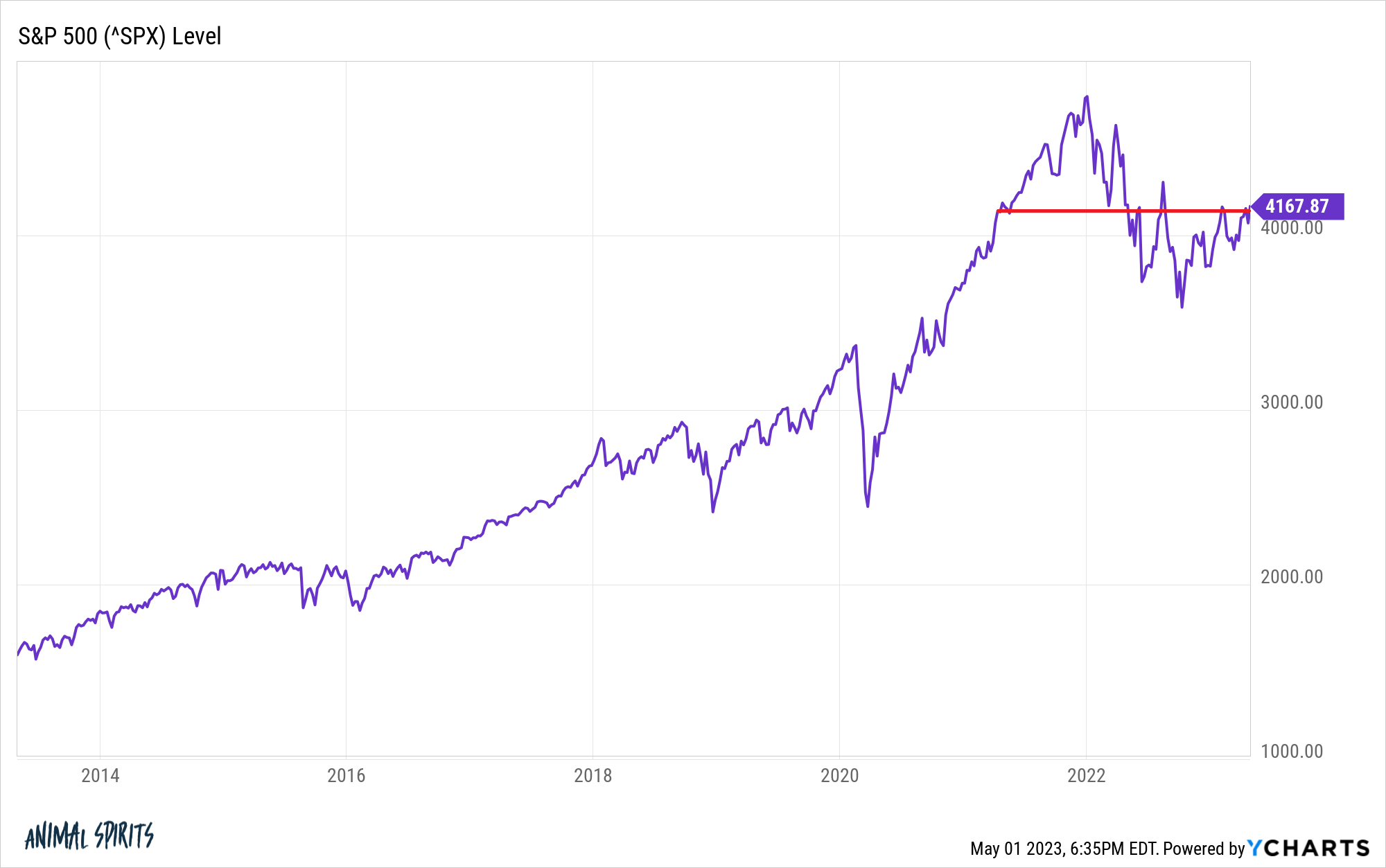

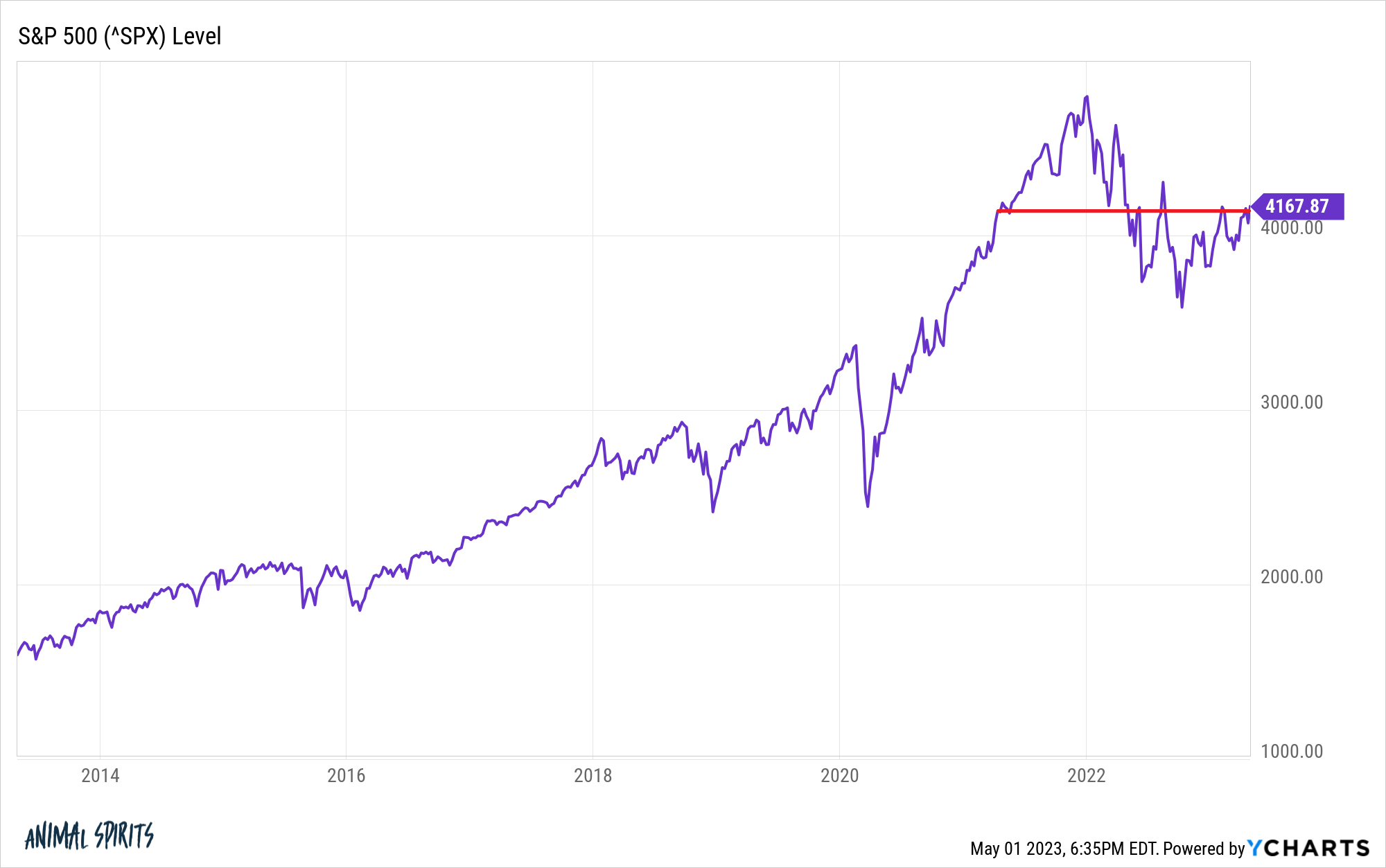

Debunking the Myth: Why High Valuations Aren't Always a Negative Indicator

Traditional valuation metrics, like price-to-earnings (P/E) ratios, can be misleading in the current environment. Simply looking at high P/E ratios without context can be deceptive.

- Low Interest Rates and P/E Ratios: Low interest rates justify higher P/E ratios. When borrowing costs are low, the discount rate applied to future earnings is lower, making future earnings streams more valuable. This results in higher valuations for companies, even if their current earnings are not exceptionally high.

- Technological Innovation and Growth: The rapid pace of technological innovation is driving significant growth in certain sectors, justifying premium valuations for companies at the forefront of these advancements. These companies are expected to deliver substantial future earnings growth.

- Future Earnings Growth Potential: It's crucial to focus on a company’s future earnings growth potential rather than solely on its current earnings. Companies with strong growth prospects might have high P/E ratios today, but these ratios may appear more reasonable considering their projected future profitability.

Navigating the Market: Strategies for Investors Based on BofA's Analysis

Based on BofA's analysis, investors should adopt strategies that account for both the opportunities and the potential risks associated with high stock market valuations.

- Diversification: Diversification remains a cornerstone of sound investment strategy. Diversifying across different asset classes, sectors, and geographies can mitigate the risk associated with any single investment underperforming.

- Risk Tolerance and Time Horizon: Investors should tailor their investment approach to their risk tolerance and time horizon. Long-term investors with a higher risk tolerance may be comfortable with a more growth-oriented portfolio, while those with a shorter time horizon might prefer a more conservative strategy.

- Long-Term Perspective: Maintaining a long-term investment horizon is crucial. Short-term market fluctuations should not dictate long-term investment decisions. Avoid panic selling in response to short-term market volatility.

Addressing Potential Risks: Counterarguments and Considerations

While BofA presents a positive outlook, acknowledging potential risks is essential for informed decision-making.

- Inflationary Pressures: Sustained inflation could erode corporate profits and impact stock valuations. Rising inflation might lead to higher interest rates, potentially cooling economic growth.

- Geopolitical Uncertainty: Geopolitical events can significantly influence market sentiment and valuations. Unforeseen global events can introduce uncertainty and volatility.

- Interest Rate Hikes: Future interest rate hikes by central banks, aimed at curbing inflation, could impact market valuations by increasing borrowing costs for businesses and investors.

The Importance of Due Diligence:

Before making any investment decisions, conducting thorough research and seeking professional financial advice is paramount. Understanding your personal risk tolerance and financial goals is essential for creating a suitable investment strategy.

BofA's Reassurance and a Call to Action

BofA's analysis suggests that high stock market valuations, while seemingly concerning, don't necessarily portend an imminent market crash. Strong corporate earnings, supportive monetary policy, and continued economic growth underpin their bullish outlook. However, understanding potential risks, such as inflationary pressures and geopolitical uncertainty, is equally vital.

Informed decision-making is crucial for navigating this complex market environment. We encourage you to conduct further research on BofA's analysis and consider consulting a financial advisor to create a well-informed investment strategy for managing high stock market valuations and understanding high stock market valuations effectively. Don't let fear dictate your actions; instead, make informed choices based on a thorough understanding of the current market dynamics.

Featured Posts

-

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025 -

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

Apr 24, 2025

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

Apr 24, 2025 -

Columbia University Students Plea To Attend Sons Birth Rejected By Immigration Officials

Apr 24, 2025

Columbia University Students Plea To Attend Sons Birth Rejected By Immigration Officials

Apr 24, 2025 -

January 6th Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 24, 2025

January 6th Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 24, 2025 -

Google Fi 35 Unlimited Data Plan Now Available

Apr 24, 2025

Google Fi 35 Unlimited Data Plan Now Available

Apr 24, 2025