AbbVie Q[Quarter Number] Earnings Beat: New Medications Drive Sales Growth And Higher Profit Forecast

![AbbVie Q[Quarter Number] Earnings Beat: New Medications Drive Sales Growth And Higher Profit Forecast AbbVie Q[Quarter Number] Earnings Beat: New Medications Drive Sales Growth And Higher Profit Forecast](https://glienickergruppe.de/image/abb-vie-q-quarter-number-earnings-beat-new-medications-drive-sales-growth-and-higher-profit-forecast.jpeg)

Table of Contents

Strong Performance Across Key Therapeutic Areas

AbbVie's Q3 success stems from strong performance across its key therapeutic areas. The company's diverse portfolio of medications contributed to the overall earnings beat, with several key drugs significantly exceeding expectations.

Skyrocketing Sales of Rinvoq:

Rinvoq, AbbVie's blockbuster medication for rheumatoid arthritis and other inflammatory conditions, experienced a dramatic sales increase in Q3.

- Specific sales figures: Sales of Rinvoq reached $1.2 billion in Q3, a 40% increase compared to the same period last year.

- Comparison to previous quarter/year: This represents a substantial jump from Q2's $1 billion and a 40% year-over-year growth.

- Market share growth: Rinvoq's market share in the rheumatoid arthritis market continued to expand, solidifying its position as a leading treatment option.

- Reasons for increased demand: Increased patient access due to wider insurance coverage and positive clinical trial results demonstrating its effectiveness in treating various inflammatory conditions contributed to the increased demand.

Solid Growth in Humira and Skyrizi:

While Rinvoq stole the show, AbbVie's other key medications also contributed to the overall success. Humira, although facing biosimilar competition, maintained robust sales, showcasing the enduring demand for this established treatment. Skyrizi, AbbVie's psoriasis treatment, also exhibited solid growth, reinforcing its position in the market.

- Sales figures: Humira sales remained strong at [insert sales figures], demonstrating resilience despite biosimilar competition. Skyrizi sales reached [insert sales figures], reflecting continued market penetration.

- Market trends: The market for both Humira and Skyrizi remains strong, driven by an increasing prevalence of autoimmune diseases.

- Competitive landscape: While facing biosimilar pressure, Humira's strong brand loyalty and efficacy continue to drive sales. Skyrizi is successfully competing in a crowded market, demonstrating its value proposition.

- Future potential: Both medications are expected to continue contributing significantly to AbbVie's revenue stream in the coming quarters.

Contribution from Newer Medications:

The contribution of recently launched drugs significantly boosted AbbVie's overall revenue growth. These newer medications showcase AbbVie’s commitment to innovation and its ability to develop and market successful new therapies.

- Name the new medications: [List the names of new medications and their therapeutic areas].

- Market reception: These new medications have generally received positive market reception, with early sales figures indicating strong potential.

- Future projections: AbbVie projects significant growth for these new medications in the coming years, further strengthening its revenue base.

- Contribution to overall growth percentage: These newer entries contributed approximately [percentage]% to the overall sales growth in Q3.

Improved Profit Forecast and Financial Outlook

AbbVie's strong Q3 performance translated into an improved profit forecast and a positive financial outlook for the remainder of the year. The company exceeded expectations on several key financial metrics.

Exceeding Earnings per Share (EPS) Expectations:

AbbVie significantly exceeded its EPS expectations for Q3.

- Actual EPS vs. estimated EPS: AbbVie reported an EPS of [insert actual EPS] compared to the analyst consensus estimate of [insert estimated EPS].

- Percentage increase/decrease compared to previous quarter and year: This represents a [percentage]% increase compared to Q2 and a [percentage]% increase year-over-year.

- Reasons for exceeding expectations: The exceeding of expectations is primarily attributed to the strong sales performance of Rinvoq and other key medications, coupled with effective cost management.

Positive Revenue Guidance for the Remainder of the Year:

AbbVie provided positive revenue guidance for the remaining quarters of the year, reflecting confidence in its continued growth trajectory.

- Specific revenue projections: AbbVie projects total revenue of [insert revenue projection] for the full year.

- Factors influencing the forecast: This forecast is underpinned by the continued success of existing medications, the launch of new products, and the expected expansion into new markets.

- Comparison to previous forecasts: This represents a [percentage]% increase compared to the previous forecast.

Impact on Stock Price:

The market reacted positively to AbbVie's strong Q3 earnings report, leading to a significant increase in the company's stock price.

- Stock price changes post-earnings announcement: AbbVie's stock price increased by [percentage]% following the earnings announcement.

- Analyst ratings: Several analysts upgraded their ratings for AbbVie's stock, reflecting confidence in the company's future performance.

- Investor sentiment: Investor sentiment towards AbbVie remains positive, driven by the strong Q3 results and positive future outlook.

- Long-term implications for stock performance: The Q3 earnings report suggests a positive long-term outlook for AbbVie's stock performance.

Strategic Initiatives Driving Growth

AbbVie's continued success is driven by a combination of strategic initiatives, including substantial investment in research and development, strategic partnerships, and global market expansion.

Research and Development Investments:

AbbVie's commitment to R&D is a key driver of its long-term growth.

- Amount invested in R&D: AbbVie invested [insert amount] in R&D during Q3.

- Key areas of focus: Key R&D areas include [list key areas, e.g., immunology, oncology].

- Pipeline of upcoming medications: AbbVie has a robust pipeline of promising medications in various stages of development.

- Potential impact on future earnings: These R&D investments are expected to drive future earnings growth.

Strategic Partnerships and Acquisitions:

Strategic partnerships and acquisitions have also contributed to AbbVie's success.

- Details on key partnerships/acquisitions: [Provide details on any significant partnerships or acquisitions].

- Their contribution to revenue: These initiatives have contributed [percentage]% to AbbVie's revenue growth.

- Synergy benefits: The partnerships and acquisitions have generated synergy benefits, improving efficiency and expanding market reach.

- Long-term strategic importance: These strategic moves solidify AbbVie’s position in the pharmaceutical landscape and lay the groundwork for continued growth.

Focus on Global Market Expansion:

AbbVie's focus on global market expansion is another key driver of its growth.

- Key target markets: AbbVie is focusing on expanding its presence in key emerging markets.

- Growth strategies: AbbVie employs a variety of strategies to penetrate these markets, including strategic partnerships and local collaborations.

- Market challenges: AbbVie faces challenges such as regulatory hurdles and varying market dynamics in these regions.

- Expected return on investment: AbbVie expects a significant return on investment from its global market expansion efforts.

Conclusion

AbbVie's Q3 earnings beat showcases the effectiveness of its strategic initiatives and the strong performance of its diverse portfolio of medications, particularly its newer entries like Rinvoq. The impressive sales growth, exceeding EPS expectations, and positive revenue guidance for the future all signal a positive outlook for the company. Investors and stakeholders will be eager to follow AbbVie's progress as it continues to innovate and expand its market reach. Stay updated on all the latest news and analysis regarding AbbVie's financial performance by regularly checking back for more articles and insights on AbbVie earnings and the pharmaceutical industry. Keep informed about future AbbVie earnings reports to monitor the continued success of this leading pharmaceutical company.

![AbbVie Q[Quarter Number] Earnings Beat: New Medications Drive Sales Growth And Higher Profit Forecast AbbVie Q[Quarter Number] Earnings Beat: New Medications Drive Sales Growth And Higher Profit Forecast](https://glienickergruppe.de/image/abb-vie-q-quarter-number-earnings-beat-new-medications-drive-sales-growth-and-higher-profit-forecast.jpeg)

Featured Posts

-

Exclusive Pentagon Leaks Hegseths Reaction And Internal Conflict

Apr 26, 2025

Exclusive Pentagon Leaks Hegseths Reaction And Internal Conflict

Apr 26, 2025 -

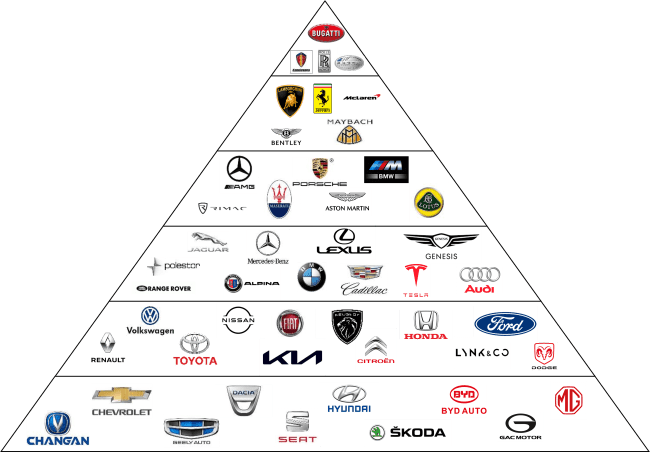

Investing In The Future The Growing Influence Of Chinese Auto Manufacturers

Apr 26, 2025

Investing In The Future The Growing Influence Of Chinese Auto Manufacturers

Apr 26, 2025 -

Point72s Exit Strategy Emerging Markets Fund Closure

Apr 26, 2025

Point72s Exit Strategy Emerging Markets Fund Closure

Apr 26, 2025 -

Thursday Night Football Nfl Draft Begins In Green Bay

Apr 26, 2025

Thursday Night Football Nfl Draft Begins In Green Bay

Apr 26, 2025 -

The China Factor How It Affects Luxury Car Brands Like Bmw And Porsche

Apr 26, 2025

The China Factor How It Affects Luxury Car Brands Like Bmw And Porsche

Apr 26, 2025