Analyzing Investor Behavior During Periods Of Market Instability

Table of Contents

The Psychology of Fear and Greed in Volatile Markets

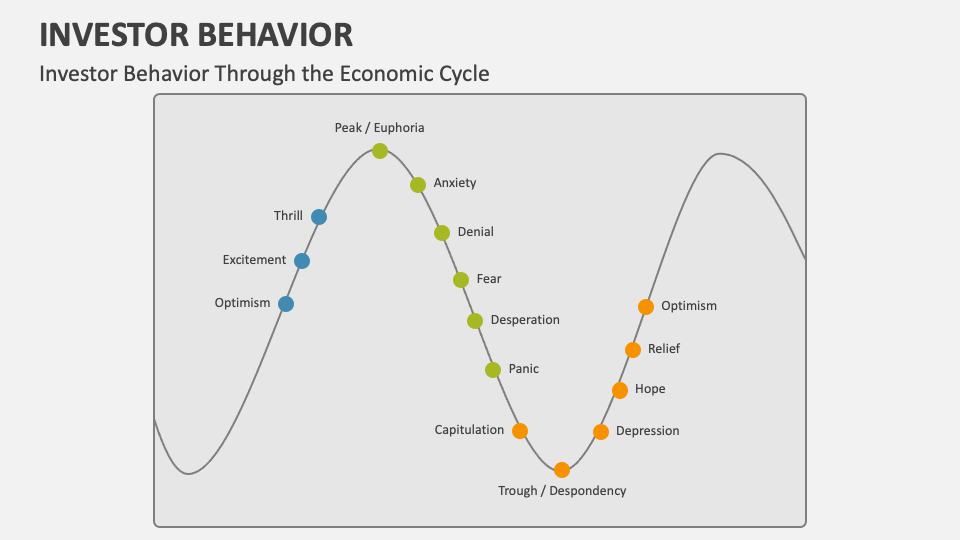

Market instability, encompassing corrections, bear markets, recessions, and geopolitical upheavals, triggers powerful emotional responses in investors. These responses significantly influence investment decisions, often leading to suboptimal outcomes.

Fear-Driven Reactions

Fear is a potent force driving impulsive actions. During market downturns, the instinct to protect capital can lead to:

- Panic selling: Selling assets at a loss to avoid further potential losses.

- Withdrawal of investments: Moving funds to perceived "safe havens" like cash or government bonds.

- Avoidance of risky assets: Shifting entirely to low-return, low-risk investments.

These reactions are often fueled by cognitive biases:

- Loss aversion: The pain of a loss is felt more strongly than the pleasure of an equivalent gain, leading to risk-averse behavior.

- Availability heuristic: Overestimating the likelihood of negative events due to their vividness in recent memory (e.g., recalling a recent market crash).

The Allure of Greed and Speculation

Conversely, as markets recover, greed and speculation can resurface. The desire to recoup losses or capitalize on apparent gains can lead to:

- Chasing high-yield investments: Seeking out high-risk, high-reward opportunities without adequate due diligence.

- Ignoring risk warnings: Dismissing potential downsides in pursuit of quick profits.

- Engaging in speculative trading: Participating in highly volatile markets based on short-term trends rather than long-term fundamentals.

This behavior is often amplified by:

- Confirmation bias: Seeking out information that confirms pre-existing beliefs, ignoring contradictory evidence.

- Overconfidence: Overestimating one's ability to predict market movements, leading to excessive risk-taking.

The Impact of Market Sentiment

Media coverage, social media discussions, and expert opinions significantly shape market sentiment and influence investor behavior.

- News coverage: Sensationalized reporting can exacerbate fear and uncertainty, prompting herd behavior.

- Misinformation: The spread of false or misleading information on social media can create panic and drive irrational trading decisions.

- Social media trends: Viral investment ideas can create bubbles and lead to unsustainable price increases.

Discerning fact from opinion during periods of instability is challenging, demanding a critical and informed approach to information consumption.

Investor Strategies During Market Instability

Effective strategies during market instability prioritize risk mitigation and informed decision-making.

Risk Management and Portfolio Diversification

A well-diversified portfolio is crucial for weathering market storms. Key risk management techniques include:

- Asset allocation strategies: Distributing investments across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio volatility.

- Hedging: Employing strategies to offset potential losses in one investment by taking an opposing position in another.

- Stop-loss orders: Setting predetermined limits to automatically sell an asset if it falls below a certain price.

- Diversification across asset classes: Spreading investments across different sectors and geographies to mitigate risk.

These strategies can significantly limit losses during market downturns.

Value Investing vs. Growth Investing

Value investing focuses on undervalued assets, while growth investing targets companies with high growth potential. Their suitability varies during instability:

- Value stocks: Often perform relatively well during market corrections as their intrinsic value remains unaffected by short-term fluctuations.

- Growth stocks: More susceptible to volatility, as their valuations are highly dependent on future expectations, which can be negatively impacted during uncertain times.

The Role of Behavioral Finance

Behavioral finance integrates psychological insights into financial decision-making. It emphasizes:

- Recognizing cognitive biases: Identifying and mitigating the impact of biases like overconfidence and loss aversion.

- Developing disciplined investment plans: Creating a well-defined plan that adheres to long-term goals, irrespective of short-term market fluctuations.

- Seeking professional financial advice: Consulting with a qualified financial advisor to gain objective insights and personalized guidance.

Concepts like mental accounting and framing effects significantly influence investment choices and need to be understood for better decision-making.

Analyzing Historical Data to Predict Investor Behavior

Examining past market crises provides valuable lessons for navigating future instability.

Case Studies of Past Market Crashes

Analyzing historical events like the 2008 financial crisis and the dot-com bubble reveals recurring patterns in investor behavior:

- 2008 Financial Crisis: Characterized by widespread panic selling, bank failures, and government intervention.

- Dot-com Bubble: A period of excessive speculation in internet-related companies, followed by a sharp market correction.

By studying these events, we can identify potential parallels with current market conditions.

Using Quantitative Data for Insights

Quantitative data, such as market volatility indices (VIX) and sentiment indicators, can offer insights into potential future investor behavior:

- VIX: Measures market volatility and can indicate increased fear and uncertainty.

- Sentiment indicators: Gauge investor optimism or pessimism based on surveys and other data points.

However, quantitative data should be combined with qualitative analysis for a comprehensive understanding.

Conclusion: Mastering Investor Behavior in Uncertain Times

Understanding analyzing investor behavior during periods of market instability is crucial for successful investing. This article highlighted the psychology of fear and greed, outlined effective strategies for navigating volatile markets, and emphasized the importance of learning from historical data. By recognizing cognitive biases, diversifying portfolios, and employing disciplined risk management techniques, investors can significantly improve their chances of navigating periods of market instability effectively. Further research into behavioral finance and the development of a robust, personalized investment strategy, potentially with the guidance of a financial advisor, are crucial steps in mastering the challenges of uncertain markets.

Featured Posts

-

The Metropolitan Museum Of Arts Monstrous Beauty A Feminist Analysis Of Chinoiserie

Apr 28, 2025

The Metropolitan Museum Of Arts Monstrous Beauty A Feminist Analysis Of Chinoiserie

Apr 28, 2025 -

Talladega Superspeedway 2025 Your Guide To Nascar Jack Link 500 Prop Bets

Apr 28, 2025

Talladega Superspeedway 2025 Your Guide To Nascar Jack Link 500 Prop Bets

Apr 28, 2025 -

9 Billion Investment At Risk Alberta Faces Dow Project Delay Due To Tariffs

Apr 28, 2025

9 Billion Investment At Risk Alberta Faces Dow Project Delay Due To Tariffs

Apr 28, 2025 -

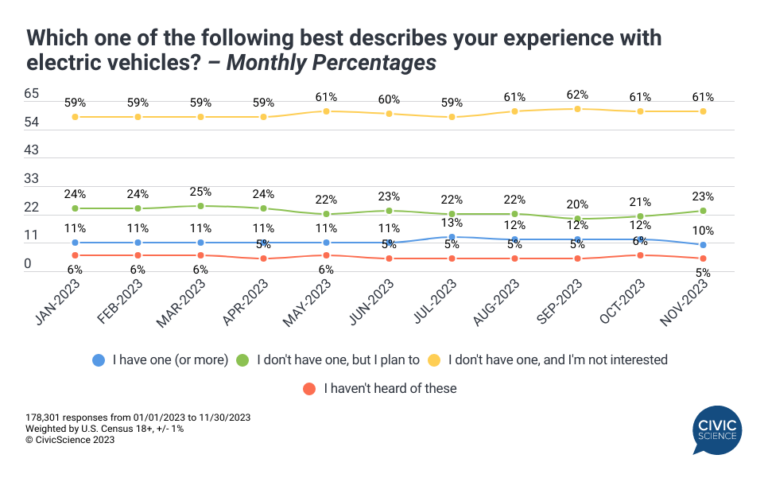

Auto Dealers Double Down On Resistance To Electric Vehicle Regulations

Apr 28, 2025

Auto Dealers Double Down On Resistance To Electric Vehicle Regulations

Apr 28, 2025 -

Aaron Judges 2025 Push Up Prediction Understanding The On Field Goal Gesture

Apr 28, 2025

Aaron Judges 2025 Push Up Prediction Understanding The On Field Goal Gesture

Apr 28, 2025