Addressing Investor Concerns: BofA's View On Elevated Stock Market Valuations

Table of Contents

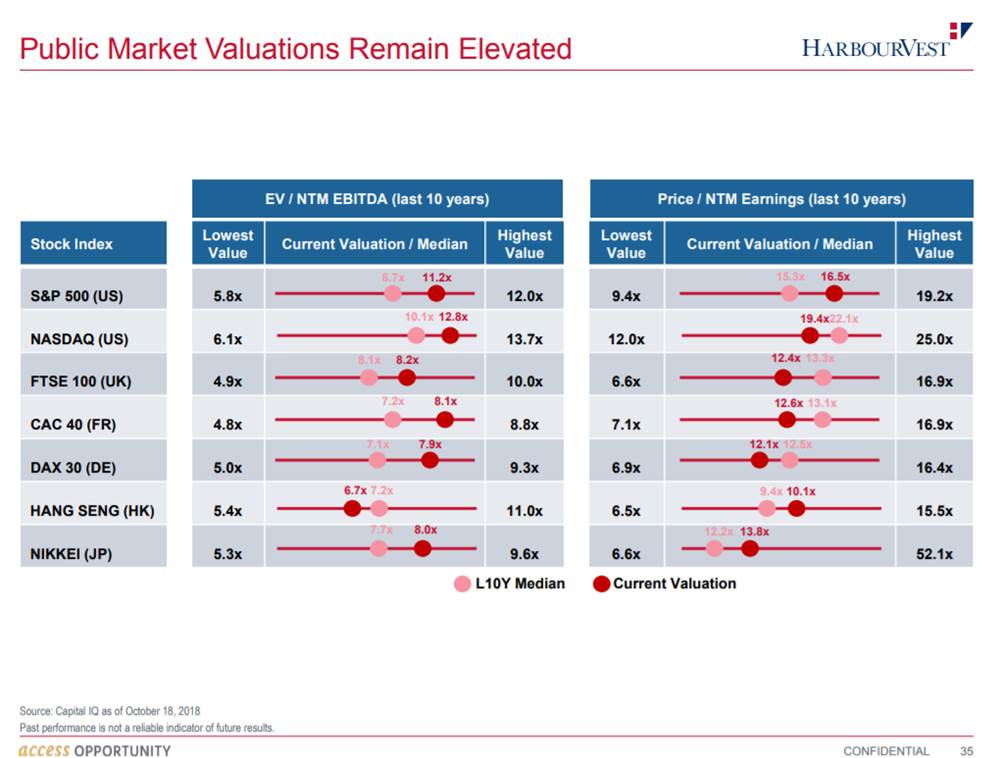

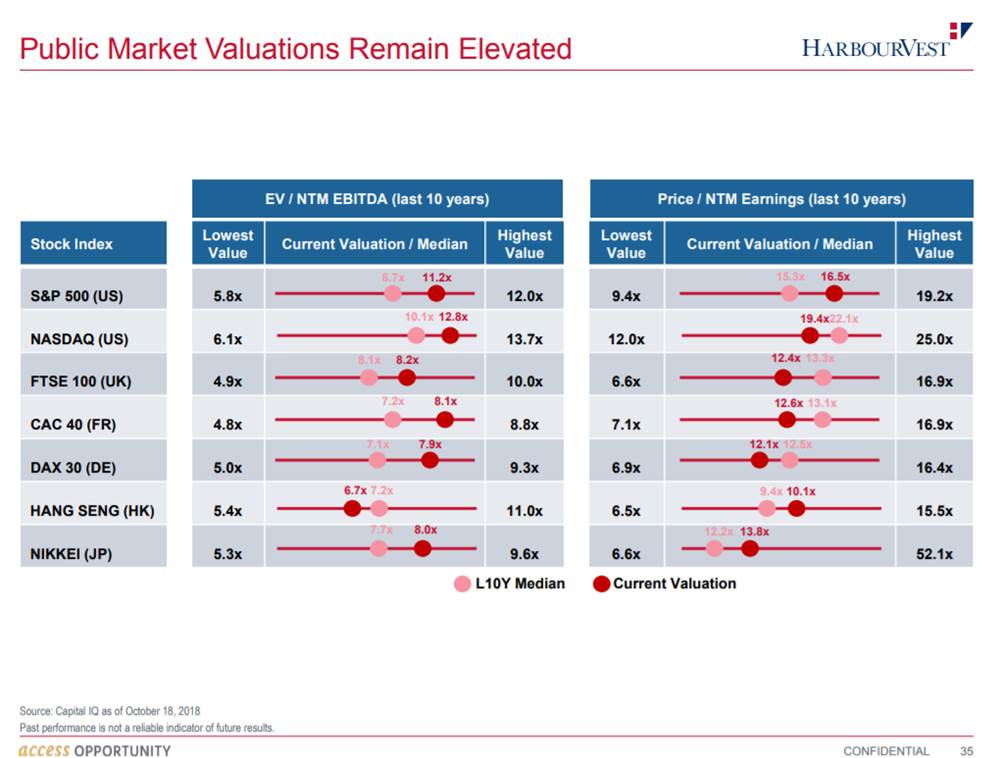

BofA's Assessment of Current Market Conditions

BofA's overall assessment of the current stock market is cautiously optimistic, leaning towards neutral. While acknowledging the high valuations, they don't foresee an immediate crash. Their assessment is heavily influenced by several key factors:

-

Interest Rates: BofA's economists forecast further interest rate hikes in the near term, aiming to curb inflation. This will impact borrowing costs for businesses and consumers, potentially slowing economic growth.

-

Inflation: Persistent inflation remains a significant headwind. BofA's analysis shows inflation eroding corporate earnings and impacting consumer spending. Their models predict a gradual easing of inflation throughout the year, but the timing and pace remain uncertain.

-

Economic Growth: BofA projects moderate economic growth, albeit slower than previous years. This tempered growth contributes to their cautious outlook on equity markets. The impact on different sectors varies greatly.

-

Specific Sector Analysis: BofA's reports highlight specific sectors. For example, they might identify the technology sector as potentially overvalued given recent performance, while sectors such as energy or healthcare may be viewed as relatively undervalued based on their earnings potential and resilience to inflationary pressures.

Specific Data Points from BofA Reports (Hypothetical Examples):

- Projected Earnings Growth: BofA predicts a 5-7% earnings growth for the S&P 500 in 2024.

- Forecasts for Interest Rate Hikes: BofA anticipates two more 25-basis-point rate hikes before pausing.

- Analysis of Inflation's Impact on Equities: BofA estimates that inflation has reduced real earnings growth by approximately 2%.

- Overvalued/Undervalued Sectors: BofA's research suggests that certain growth stocks are overvalued, while cyclical sectors might offer better value.

Addressing Investor Concerns about Overvaluation

High stock valuations naturally raise concerns about potential market corrections and the risk of significant losses. BofA addresses these concerns with the following counterarguments:

-

Potential Market Corrections: BofA acknowledges the risk of a market correction but doesn't predict a significant crash. They suggest that any correction would be a healthy adjustment rather than a catastrophic event, creating buying opportunities for long-term investors.

-

Stock Market Risk Mitigation Strategies: BofA advises investors to employ strategies such as diversification across asset classes (stocks, bonds, real estate) and value investing to mitigate risks in this environment.

-

Long-Term Growth Prospects: BofA emphasizes that long-term growth prospects remain positive, despite the current uncertainties. The bank encourages investors to maintain a long-term investment horizon, weathering short-term volatility.

Addressing Investor Concerns Directly:

- BofA's perspective on potential market corrections: Minor corrections are seen as normal and potentially beneficial for long-term growth.

- Strategies for mitigating risk: Diversification and value investing are highlighted as key risk mitigation strategies.

- Long-term growth prospects: BofA emphasizes the potential for long-term growth despite short-term challenges.

BofA's Recommendations for Investors

Based on their valuation assessment, BofA provides these recommendations:

-

Suggested Asset Allocation: A balanced portfolio, diversified across stocks and bonds, is recommended. The specific allocation might depend on individual investor risk tolerance and time horizon.

-

Recommended Sectors: BofA may suggest overweighting sectors they deem undervalued, while underweighting those perceived as overvalued. This could involve shifting investments toward sectors like energy or healthcare, which offer better resilience against inflation.

-

Advice on Timing the Market: BofA generally advises against trying to time the market, suggesting a long-term, buy-and-hold strategy instead.

Concrete Advice from BofA (Hypothetical Examples):

- Suggested asset allocation: 60% equities, 40% bonds.

- Recommended sectors: Overweight energy and healthcare; underweight technology.

- Cautions: Maintain a long-term perspective and avoid panic selling during market corrections.

Comparing BofA's View with Other Market Analyses

While BofA offers a valuable perspective, it's crucial to compare their assessment with other market analyses. Other prominent financial institutions may hold differing views on the pace of economic growth, inflation's impact, and the likelihood of a market correction.

Comparison of Market Outlooks (Hypothetical Examples):

- Key similarities: Many analysts agree that inflation is a key concern.

- Key differences: Some institutions might be more bearish than BofA, predicting a sharper market correction.

- Range of valuation estimates: Estimates for fair market value might vary by 10-15% across different institutions.

Conclusion: Navigating Elevated Stock Market Valuations with BofA's Insights

BofA's analysis highlights the challenges and opportunities presented by elevated stock market valuations. Their cautiously optimistic outlook emphasizes the importance of long-term investment strategies, diversification, and risk mitigation. Understanding these factors and incorporating BofA's insights, along with perspectives from other reputable sources, allows for more informed investment decision-making. To make sound investment choices based on the current stock market valuations, further explore BofA's research reports and consider consulting a financial advisor for personalized investment planning.

Featured Posts

-

Record Gold Prices Understanding The Trade War Impact On Bullion Investment

Apr 26, 2025

Record Gold Prices Understanding The Trade War Impact On Bullion Investment

Apr 26, 2025 -

La Fire Aftermath Price Gouging Concerns Raised By Selling Sunsets Stars Name

Apr 26, 2025

La Fire Aftermath Price Gouging Concerns Raised By Selling Sunsets Stars Name

Apr 26, 2025 -

End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 26, 2025

End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 26, 2025 -

Strong Q Quarter Number Results For Abb Vie Abbv New Drug Sales Exceed Expectations

Apr 26, 2025

Strong Q Quarter Number Results For Abb Vie Abbv New Drug Sales Exceed Expectations

Apr 26, 2025 -

Colgate Cl Q Quarter Number Earnings Sales And Profit Decline Amidst Tariff Hikes

Apr 26, 2025

Colgate Cl Q Quarter Number Earnings Sales And Profit Decline Amidst Tariff Hikes

Apr 26, 2025