A Call For Fiscal Responsibility In Canada's Political Landscape

Table of Contents

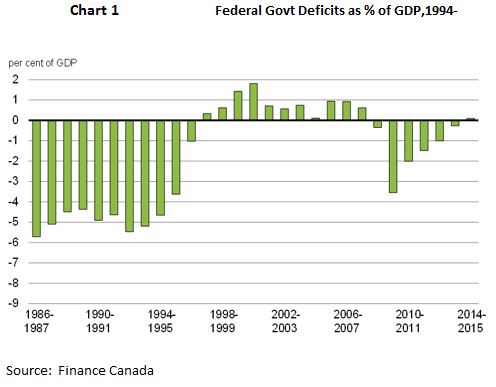

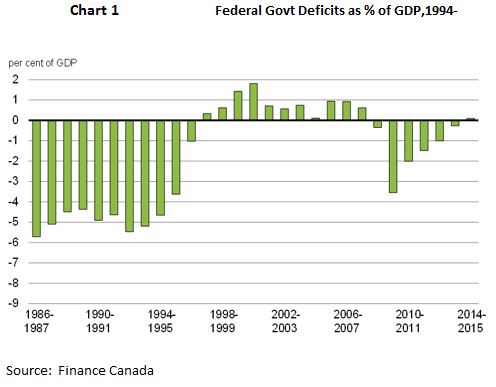

The Current State of Canada's Finances: A Cause for Concern

Canada's debt-to-GDP ratio, a key indicator of fiscal health, has been steadily rising in recent years, surpassing levels seen in other G7 nations. The ongoing fiscal deficit, the difference between government spending and revenue, continues to add to the national debt, raising concerns about long-term economic sustainability. Unchecked government spending poses significant risks. Continued high levels of debt can lead to increased interest rates, squeezing government budgets and potentially impacting crucial social programs. Inflation could also rise, eroding the purchasing power of Canadians.

Key areas of concern include:

- Rising healthcare costs: The aging population and advancements in medical technology are driving up healthcare expenditures, demanding innovative and sustainable funding models.

- Aging population and social security: The increasing proportion of seniors in the Canadian population puts immense pressure on social security programs like the Canada Pension Plan (CPP) and Old Age Security (OAS), necessitating careful long-term planning and responsible fiscal management.

- Infrastructure deficit: Canada has a significant infrastructure deficit, requiring substantial investment in roads, bridges, public transit, and other crucial assets. Responsible investment strategies are crucial to avoid adding further strain on public finances.

- Potential risks associated with high government debt: High levels of debt can increase vulnerability to economic shocks and limit the government's ability to respond effectively to unforeseen crises.

The Role of Political Parties in Promoting Fiscal Responsibility

Major Canadian political parties have varying approaches to fiscal policy, impacting debt management, taxation, and spending priorities. The Conservative party typically emphasizes fiscal conservatism, advocating for lower taxes and reduced government spending. The Liberal party often prioritizes investments in social programs and infrastructure while aiming for balanced budgets. The NDP tends to advocate for increased social spending and progressive taxation. Analyzing their platforms reveals differing priorities:

- Taxation policies: Differing approaches to taxation impact government revenue and influence the ability to manage debt and fund programs. Understanding the implications of proposed tax changes is crucial for informed decision-making.

- Spending priorities: Each party's budgetary priorities reflect its values and goals. Analyzing these priorities reveals insights into potential long-term economic consequences.

- Proposed measures for debt reduction: Parties offer varied solutions for debt reduction and deficit elimination, ranging from spending cuts to increased revenue generation.

Strategies for Achieving Fiscal Responsibility in Canada

Improving Canada's fiscal health requires a multi-pronged approach encompassing short-term and long-term strategies. Fiscal reform is crucial, requiring both budgetary control and creative revenue generation.

Potential strategies include:

- Comprehensive spending reviews: Identifying areas for efficiency gains in government spending is a key step towards fiscal responsibility. This requires careful analysis and a commitment to eliminating wasteful or duplicated programs.

- Alternative revenue generation: Exploring alternative revenue streams, such as implementing a well-designed carbon tax or reforming the tax system to ensure fairness and efficiency, can help to alleviate fiscal pressures.

- Enhanced government transparency and accountability: Improving transparency and accountability mechanisms can help ensure that government funds are used effectively and efficiently, fostering public trust.

- Promoting private sector investment: Encouraging private sector investment in infrastructure projects can alleviate the burden on public finances while stimulating economic growth.

The Importance of Public Engagement in Fiscal Responsibility

Public awareness and civic participation are essential for shaping sound fiscal policy. Understanding the implications of fiscal decisions on individuals and communities is crucial for informed public discourse. Citizens can actively engage by:

- Participating in public consultations: Engaging in public consultations on government budgets allows citizens to voice their concerns and contribute to informed decision-making.

- Following government reports: Keeping informed about government spending and debt reports empowers citizens to hold their elected officials accountable.

- Advocating for fiscal responsibility: Citizens can actively advocate for fiscally responsible policies through various channels, such as contacting elected officials or supporting organizations that promote fiscal accountability.

Conclusion: A Call to Action for Fiscal Responsibility in Canada

Canada's long-term economic well-being hinges on a commitment to responsible fiscal management. The current trajectory of rising debt and persistent deficits necessitates immediate action. Inaction will lead to increased interest rates, reduced government services, and potentially a weakened economy. We must demand greater transparency and accountability from our elected officials and support policies that prioritize sustainable Canadian finances. Engage in informed political discourse, hold your representatives accountable, and advocate for policies that promote responsible fiscal management. For further information on Canadian fiscal policy, refer to resources from the Parliamentary Budget Officer and the Department of Finance Canada. Let's work together to improve Canada's fiscal health and secure a brighter future for generations to come.

Featured Posts

-

Fbi Investigating Multi Million Dollar Office365 Executive Data Breach

Apr 24, 2025

Fbi Investigating Multi Million Dollar Office365 Executive Data Breach

Apr 24, 2025 -

Investigation Reveals Toxic Chemical Residues From Ohio Derailment Remain In Buildings

Apr 24, 2025

Investigation Reveals Toxic Chemical Residues From Ohio Derailment Remain In Buildings

Apr 24, 2025 -

Anchor Brewing Companys Closure A Look Back At 127 Years Of Brewing

Apr 24, 2025

Anchor Brewing Companys Closure A Look Back At 127 Years Of Brewing

Apr 24, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 24, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 24, 2025 -

Liams Unstable Behavior And Bridgets Revelation The Bold And The Beautiful April 16 Recap

Apr 24, 2025

Liams Unstable Behavior And Bridgets Revelation The Bold And The Beautiful April 16 Recap

Apr 24, 2025