$440 Million Deal: CMA CGM Acquires Major Stake In Turkish Logistics

Table of Contents

CMA CGM's Strategic Expansion into Turkey

This acquisition represents a significant step in CMA CGM's ongoing global expansion strategy. The company already boasts a vast network, connecting numerous ports worldwide. However, this investment strategically strengthens its position, particularly within the dynamic Eurasian trade lanes.

Strengthening Global Network

The CMA CGM global network expansion is significantly boosted by this acquisition. Gaining a substantial stake in a prominent Turkish logistics firm provides access to critical infrastructure and operational capabilities.

- Increased access to Turkish ports: This provides CMA CGM with more efficient port operations and reduces reliance on third-party logistics providers.

- Improved connectivity to landlocked countries: Turkey's geographical location acts as a vital gateway to Central Asia and beyond, enhancing CMA CGM's reach into these markets.

- Diversification of shipping routes: The acquisition allows for greater flexibility and resilience in its shipping routes, mitigating risks associated with geopolitical instability or port congestion in other regions. This diversification within the CMA CGM global network is key to future success. Improved connectivity is crucial for the optimization of Turkish port infrastructure.

Accessing the Growing Turkish Market

Turkey's logistics sector presents a compelling investment opportunity, offering substantial growth potential. Several factors contribute to this attractiveness:

- Turkey's strategic location: Situated at the crossroads of Europe and Asia, Turkey serves as a crucial transit point for goods flowing between continents.

- Rising e-commerce: The booming e-commerce sector in Turkey demands efficient and reliable logistics solutions, creating high demand for services.

- Growing manufacturing sector: Turkey's expanding manufacturing base requires robust logistics support for the movement of raw materials and finished goods.

- Access to Central Asian markets: The acquisition opens doors to the burgeoning Central Asian markets, offering CMA CGM a significant competitive edge. The growth of e-commerce in Turkey is a key driver of this increased demand within the Turkish logistics market.

Impact on Turkish Logistics and the Global Supply Chain

The CMA CGM Turkish logistics acquisition is expected to have far-reaching consequences for the Turkish logistics market and the broader global supply chain.

Increased Competition and Efficiency

The entry of such a significant global player is likely to intensify competition within the Turkish logistics sector. This increased competition can lead to several positive outcomes:

- Potential for lower shipping costs: Increased competition often translates into more competitive pricing for shippers, benefiting both businesses and consumers.

- Improved service quality: To maintain a competitive edge, logistics providers will likely strive to improve the quality of their services, leading to enhanced customer satisfaction.

- Enhanced technological advancements: CMA CGM's technological expertise could stimulate innovation and modernization within the Turkish logistics sector, improving efficiency and traceability. This focus on supply chain efficiency is a key element of the CMA CGM investment strategy. The impact on Turkish logistics competition will be a key area to watch.

Geopolitical Implications

The acquisition carries significant geopolitical implications, affecting trade relations and regional power dynamics.

- Impact on trade routes: CMA CGM's increased presence in Turkey could influence the flow of goods through the region, potentially redirecting trade routes and impacting existing alliances.

- Relationship with the EU: The deal's implications for Turkey's trade relations with the European Union are noteworthy, particularly concerning customs and regulations.

- Potential influence on regional power dynamics: The acquisition could shift the balance of power within the region, affecting relationships between Turkey and other countries in the area. Turkey's geopolitical influence will undoubtedly be a subject of ongoing analysis following this acquisition. Understanding global trade routes and their impact is crucial for interpreting the long-term effects.

Financial Aspects of the Acquisition

The $440 million investment represents a substantial commitment by CMA CGM, signifying its confidence in the Turkish logistics market's long-term potential.

Investment Details and Return on Investment (ROI)

While the exact breakdown of the $440 million investment and the percentage stake acquired hasn't been fully disclosed, the anticipated ROI is likely significant.

- Breakdown of the $440 million investment: Further details are awaited from official company announcements.

- Projected ROI: The acquisition is projected to yield significant returns, driven by increased market share, operational efficiencies, and synergies.

- Potential synergies and cost-savings: Integrating the acquired company into CMA CGM's existing global network is expected to generate significant cost savings and operational efficiencies. A detailed financial analysis of the acquisition is anticipated as more information becomes available. Understanding CMA CGM's investment strategy is crucial for assessing the long-term benefits.

Market Reaction and Stock Performance

The market's response to the news of the acquisition has been largely positive, with analysts praising CMA CGM's strategic vision.

- Share price changes: Following the announcement, CMA CGM's stock price experienced a positive reaction.

- Analyst comments: Industry analysts have generally welcomed the deal, highlighting its strategic importance and potential for future growth.

- Investor sentiment: Investor sentiment appears positive, reflecting confidence in the acquisition's potential to enhance CMA CGM's long-term growth prospects. The market reaction to the acquisition and its impact on CMA CGM stock performance will be closely monitored.

Conclusion

The CMA CGM Turkish logistics acquisition represents a landmark deal, solidifying CMA CGM's global presence and significantly impacting the Turkish logistics sector. The strategic expansion into this key region enhances CMA CGM's global network, improves its access to growing markets, and creates potential for increased efficiency and competitiveness. The financial implications are significant, and early market reactions suggest positive investor sentiment. This $440 million investment underscores the importance of strategic acquisitions in shaping the future of global shipping.

Stay updated on the evolving dynamics of the CMA CGM Turkish Logistics Acquisition and its far-reaching consequences for the global supply chain. Further research into CMA CGM's future plans in Turkey and their wider implications for the global shipping industry is highly recommended.

Featured Posts

-

Belinda Bencic Reaches Abu Dhabi Open Final After Daughters Birth

Apr 27, 2025

Belinda Bencic Reaches Abu Dhabi Open Final After Daughters Birth

Apr 27, 2025 -

Planning For A Happy Day On February 20 2025

Apr 27, 2025

Planning For A Happy Day On February 20 2025

Apr 27, 2025 -

The Zuckerberg Trump Dynamic Implications For Tech And Politics

Apr 27, 2025

The Zuckerberg Trump Dynamic Implications For Tech And Politics

Apr 27, 2025 -

Dip Dyed Perfection Ariana Grandes Hairstyle For Swarovski

Apr 27, 2025

Dip Dyed Perfection Ariana Grandes Hairstyle For Swarovski

Apr 27, 2025 -

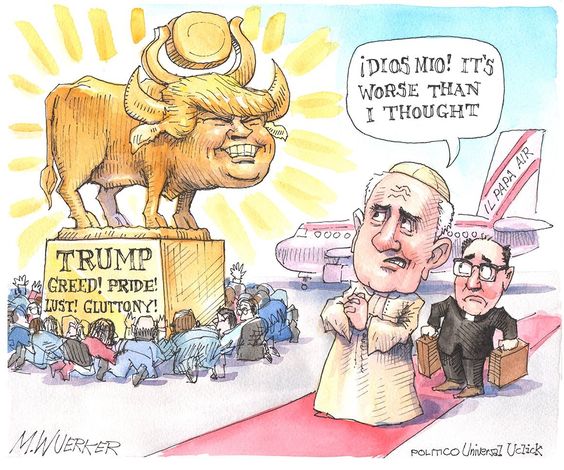

Analyzing Trumps Conduct At Pope Benedict Xvis Funeral Service

Apr 27, 2025

Analyzing Trumps Conduct At Pope Benedict Xvis Funeral Service

Apr 27, 2025