65 Hudson's Bay Leases Generate Buyer Interest

Table of Contents

The Appeal of the Hudson's Bay Lease Portfolio

The substantial interest in the 65 Hudson's Bay leases stems from several compelling factors making this portfolio a highly attractive investment opportunity.

Prime Locations and High Foot Traffic

The 65 properties boast strategic locations characterized by high foot traffic and excellent accessibility. Many are situated in thriving urban centers, close to major transportation hubs and within affluent neighborhoods or popular shopping districts. This prime retail space translates to significant potential for high returns.

- Examples of prime locations: Several properties are located in major Canadian cities like Toronto, Vancouver, and Calgary, benefitting from dense populations and strong consumer spending.

- Data on foot traffic: Many locations are situated in malls or shopping centers with documented high daily foot traffic, ensuring maximum exposure for tenants.

- Unique features: Some properties may possess unique architectural features or ample parking, further enhancing their appeal to potential buyers and tenants. These desirable locations are a key driver of the interest surrounding the Hudson's Bay lease portfolio.

Strong Anchor Tenants and Brand Recognition

The existing tenants within the leased properties significantly contribute to buyer interest. The strong anchor tenants, combined with the inherent brand recognition associated with the Hudson's Bay Company, create a stable and attractive investment profile.

- Examples of strong anchor tenants: The Hudson's Bay Company itself often acts as a major anchor tenant, drawing significant foot traffic and establishing a strong foundation for other businesses.

- Reputation of the Hudson's Bay brand: The Hudson's Bay Company's long-standing history and reputation for quality contribute to the overall desirability of these properties. This established brand value attracts both tenants and investors.

- Influence on attracting other businesses: The presence of strong anchor tenants and the Hudson's Bay brand makes it easier to attract other businesses, leading to higher occupancy rates and rental income.

Investment Potential and Return on Investment (ROI)

The 65 Hudson's Bay leases present a compelling investment opportunity with significant potential for high returns. Several factors contribute to this promising ROI outlook.

- Potential rental income: The high-traffic locations and strong tenant base ensure consistent rental income streams.

- Property appreciation prospects: The strategic locations and strong brand association suggest a positive outlook for property appreciation over time.

- Market trends supporting high ROI: The current market conditions and robust demand for retail space further support the potential for a significant return on investment. This high-yield investment opportunity is attracting substantial interest from various investors.

Types of Buyers Showing Interest

The diverse range of buyers expressing interest in the 65 Hudson's Bay leases highlights the broad appeal of this investment opportunity.

Real Estate Investment Trusts (REITs)

REITs are actively involved, viewing these properties as valuable additions to their portfolios. Their investment strategies align well with the characteristics of the Hudson's Bay lease portfolio.

- Examples of REITs potentially interested: Several major Canadian REITs specializing in retail properties are likely to be strong contenders.

- Investment criteria: REITs typically look for properties with stable rental income, strong tenant occupancy, and excellent locations. The Hudson's Bay portfolio aligns well with these criteria.

- Market analysis: REITs conduct thorough market analysis to assess the long-term potential of such investments.

Private Equity Firms

Private equity firms are also keen on acquiring large-scale commercial properties like these, viewing them as potentially lucrative investments.

- Examples of private equity firms potentially involved: Several large firms specializing in real estate investments are likely to be actively pursuing these acquisitions.

- Investment focus: Private equity firms often look for opportunities to acquire undervalued assets and add value through strategic management and repositioning.

- Market outlook: The strong market outlook for retail properties in prime locations makes these assets particularly attractive to private equity.

Individual Investors

High-net-worth individuals and smaller investment groups are also showing interest in specific properties within the portfolio.

- Reasons for individual investor interest: These investors are often drawn to the potential for long-term capital appreciation and stable income streams.

- Type of properties they might target: Individual investors may focus on smaller, more manageable properties within the portfolio.

- Market factors driving this interest: The relative stability of the retail market and the strong brand association of the Hudson's Bay properties make them an appealing investment for individual investors.

Market Analysis and Future Outlook for 65 Hudson's Bay Leases

Current market trends indicate a strong demand for high-quality retail properties in prime locations. This favorable market environment contributes significantly to the value and attractiveness of the 65 Hudson's Bay leases. The long-term implications for the retail landscape are likely to be positive, with these properties continuing to attract tenants and generate strong returns. Experts predict continued growth in the value of these properties, driven by strong consumer spending and ongoing redevelopment in many of the locations.

Conclusion: Securing Your Piece of the Action with 65 Hudson's Bay Leases

The significant buyer interest in the 65 Hudson's Bay leases is driven by a confluence of factors: prime locations, strong anchor tenants, the inherent brand value of the Hudson's Bay Company, and an excellent potential for return on investment. This makes these properties a truly compelling investment opportunity in the commercial real estate market. Don't miss out on this unique investment opportunity! Explore the potential of the 65 Hudson's Bay leases and discover how you can benefit from this thriving market. Contact [relevant contact information or link to a relevant website] to learn more about the available Hudson's Bay property sales and investment opportunities within this exciting portfolio.

Featured Posts

-

Rep Nancy Mace Faces Angry Voter In South Carolina

Apr 24, 2025

Rep Nancy Mace Faces Angry Voter In South Carolina

Apr 24, 2025 -

Blue Origin Scraps Rocket Launch Due To Vehicle Subsystem Problem

Apr 24, 2025

Blue Origin Scraps Rocket Launch Due To Vehicle Subsystem Problem

Apr 24, 2025 -

Why This Startup Airline Uses Deportation Flights

Apr 24, 2025

Why This Startup Airline Uses Deportation Flights

Apr 24, 2025 -

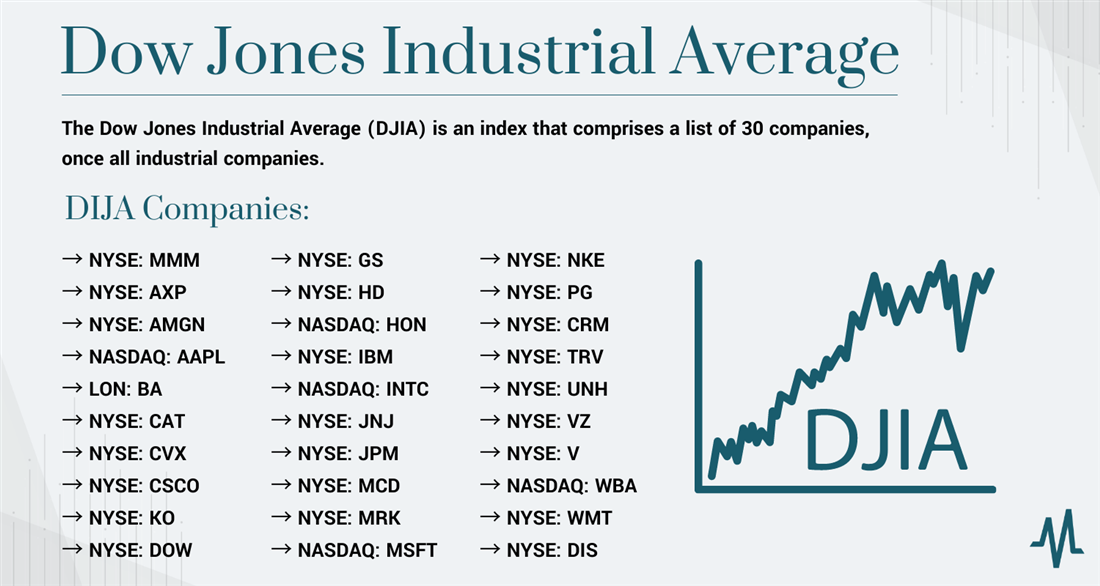

Todays Stock Market Dow S And P 500 April 23rd Analysis

Apr 24, 2025

Todays Stock Market Dow S And P 500 April 23rd Analysis

Apr 24, 2025 -

Exploring The Conservative Plan Tax Relief And Fiscal Responsibility In Canada

Apr 24, 2025

Exploring The Conservative Plan Tax Relief And Fiscal Responsibility In Canada

Apr 24, 2025